Queensland Pacific Metals Ltd (ASX:QPM) has wrapped up its advanced feasibility study for Stage 1 of the TECH Project in North Queensland, which will produce nickel and cobalt for the EV and energy storage industries, and a scoping study for the Stage 2 expansion of the project.

The feasibility study outline strong financial metrics for the TECH Project, which has already secured offtake agreements for 100% of nickel and cobalt sales for the life of the project with General Motors (NYSE:GM), LG Energy Solutions and POSCO, all three of which are also shareholders of QPM.

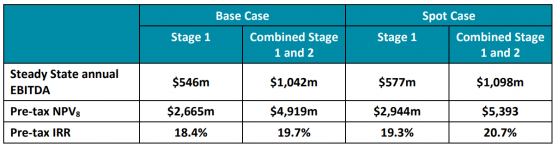

The study shows the strong financial metrics of the project.

The Stage 1 development capex estimate of A$1.9 billion plus contingency allowance compares well with a 2020 pre-feasibility study estimate of A$650 million, in the face of a 2.7x plant scale increase and global equipment cost inflation over the past two years.

Of particular note is a lowest quartile operating cost – after co-product credits – on the nickel cost curve.

"A moment in time"

Managing director and CEO Dr Stephen Grocott said, “We are pleased to present the results of the feasibility studies for the TECH Project.

“The outputs of these studies represent a moment in time and the culmination of hard work from the QPM team, Hatch Ltd and our other consultants.

"However, the work does not stop here and we now continue to work on the project and advance towards a final investment decision in parallel with our funding initiatives.”

Financial discussions to start

The company can now kick off the debt funding process with potential lenders and provide guidance to investors.

The capex estimate used for the study was taken at a peak in global inflation and equipment pricing.

QPM is heartened by advice from key vendors that they are seeing the cost of manufacturing reduce significantly, which will assist QPM when it is time to place formal orders.

The capital estimate was prepared by recognised engineering firm Hatch with support from other key vendors and consultants.

Next up is the debt financing due diligence process, led by advisors KPMG, which will start immediately and include:

- NAIF – strategic assessment phase completed;

- Export Finance Australia – conditional commitment received of A$250 million;

- K-Sure – formal expression of interest to participate on terms similar to Export Finance Australia; and

- other export credit agencies and commercial banks who have provided formal expressions of interest.

Easing global inflation, particularly continued reductions in equipment manufacturing costs in the near term, will likely reduce the capital cost of constructing the TECH Project and improve the study’s metrics further.

Scoping study for Stage 2

The scoping study identified synergies for the TECH Project, including a $350 million reduction in capital cost compared with the Stage 1 capital estimate.

These savings are the result of no planned expansion of HPA production, along with estimated opex reductions of around 7% due to economies of scale, increased purchasing power and shared services.

Assumptions used in the scoping study include that:

- Stage 2 is at the same scale as Stage 1, with the same grade of ore being processed;

- HPA production levels are not increased as part of the expansion, but this is possible if there is strong market demand;

- no use of existing rail infrastructure for logistics – work will be undertaken in the future to assess this opex-saving opportunity; and

- co-location of Stage 2 expansion next to Stage 1, within the Lansdown precinct.

The company is conducting ongoing work on some aspects of the TECH Project to improve estimate accuracy and value engineering initiatives to implement identify capex savings over the next few months in parallel with the debt financing process.

Between now and the final investment decision, QPM will continue to work with its key equipment suppliers and engineering service providers to bring forward commissioning and first production.

Read more on Proactive Investors AU