Samso Rooster Talk Episode 71 is with OD6 Metals Ltd (ASX:OD6) managing director and CEO Brett Hazelden.

The OD6 story is now one step closer to its holy grail with the latest announcement. This latest Rooster Talk is a discussion on what the news means for the company. Could this be an endorsement of the entire clay rare earth sector?

The latest news - hot off the press

The first conversation I had with Brett Hazelden was on Coffee with Samso with this story - OD6 Metals Limited (ASX: OD6) - The Rare Earth Elements Story.) where my understanding of the clay rare earth sector was initiated. I had to admit I had little foundation then and what I had learnt before was scarce. Now that we have had four lessons with Brett, I am starting to believe that I know this sector.

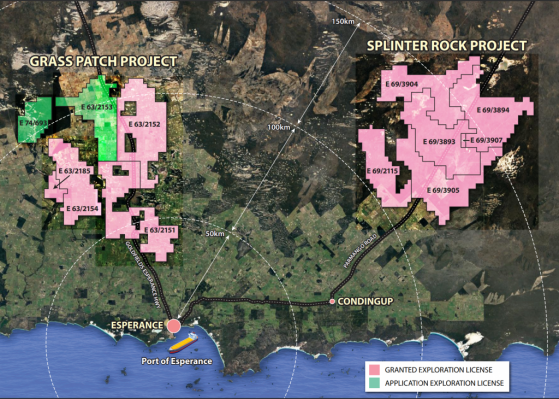

Figure 1: Project locations for OD6 Metals Limited. (source: OD6 Metals).

The two projects, Splinter Rock and Grass Patch make OD6 Metals Limited (Figure 1). The latest announcement is critical as it puts the question of "Can they get the REE out?" I feel that this question would have been on many lips and now it is confirmed.

"The current drilling is no longer a guessing game.", Brett Hazelden confidently explains ...

The process is now pretty much a step at a time but one has to feel that things are gearing towards the positive. What is important now is using the announced results and moving into the refinement of the process.

When Brett talks about the path forward, I feel like there is a fair amount of confidence that OD6 knows what they are expecting. An interesting comment that I remember was that the current drilling is no longer a guessing game. They are expecting results as projected.

The geology, which is a common feature in all these types of deposits, are consistent and there is not much variability. This is what Brett has been told by his competent person, who knows the deposit style. What that means is that there will be no surprises from the current drilling program.

Brett reminds us that the potential resources in both projects are going to be big. He says the potential resource will be comparable to that of Ionic Rare Earths Limited (ASX: IXR). There are already similarities and Brett is optimistic that OD6 will be in the same league or larger. He also spoke of comparisons to another peer, Australian Rare Earths Limited (ASX: AR3).

What are the Key Points of the Announcement?

Download OD6 announcement of 3rd April 2023

All system is a go which is the takeaway point of this Rooster Talk. The much-anticipated metallurgical results have come and the results are consistent with OD6's expectations. OD6 now understands the geology and the mineralisation better. The resource-building exercise appears to be simpler as management now knows where the better grades and recoveries are located.

The potential future resource is going to be big. The scale is not what investors may be used to as the number is going to be big. The simplistic nature of the geology will also mean that the resource definition process will be easier.

Samso Conclusion

Having the fortune to have followed the OD6 journey for a while has been one of the best feelings of doing this job. I have always said that the business will be on its way forward once some results on the chemistry is known.

Although, this is still very early stage, the results from the latest test indicates consistency moving forward. The recovery rates in the 70% range appears to be what management was looking for as a start. The segregation of the impurities in the coarser fragments is fortuitous. The physical separation of the coarser materials forming the fines will simplify the quality control process.

I was once told that OD6 had a good project. When I first looked at the company and after doing a few Coffee with Samso and Rooster Talks, I agreed. However, the burning question was still about whether they can process the end product.

As I understand from Brett, this is the first step to answering that question with conviction. I think when viewers watch the Rooster Talk, you will feel that there is some level of confidence in his voice. The resource is going to be big and he says, we only need 5% of that.

Chapters:

00:00 Start

00:26 Introduction

00:59 Brett introduces the Findings from the announcement.

01:47 The details of the announcement.

06:12 Process of Defining the Quality of the REE End Product.

09:00 The Acid usage Discussion

11:12 Investors Expectations - Comparisons to Peers

14:56 Resource potential of OD6 4 projects.

16:04 Prop Prospect

18:28 It is all about the Stripping Ratio.

18:58 The "Good" Areas.

19:50 The perfect place for a project.

21:43 Market Sentiment - Critical Minerals Demand

23:53 News Flow

25:06 Drilling results should be consistent with previous drilling.

