Investing.com -- Shares in Sanmina (NASDAQ:SANM) surged in early U.S. trading on Tuesday after the electronics manufacturing services provider forecast second-quarter income that topped average analyst estimates.

The California-based group guided for adjusted earnings per share of $1.20 to $1.30 in its current quarter, above Bloomberg consensus expectations of $1.02. Revenue was seen at $1.83 billion to $1.93 billion, also ahead of projections.

"Our outlook for the second quarter is essentially flat with the prior quarter and is in line with our expectations for the first half of fiscal 2024," said Chief Executive Officer Jure Sola in a statement.

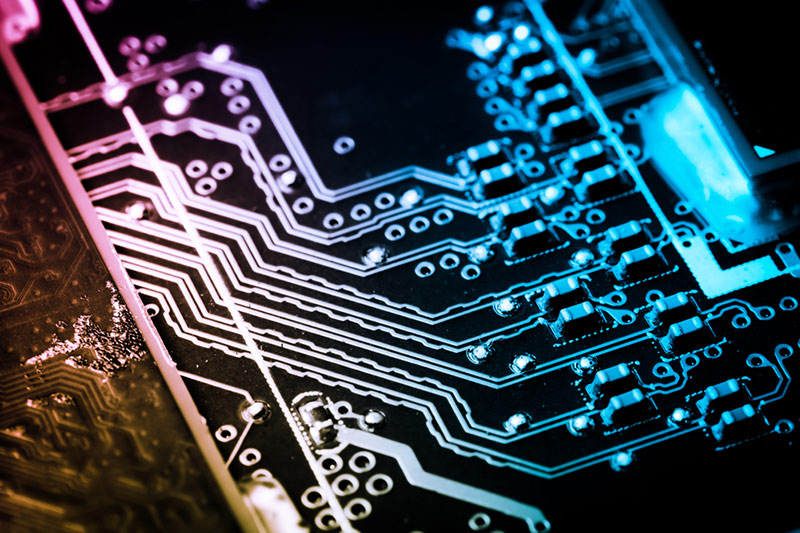

Sanmina, which manufacturers complex printed circuit boards incorporated into electronics used in a variety of industries, did not provide formal guidance beyond the second quarter, although Chief Financial Officer Jon Faust said in a post-earnings call that the company is "seeing signs that demand and revenue should start to improve in the second half of the year."

The comments come after Sanmina previously warned that it would face headwinds "for the next couple of quarters" due in part to ongoing macroeconomic uncertainty.

In a note to clients on Tuesday, analysts at Bank of America (NYSE:BAC) Securities flagged that it also "remains unclear" how long an ongoing adjustment in customer inventory levels in inventories will take. Sanmina has said that it expects this correction to weigh on its results.

Sanmina's fiscal first-quarter adjusted per-share profit slid to $1.30 in the three months ended on Dec. 30, a decline of 24.4% but still above Wall Street predictions. Net sales, meanwhile, dipped by 21% to $1.87B.