Strickland Metals Ltd (ASX:STK) is well on the way to demerge its Iroquois Zinc-Lead Project in the Earaheedy Basin and its Bryah Basin Project in the Gascoyne district into a separate Western Australia-focused entity with completion expected in the first half of this year.

To recap, STK announced in October last year it was proposing to unlock the value of the assets to focus on developing its flagship Yandal Gold Project.

The Iroquois and Bryah Basin projects, believed to be undervalued within the current company structure, will be held by a wholly-owned subsidiary of the company, to be known temporarily as DemergerCo, which will eventually be listed on the Australian Securities Exchange (ASX).

Strickland shareholders will receive free DemergerCo shares on a pro-rata basis via an in-specie distribution, subject to shareholder, ASX and regulatory approvals.

Process well advanced

“Work is significantly well advanced on the proposed demerger of our Iroquois and Bryah projects,” STK’s chief executive officer Andrew Bray said.

Key consultants including legal and tax advisors were appointed in the fourth quarter. They are:

- Legal advisors – Hamilton Locke;

- Lead broker – JP Equity;

- Investigative accountants report – BDO;

- Tax advisors – Crowe; and

- Geological consultant – OMNI GeoX.

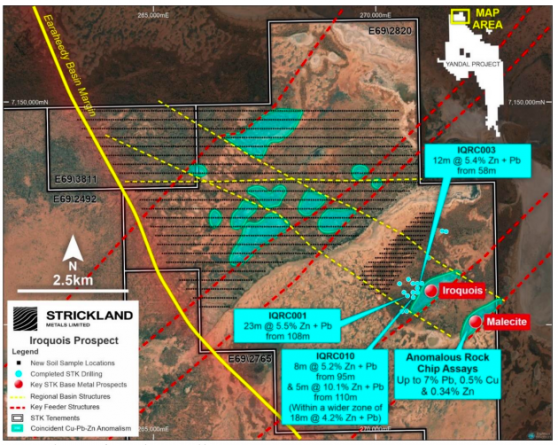

Plan view of Iroquois mineralisation and key target areas.

IPO in the first half

“Drafting of the prospectus is well advanced with the main outstanding lead time item being obtaining Demerger Relief from the Australian Taxation Office," Bray said.

"It is expected the application for Demerger Relief will be lodged during the current quarter. The IPO is expected to be completed during the current half-year period.

“Work is also advanced on the composition of the proposed new board and management team. A further update will be provided to the market once a final decision has been made.

“As announced on October 21, 2022, Strickland plans to conduct a full in-specie distribution of the shares of DemergerCo. This means all Strickland shareholders at the record date, which will be determined by the board in due course, will receive pro-rata shares, at no cost, in the new company.

“Existing shareholders will also receive priority allocations in the IPO capital raise. Strickland will provide further updates as they become available.”

Undervalued assets

The Iroquois Project, an 80-20 joint venture between STK, the manager of the JV, and Gibb River Diamonds (ASX:GIB) Ltd is within the Earaheedy Basin, which is emerging as a significant new mineralised province and is highly prospective for further zinc-lead discoveries.

STK controls about 30 kilometres of strike extending from Rumble Resources Ltd (ASX:RTR)'s Earaheedy Project.

The Bryah Basin Project, meanwhile, comprises five early-stage exploration licences covering 260 square kilometres and is about 80 kilometres north of Meekatharra in the Gascoyne district.

The basin is host to volcanogenic massive sulphide deposits of copper and gold formed during early-stage volcanism, including Sandfire Resources Ltd’s DeGrussa operations.

It also hosts significant structurally-controlled orogenic gold deposits, including the Fortnum Gold deposits currently being mined by Westgold Resources Ltd (ASX:WGX).

Read more on Proactive Investors AU