Queensland Pacific Metals Ltd (ASX:QPM) has established a long-term collaboration with global carmaker General Motors (NYSE:GM), setting the stage for a strategic investment and offtake agreement.

GM could seed as much as US$69 million (A$108 million) in funding through an equity subscription — a deal that includes an initial, binding US$20.1 million (A$31.4 million) investment.

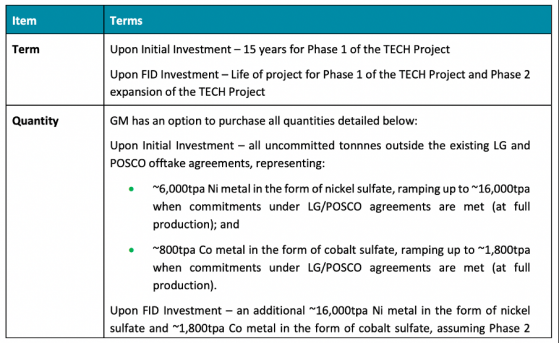

Through the collaboration, GM also has the right to purchase all uncommitted nickel and cobalt sulphate produced in the first 15 years of the Queensland-based TECH Project’s first phase of operation.

If it opts in for a further investment when QPM reaches a final investment decision, GM’s offtake rights will extend to the project’s lifespan, and it can purchase all of the nickel and cobalt sulphate covered under the phase two expansion.

QPM will use the funding to accelerate development and construction across its battery metals TECH hub.

Investors have responded positively to the collaboration with shares as much as 33.34% higher intraday to $0.20.

Show me the money

As part of its initial investment, GM will pick up around 175 million QPM shares at $0.18 a pop.

This price represents a 20% premium on QPM’s last closing price and a 22.8% markup on the 3-month volume-weighted average price.

Around 138 million shares can be issued under QPM’s existing placement capacity, but the other 20 million need shareholder approval to vest. QPM will put it to a vote at an extraordinary general meeting in the near term.

QPM will also issue GM just under 47 million options, exercisable at 20 cents within three years of issue.

The balance of the initial investment can be called by QPM prior to a final investment decision (FID), meaning it can have cash on hand to support other agreed funding initiatives in relation to the TECH Project.

Following the FID — provided it’s happy with the definitive feasibility study and other customary conditions — GM will also take part in another raise to bring the TECH project into construction.

It plans to commit up to US$44 million, making it a cornerstone investor in the pivotal raise.

Offtake deal

QPM and GM’s collaboration also tees up an offtake deal that covers at least the first 15 years of the TECH project.

The key details are:

Pricing remains commercially confident, but it’s linked to the underlying price of nickel and cobalt as seen on the London Metals Exchange.

One step closer to delivering clean nickel and cobalt

QPM managing director Dr Stephen Grocott said the company was absolutely delighted to form this partnership with General Motors.

“GM’s strategic direction, company values and focus on sustainability in its pursuit of making electric vehicles for all is a perfect fit for Queensland Pacific Metals and our TECH Project.

“GM’s investment in our company and the associated offtake brings us one step closer toward construction of the TECH Project where we will one day aim to deliver the world’s cleanest produced nickel and cobalt.

“We thank GM for their support of our TECH Project and look forward to becoming part of the GM sustainably sourced raw material supply chain.”

GM’s vice president of global purchasing and supply chain Jeff Morrison said the deal aligned with the company’s operational values.

"The collaboration with Queensland Pacific Metals will provide GM with a secure, cost-competitive and long-term supply of nickel and cobalt from a free-trade agreement partner to help support our fast-growing EV production needs.

“Importantly, the agreement demonstrates our commitment to building strong supplier relationships and is aligned with our approach to responsible sourcing and supply chain management."

Read more on Proactive Investors AU