Reward Minerals Ltd (ASX:RWD) has launched a renounceable entitlement issue of shares to existing shareholders at an issue price of $0.05 per share to raise ~$22.8 million.

The capital raising will help Reward fund the proposed acquisition of the Beyondie Sulphate of Potash (SOP) Project in Western Australia from Kalium Lakes Ltd.

The renounceable entitlement issue will involve two new shares for every one existing share held along with one free option for every two shares subscribed and issued.

These options will have a term of two years from the issue date and an exercise price of $0.10.

The offer is proposed to be fully underwritten by RM Corporate Finance Pty Ltd, subject to execution of an underwriting agreement.

Read: Reward Minerals takes next step to acquire Beyondie Sulphate of Potash Project

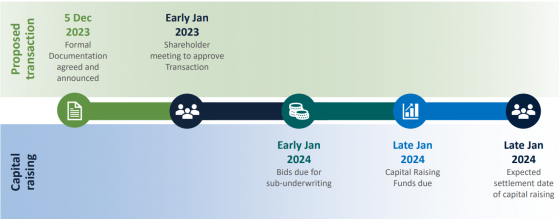

Earlier this month, Reward entered into a binding share sale agreement with the receivers and managers of Kalium Lakes, which is under administration, to acquire the project.

The acquisition is agreed upon a debt-free and encumbrance-free basis for a total consideration of $20 million.

This amount includes an exclusivity payment of $250,000, upfront cash of $14.75 million and a deferred cash payment of $5 million due by the end of the current financial year.

Reward has been investigating the Beyondie Project for some time and believes the current flowsheet and unit operations can be simplified, enabling potentially significant cash flow generating SOP production at the site.

The company considers the acquisition terms to be highly favourable compared to the significant infrastructure being acquired ($466 million sunk investment).

Reward views this as a rare opportunity to acquire an SOP play at a time when the market outlook is strong, with high prices driven by restricted supply, population growth, demand for low-chloride fertilizer and an increased need for SOP for higher-value crops.

Upon completion of the acquisition, Reward plans to maintain the Beyondie Project on care and maintenance for 12 months, focusing on assessing and resolving operational shortcomings.

Reward then aims to integrate its new SOP processing technology (Reward Process) into the Beyondie Project's brine supply and plant flow sheet, a low-cost R&D program leveraging existing infrastructure.

This will position Reward to evaluate the revenue-generation viability of the Beyondie Project processing plant and any additional capital expenditure required.

Evaluation on horizon

“Reward is pleased to have progressed the potential acquisition of the Beyondie SOP project on a debt-free basis, free of encumbrances to the execution of the Share Sale Agreement stage,” said executive director Michael Ruane last week.

“Assuming that the proposed DOCA with creditors, shareholder approval and capital raising are completed, the Reward team is keen to move quickly on evaluation of the plant and flowsheet modifications and costs for potentially recommissioning the Beyondie Project.

“The evaluation will also cover the incorporation of the Reward Process into the existing project layout and also for SOP recovery operations at other SOP resource sites.”

Read more on Proactive Investors AU