26:42 Easy to resource Clay REE Geology.

27:58 The Results Confirm that OD6 will Work.

28:51 Conclusion

PODCAST

About Brett Hazelden

Managing Director & Chief Executive Officer

BSc, MBA, AICD

Mr Hazelden is a Metallurgist who brings over 25 years’ experience serving the Australasian resources industry. His experience includes being a Company Director, Managing Director, CEO, Project Manager, Study Manager and originally a Metallurgist in an operating environment.

Mr Hazelden brings a diverse range of capabilities from exploration, project development studies, research and development, project approvals, offtake agreements, equity raising, debt financing plus mergers and acquisitions. He has worked across multiple commodities including potash, gold, copper, zinc, lead, iron ore, tungsten, salt, diamond and now rare earth sectors. Most recently, Brett was the Co-founder and Managing Director/CEO of Kalium Lakes (Kalium Lakes Ltd (ASX:KLL)).

Mr Hazelden was appointed as a Director on 1 April 2022.

Mr Hazelden is not considered to be an independent Director as he is engaged in an executive capacity.

About OD6 Metals Limited (ASX: OD6)

OD6 Metals is an Australian public company with a purpose to pursue exploration and development opportunities within the resources sector. The Company holds a 100% interest in the Splinter Rock Project and Grass Patch Project which are located in the Goldfields-Esperance region of Western Australia, about 30 to 150km north of the major port and town of Esperance.

The projects are considered prospective for clay rare earth elements (REEs), with the Company’s aim of delineating and defining economic resources and reserves to develop into a future revenue generating operational mine. Clay REE deposits are currently economically extracted in China who is the dominant world producer.

Rare earth elements (in particular, Nd and Pr), are becoming increasingly important in the global economy, with uses including advanced electronics, permanent magnets in electric motors and electricity generators (such as wind turbines) and consumer electronics.

Why OD6 Metals?

- Emerging REE major new clay province in WA, potentially competitive with China’s deposits.

- Dominant land position with over 4,800 km2

- Located close to Esperance port, sealed roads and renewable energy infrastructure.

- Extensive Clay REE in 10 to 37m thick blanket over very large areas .

- Wide intersections of TREO with excellent Nd-Pr concentrations of 20%

- Multiple targets for potentially globally significant REE resources.

- Excellent regional metallurgy.

- Clay REE’S are typically low capital intensity and high margin product.

- Significant supply shortage forecast due to rapid demand increase for renewable power, electric vehicles and electronics.

- Critical metals being prioritised by Governments around the world (need for diversity of supply away from China).

Please let Samso know your thoughts and send any comments to info@Samso.com.au. Remember to Subscribe to the YouTube Channel, Samso Media and the mail list to stay informed and make comments where appropriate. Other than that, also feel free to provide a Review on Google (NASDAQ:GOOGL).

For further information about Coffee with Samso and Rooster Talks visit: www.samso.com.au

About Samso

Samso is a renowned resource among the investment community for keen market analysis and insights into the companies and business trends that matter.

Investors seek out Samso for knowledgeable evaluations of current industry developments across a variety of business sectors and considered forecasts of future performances.

With a compelling format of relaxed online video interviews, Samso provides clear answers to questions they may not have the opportunity to ask and lays out the big picture to help them complete their investment research.

And in doing so, Samso also enables companies featured in interviews to build valuable engagement with their investment communities and customers.

Headed by industry veteran Noel Ong and based in Perth, Western Australia, Samso’s Coffee with Samso and Rooster Talk interviews both feature friendly conversations with business figures that give insights into Australian Stock Exchange (ASX) companies, related concepts and industry trends.

Noel Ong is a geologist with nearly 30 years of industry experience and a strong background in capital markets, corporate finance and the mineral resource sector. He was founder and managing director of ASX-listed company Siburan Resources Limited from 2009-2017 and has also been involved in several other ASX listings, providing advice, procuring projects and helping to raise capital.

He brings all this experience and expertise to the Samso interviews, where his engaging conversation style creates a relaxed dialogue, revealing insights that can pique investor interest.

Noel Ong travels across Australia to record the interviews, only requiring a coffee shop environment where they can be set up. The interviews are posted on Samso’s website and podcasts, YouTube and other relevant online environments where they can be shared among investment communities.

Samso also has a track record of developing successful business concepts in the Australasia region and provides bespoke research and counsel to businesses seeking to raise capital and procuring projects for ASX listings.

Disclaimer

The information contained in this article is the writer’s personal opinion and is provided for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. Read full disclaimer.