Shaw and Partners provided upgrades across its coverage universe after the Australian gold sector finished 2023 strongly with gold prices rallying to over A$3,000/ounce.

The S&P ASX gold index (XGD) is up +20% since the start of the year (compared to -9% in 2022).

The following is an extract from Shaw and Partners’ sector report:

Price Levers & Outlook

- Monetary Policy: Lower interest rates reduce the yields on assets such as Government Bonds, resulting in demand for alternative ‘safe’ investments such as gold increasing. Softening economic data has heightened speculation that the Fed is done with raising rates and the economy is headed towards a soft landing that would allow it to start easing in the coming months. The US 10-year yield has been dropping from a top of 5% in October 2023. Following the US GDP data, bond markets raised bets of rate cuts and are pricing in more than four cuts of a quarter percentage point each in 2024, starting in May.

- Geopolitical Tensions: Gold is viewed by investors as a physical, relatively scarce asset that has historically held its value, as such it has been classed as a ‘safe haven’ asset. The current geopolitical backdrop of the Russia-Ukraine war, escalation of tensions in the Middle East as well as trade concerns between China and the US has resulted in increased interest in gold from investors looking for a secure store of value.

- It is our view that interest rate movements will be the most significant catalyst for gold prices in 2024 and 2025. The long-term relationship between gold and rates suggests that for every 100 basis points drop in US 10-year real rates, gold rallies by 11%.

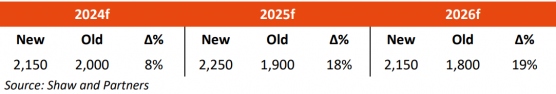

- The current macroeconomic setting has resulted in an update to our gold price forecast.

US$ Gold Price Forecast

Recommendation

We recommend an overweight exposure to the gold sector with Ramelius Resources as our core holding.

1. Ramelius Resources (RMS-ASX, BUY, $2.00) - Costs are expected to materially decrease through the year as higher grade ore from the Penny mine is delivered whilst it continues to ramp-up. Ramelius are on track to make record margins.

2. Antipa Minerals (AZY-ASX, Buy, $0.06) – Antipa is targeting rapid, sizeable success at targets such as GEO-01, Tetris and Pacman. Antipa has also identified a new gold anomaly just 10km northeast of Newmont’s giant Telfer mine.

3. Black Cat Syndicate (BC8-ASX, BUY, $0.74) – Black Cat has three gold development projects in West Australia and a pathway to ~150kozpa of gold production. The funding package for the Paulsens restart project has been approved by shareholders and awaiting government approvals.

4. Matador Mining (MZZ-ASX, BUY, $0.19) – Company has changed the focus from brownfields exploration in the Central Zone to targeting high impact greenfield targets. B2Gold (NYSE:BTG) (BTO-TSE, C$5.6B market cap) has a 10.9% stake with a 5-year option to subscribe for a further 39.1m that would take B2Gold to 19.9%.

5. Saturn Metals (STN-ASX, BUY, $0.44) – a Preliminary Economic Assessment (PEA) for Apollo Hill outlines an initial 10.5-year mine life producing an average 122kozpa at an All-in-sustaining-cost of A$1,852/oz. The first phase of the project will involve a low-cost starter pit and pilot plant that could be producing gold by the end of CY24.

Read more on Proactive Investors AU