Targa Resources Corp. (NYSE:TRGP) and Lucid Energy Group announced that a wholly-owned subsidiary of Targa will acquire Lucid Energy Delaware, LLC from Riverstone Holdings LLC and Goldman Sachs (NYSE:GS) Asset Management for $3.55 billion in cash. The transaction is expected to close in Q3/22, subject to customary closing conditions, including regulatory approvals.

The deal will boost Targa's size and scale in the Delaware Basin.

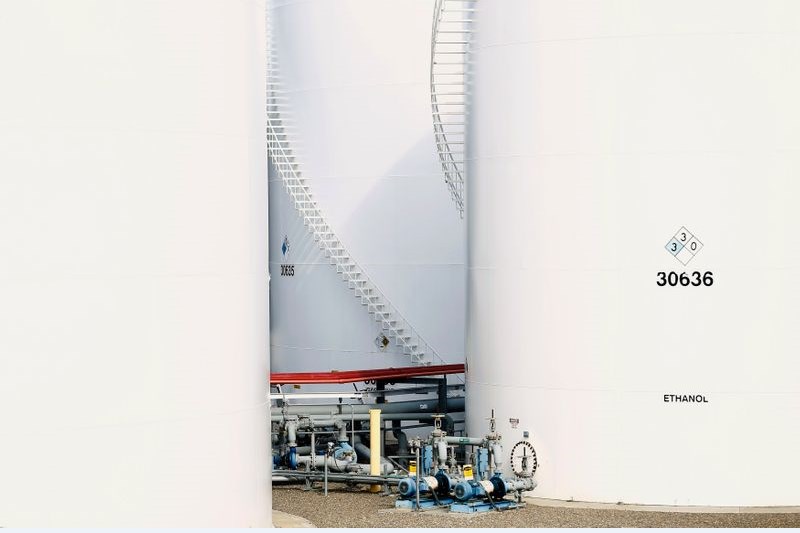

Lucid provides natural gas gathering, treating, and processing services in the Delaware Basin, including approximately 1,050 miles of natural gas pipelines and approximately 1.4 billion cubic feet per day of cryogenic natural gas processing capacity in service or under construction located primarily in Eddy and Lea counties of New Mexico.

“The strength of Targa’s standalone financial position has afforded us the flexibility to consider attractive opportunities to grow our business through acquisitions, as evidenced by our ability to finance the purchase of Lucid utilizing available cash and debt with estimated pro forma year-end 2022 leverage around 3.5 times, well within our long-term leverage ratio target range,” said Matt Meloy, Chief Executive Officer of Targa. “Lucid’s management team has developed an attractive position in the Delaware Basin and we look forward to continuing to provide value added services to the producer customers. This is an exciting acquisition that aligns with our integrated strategy as we are expanding and diversifying our Permian Basin footprint with Lucid’s complementary presence at an attractive investment multiple that we expect will further enhance the creation of shareholder value and continue to drive more volumes through Targa’s downstream businesses.”

The acquisition is expected to be immediately accretive to distributable cash flow per share.

Targa's standalone 2022 outlook has continued to improve due to the strength of commodity markets and producer activity levels, with 2022 adjusted EBITDA now estimated to be in the range of $2.675-$2.775 billion and a year-end leverage ratio of 2.7x.

By Davit Kirakosyan