(Bloomberg) -- The global spike in energy prices and China’s crackdown on power consumption look set to create more losers than winners in Asian equities as production costs surge and output takes a hit.

Chinese stocks dominate the watch lists of traders, given that the country is the world’s biggest consumer of electricity and largest exporter of goods. Factories churning out everything from toys to vital components for Apple Inc (NASDAQ:AAPL). and Tesla (NASDAQ:TSLA) Inc. have been caught in the fallout.

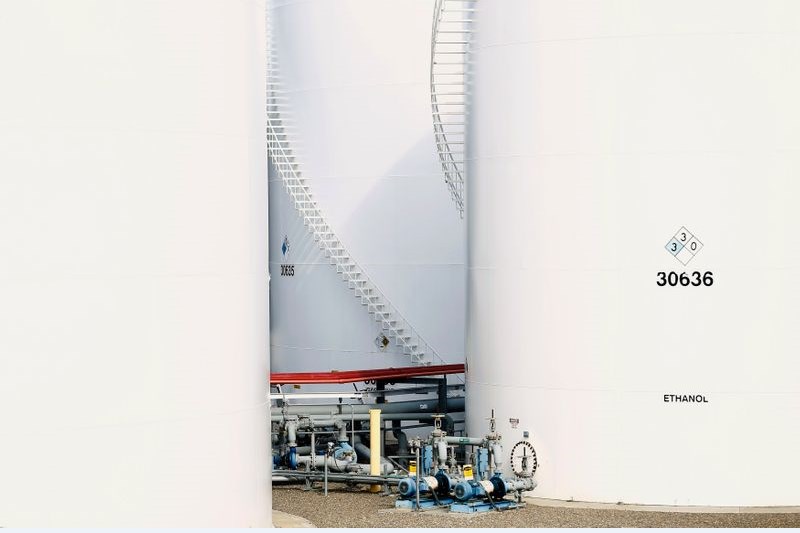

The region’s coal and natural gas producers will benefit in the short term from higher prices while their green-energy rivals should gain in the longer run. Energy-intensive sectors that make metals and chemicals may have the most to lose.

Rising demand for hydrocarbon as economies recover from the pandemic coupled with lower supplies globally created the shortage. China’s increasingly aggressive push to curb emissions along is amplifying the immediate impact on businesses.

More than half of China’s mainland provinces are limiting electricity use, forcing factory shutdowns that are reverberating through global supply chains.

Here are some of the stocks and sectors to watch:

Gas Plays

Companies that produce and export gas for the region will be clear beneficiaries of surging prices, while those importing, consuming and distributing stand to lose.

Likely winners include Australia’s Woodside (OTC:WOPEY) Petroleum, Malaysia’s Petronas Gas Bhd., Japan’s Inpex Corp., India’s Oil and Natural Gas Corp. and Reliance Industries Ltd. On the other hand, gas distributors such as China Gas Holdings (OTC:CGHLY) Ltd., Hong Kong and China Gas Co. and Kunlun Energy Co may face pressure.

Costs are poised to climb for Indian gas importers like Petronet LNG Ltd. and city gas distributors, which use natural gas as feedstock, such as Indraprastha Gas Ltd.

“The risk is that we are going to see a margin squeeze as we come into the winter” for gas distributors, Neil Beveridge, senior energy analyst at Sanford C. Bernstein said in an interview with Bloomberg Television. Gas distributors may not be able to pass through the rising prices as they are regulated by China, he added.

Coal and Power

Coal miners may mint more amid high prices for their commodity. Stocks to watch include Indonesia’s Adaro Energy Tbk, Australia’s Whitehaven Coal Ltd. and Coal India Ltd. Chinese names include China Shenhua Energy Co., China Coal Energy Co. and Shanxi Coking Coal Energy Group Co.

Stocks of coal-based power generators such as China’s Huadian Power International Corp., Huaneng Power International (NYSE:HNP) Inc. and Datang International Power Generation Co. suffered steep losses Monday that were only partially recovered Tuesday.

Independent coal-fired power producers in China are likely to report net losses in the third quarter on higher costs, Citigroup Inc (NYSE:C). analysts Pierre Lau and Lesley Li wrote in a Sept. 26 note. They add that companies will be unable to pass on the complete impact of surging coal prices to consumers.

Electricity Users

Surging electricity prices threaten to hurt shares of intensive power users, with stocks to watch including Aluminum Corporation of China Ltd., Baoshan Iron & Steel Co., Angang Steel Co., China National Chemical Engineering Co. and Zhejiang Longsheng Group Co.

As power cuts in China curb industrial output, this flows on into lower shipping demand, affecting stocks like Cosco Shipping Holdings Co., according to analysts.

“The shock is also a wake up call to some long on cyclicals like metals and coal that the best leg of gains are over,” said Shi Junbo, fund manager at Hangzhou Xiyan Asset Management Co.

Global Supply Chain

Some suppliers for iPhones and carmakers have halted production at certain facilities in China to meet Beijing’s tighter energy-consumption policy.

Apple supplier ASE Technology Holding Co (NYSE:ASX). said a plant in Kunshan City will see no production from Sept. 27 to Sept. 30 due to power restrictions. Other stocks to watch for similar risks include Tesla suppliers like Eve Energy Co. and Ningbo Joyson Electronic Corp. Among Chinese carmakers, traders are watching BYD Co (OTC:BYDDF)., Geely Automobile Holdings (OTC:GELYF) Ltd., Li Auto Inc., SAIC Motor Corp. and XPeng Inc.

“If power rationing lasts longer, upstream material price will likely increase, bringing cost pressure to part makers,” Bank of America Corp (NYSE:BAC). analysts including Ming Hsun Lee wrote in a Sept. 27 note.

Green Energy Stocks

Companies generating power via renewable sources such as wind and water have bucked the weakness seen by their coal-fueled peers. China Longyuan Power Group Corp. shares reached a record on Tuesday after jumping 21% in five sessions. Other stocks in focus include Huaneng Lancang River Hydropower Inc., Fujian Mindong Electric Power Ltd. and Cecep Wind-Power Corp.

The government-backed Economic Daily said in a front page commentary on Tuesday that the ultimate way to solve tightness in power supply is through transitioning to lower energy consumption.

“In the long term, the events will provide greater support for wind and solar, and omissions targets will expedite clean energy to join the grid,” Hangzhou Xiyan Asset’s Shi said.

©2021 Bloomberg L.P.