The Iroquois Zinc-Lead Project of Strickland Metals Ltd (ASX:STK) in the Earaheedy Basin of WA has yielded ‘fantastic’ results in recent diamond drilling, including 4.3 metres at 27% zinc

During the drilling in March and April at the project, which is 80% held by the company and 20% by Gibb River Diamonds (ASX:GIB) Ltd, Strickland completed four diamond drill holes for 885.6 metres.

Highlights

Assays have now been received for the first two holes and the company reports multiple zinc-lead-silver intersections, including a very impressive zone of massive sphalerite mineralisation.

Impressive high-grade zinc, part of what Strickland is calling a very substantial mineralised system, was intersected during the drilling program:

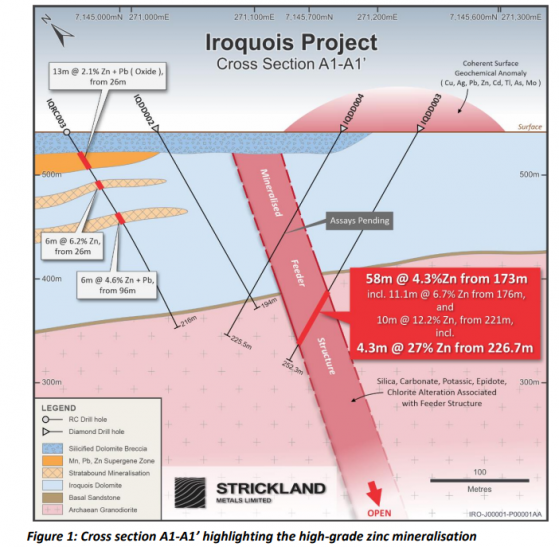

An intersection of 58 metres at 4.3% zinc and 3.7 g/t silver from 173 metres included:

- 11.1 metres at 6.7% zinc and 7.4 g/t silver from 176 metres; and

- 4.3 metres at 27% zinc, 0.1% lead and 19.9 g/t silver from 226.7 metres.

Drilling of two holes successfully intersected the ‘feeder structure’ in the basement, and the company eagerly awaits assays for a third hole.

The campaign confirms the company’s belief that Iroquois has strong potential to host skarn-type mineralisation proximal to the intrusion, as well as carbonate replacement mineralisation along the mapped 1.8-kilometre structure extending from the intrusion.

“Our maiden diamond drilling program at Iroquois has yielded fantastic initial results, intersecting a very impressive 4.3 metres at 27% zinc from 226.7 metres, within a broader zone of 58 metres at 4.3% zinc from 173 metres,” CEO Andrew Bray said.

Zinc feeder structure

“The same feeder structure was also intersected approximately 300 metres to the southwest in IQDD001 (albeit with the drill rig’s position drilling mineralisation down dip).

“The company believes this basement mineralisation represents part of the plumbing for a much larger mineralising system at Iroquois.

“Both IQDD001 and IQDD003 show strong continuity of mineralisation, which significantly strengthens towards intrusion.

"This demonstrably opens up the 1.8-kilometre mapped trend for significant carbonate replacement style mineralisation, as well as skarn type mineralisation closer to the intrusion. Both concepts are high priority and very promising drill targets for future programs.

“Unfortunately, due to numerous recent weather events, including the cyclone which passed through the Wiluna region, the project became inaccessible over recent weeks, and only a small part of the core from IQDD004 was able to be processed.

“Strickland’s field crew is now back on site processing the core, with delivery to Perth expected next week. Assays are expected approximately six weeks after that.

“Planning is underway for a ground-based IP survey, which will assist the company to vector towards further high-grade polymetallic mineralisation. Additional planning has also begun for follow-up drill programs.”

Demerger

Strickland has proposed to demerge the asset subject to obtaining the necessary shareholder, ASX and regulatory approvals.

The demerger will create a dedicated, WA-focused base metals exploration company and enable Strickland to focus its resources on developing its flagship Yandal Gold Project.

Read more on Proactive Investors AU