Red River Resources Ltd 's (ASX:RVR) Thalanga Operations achieved strong September quarter base metal output with copper concentrate production increasing for the fourth quarter in a row to a new record of 4,073 dry metric tonnes (DMT).

Thalanga also increased zinc concentrate production to 7,026 DMT while lead concentrate production reached 1,947 DMT – an increase of 72%.

The improved production at Thalanga comes as the company is on-track to re-start production at Hillgrove Gold Project in northern NSW by the end of the year.

Thalanga Operations

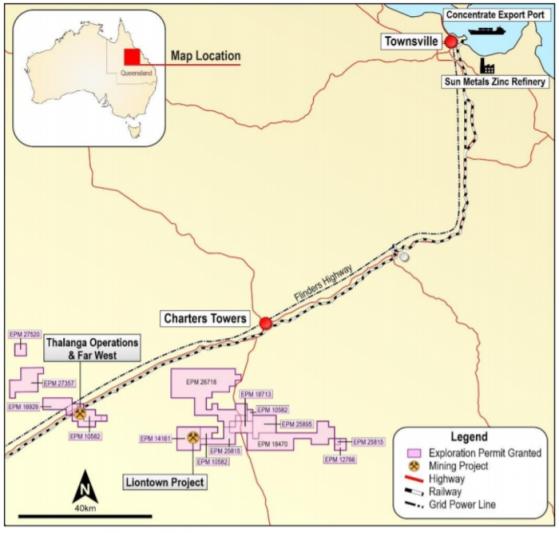

Red River acquired Thalanga, which is around 55 kilometres west of Charter Towers in Northern Queensland, in 2014 and started production from the West 45 deposit in 2017.

Production from West 45 ceased in 2020 and ore for the Thalanga Operation is now sourced from the Far West underground mine, with plans to develop the Liontown deposit to extend the operational life.

The project consists of a 650,000 tonnes per annum mill producing copper, lead and zinc concentrates with material precious metal credits (gold and silver) from high-grade volcanogenic hosted massive sulphide (VHMS) deposits hosted in the Cambro-Ordovician Mt Windsor Volcanics sequence.

During the quarter, the company continued to invest in the development of the Far West UG Mine with:

- Capital development of 973 metres for the quarter;

- Operating development of 915 metres; and

- Total development during the quarter reaching 1,888 metres.

Lead and zinc offtake extended

Red River recently renewed the lead and zinc concentrate offtake agreements on top of extending the working capital facility with Trafigura Pte Ltd.

These offtake agreements begin in January 2021 and will run for three years.

Under the terms of the offtake agreements, zinc and lead concentrates will be trucked around 200 kilometres to the Port of Townsville, for onward delivery to customers.

The working capital facility of up to US$15 million is available to Red River and its affiliate Cromarty Resources Pty Ltd for general working capital, corporate and other purposes.

This facility will be provided on similar terms as the previous US$10 million working capital facility.

Trafigura is one of the world's largest physical commodities trading groups. It sources, stores, transports and delivers a range of raw materials, including oil and refined products and metals and minerals, to clients globally.

The trading business is supported by industrial and financial assets, including a majority ownership of global zinc and lead producer Nyrstar NV (OTCMKTS:NYRSY) (FRA:3NY1), which has mining, smelting and other operations in Europe, the Americas and Australia.

Project development

Red River continued with mine planning and metallurgical aspects for the Liontown Project, with a focus on developing a combined open pit and underground operation with a conceptual mine life of more than 10 years.

Liontown has a current mineral resource of 4.1 million tonnes at 0.6% copper, 1.9% lead, 5.9% zinc, 1.1 g/t gold and 29 g/t silver, and is around 32 kilometres in a direct line from the Thalanga operations.

On top of this, the company carried out an intensive program of mapping and sampling activities at the New Homestead, Toomba and Don gold targets within the highly prospective Mt Windsor volcanic belt in northern Queensland as part of drill target definition activities.

Red River expects to begin drilling these targets within the coming quarter.

RVR’s gold exploration targets in the Thalanga region.

Hillgrove Gold Project

Earlier in November, the company received strong results from a maiden diamond drilling program targeting Curry’s Lode at the Hillgrove Gold Project in northern NSW with all holes intersecting gold-tungsten-antimony mineralisation.

Red River completed seven diamond drill holes for a total of 776.4 metres and noted that tungsten is present as scheelite (calcium tungstate CaW04) and minor visible gold mineralisation in several intercepts.

Drilling returned peak assays up to 19.7 g/t gold, 0.66% tungsten and 5.8%.

These results provide further encouragement as the company maintains momentum at Hillgrove towards restarting gold production by the end of the year using material from existing stockpiles before restarting underground operations at Metz Mining Centre in mid to late 2021.

The company has started planning the next phase of Curry’s Lode drilling targeting extensions of the mineralisation.

A detailed review of the drilling is also underway to seek to target zones of higher-grade mineralisation for a 2021 drilling program.

As well as the restart plans, Red River aims to develop additional mining centres at Hillgrove through exploration for gold and critical metals, including tungsten and antimony

Read more on Proactive Investors AU