Strata Investment Holdings PLC (ASX:SRT)’s investment strategy recently shifted from direct project investments to equity and royalties in companies operating within the mining sector.

The company has gained a strategic holding of copper assets in the Kalahari Copper Belt (KCB) in Botswana via equity and royalties in Sandfire Resources NL (ASX:SFR) and Cobre Ltd (ASX:CBE), establishing a strong position across the development cycle.

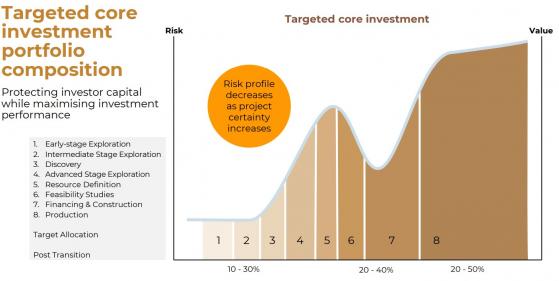

Strata’s aim is to transition gradually over time from its existing portfolio of active and passive investments and legacy positions in royalty interests into a more diversified, balanced and liquid investment portfolio.

Botswana is ranked in the top 10 mining jurisdictions globally for investment attractiveness and ranked first in Africa.

Strata has a commanding position in the KCB in Botswana, one of the world’s most prospective areas for yet-to-be-discovered sediment-hosted copper deposits.

Equity

- Circa 1% stake in Sandfire Resources − dominant license holding in the central copper zone; and

- 19.99% stake in Cobre which owns 100% of the second largest landholding in the KCB − dominant license holding on the basin margin of the KCB.

Royalty

- 2% NSR (net smelter return) over Sandfire’s T3 Project (Motheo Production Hub), capped at US$2 million;

- 2% uncapped NSR over Sandfire’s circa 8,000 square kilometres (excluding the T3 project area but including the A4 project); and

- 2% uncapped NSR over three of Cobre’s tenements.

Sandfire’s production ramp-up

The Motheo Production Hub was acquired by Sandfire in October 2019 from MOD Resources Ltd for A$167 million (Strata was the largest shareholder of MOD at circa 25%).

T3 within Motheo is already in production at 3.2 million tonnes per annum (mtpa) and expanding to 5.2 mtpa by mid-2024.

The production is ramping up to circa 50,000 tpa contained copper in concentrate per annum and extensive exploration efforts are ongoing focused on near-mine opportunities.

Sandfire and Cobre have set out on an exploration collaboration via a significant 8,778-kilometre airborne gravity gradient (AGG) survey over the KCB to assess high-priority exploration targets.

Source: Sandfire Resources March 2023 quarterly report, Motheo Copper Project, 27 April 2023.

Cobre’s district-scale copper projects

The Ngami Copper Project (NCP) and Kitlanya West Project (Kit West) are strategically located near the basin margin of the KCB - typically prioritised for sedimentary-hosted copper deposits.

Recent results from the Comet area demonstrate the significant copper potential on the northern margin of the KCB where Cobre holds a dominant license position (>2,500 square kilometres).

Exploration is ongoing over Cobre’s tenements with a resource update targeted this month.

Copper − “metal of electrification”

Copper demand is projected to almost double from just over 25 million tonnes in 2021 to nearly 49 million tonnes in 2035.

It is impossible to meet the growing demand with current exploration and feasibility stage project trends.

Projected to begin in the middle of this decade, supply deficits could have serious consequences across the global economy, affecting the timing of net-zero emissions by 2050.

Source: 2022 S&P Global | The Future of Copper: Will the looming supply gap short-circuit the energy transition?

Copper mining profits have surged with rising copper prices since 2021 with projected EBITDA increases of 12.9% year-on-year from 2022.

However, only two new projects entered commercial production in 2022 with the majority of future supply growth expected from planned expansions at existing mines.

Source: 2022 S&P Global | The Future of Copper: Will the looming supply gap short-circuit the energy transition?

Strata is at the right place at the right time and has significant potential for valuation upside through its equity and royalty holdings in the KCB.

Read more on Proactive Investors AU