Strickland Metals Ltd (ASX:STK) is trading higher on making a new gold discovery at its 100%-owned Horse Well prospect at the Yandal Gold Project in Western Australia with a high-grade result of 31 metres grading 5.6 g/t gold from 72 metres, including 8 metres at 17.7 g/t.

The company is undertaking an aggressive 40,000-metre aircore program with the initial phase of drilling focused on mapping the Horse Well shear structures.

Drilling in the central portion of the Horse Well area intersected significant shearing, silica alteration and veining in the discovery hole. The company also notes that the discovery hole ends in mineralisation, suggesting the mineralisation may continue further with additional drilling.

Marwari discovery

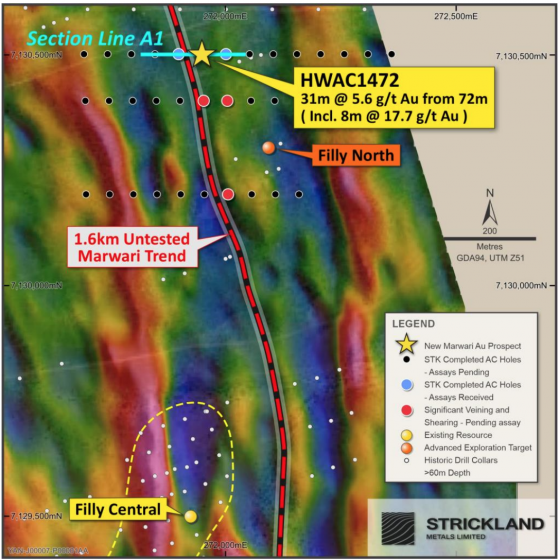

The discovery, termed Marwari, was made at the previously unidentified and undrilled Marwari trend.

Thus far, the structure has a total strike length of 350 metres with the same structure appearing to have been intersected 100 metres to the south in an aircore fence line, then intersected again a further 250 metres south in another aircore fence line. Both fence lines were drilled last week. Assays for these holes are pending.

The news has been welcomed by investors, with STK shares as much as 18.75% higher this morning to $0.057.

Despite significant historical drilling in the broader Horse Well area, the system remained very poorly understood and previous work was “patchy”.

Not only has Strickland’s current systematic aircore program delivered a new discovery at Marwari, but it has also provided significantly more understanding of the system and controls on mineralisation. Ideally, this work will reveal further mineralisation and potentially result in more discoveries in the region.

The discovery sits in an analogous geological setting to the nearby Millrose gold deposit, with intense silica alteration, a near vertical dip to the shear zone and the presence of a BIF marker horizon.

Pleasingly, the shear zone and BIF formation are traceable in geophysical datasets, giving Strickland approximately 1.5 kilometres of strike to continue testing.

Unlocking further value

Strickland is now adjusting its current drill program to accommodate closer-spaced aircore drilling over the Marwari trend within the known 350-metre strike, as well as following the trend further to the south.

An RC rig will then undertake immediate follow-up drilling before the end of the calendar year.

Strickland CEO Andrew Bray said, “After selling the Millrose gold deposit to Northern Star Resources (ASX:NST) for ~$61 million in July this year, Strickland remains extremely well funded to capitalise on Marwari and unlock further value in any additional discoveries current programs may yield.”

Read more on Proactive Investors AU