Queensland-based copper-gold explorer QMines Ltd (ASX:QML) is projected by East Coast Research to deliver a 138% upside from its current share price of A$0.066, reaching what the analysts consider a fair valuation of A$0.157 per share.

Sizeable MRE and regular updates

In its recent report, East Coast reasons that the company's flagship asset, the Mt Chalmers project near Rockhampton, boasts a JORC-compliant mineral resource estimate (MRE) of 15.1 million tonnes at 1.3% copper equivalent (CuEq).

A recently completed pre-feasibility study (PFS) reveals robust metrics, including a pretax net present value (NPV) of A$373 million, a 54% internal rate of return (IRR) and a payback period of 1.84 years.

“As per its recently concluded PFS, the Mt Chalmers project is positioned at the top of its comparable ASX-listed copper explorer peer group across a number of investment return indicators,” the report said.

“QMines’ management exhibits a record of executing on stated goals, with the company delivering six resource upgrades since its IPO in 2021 and a likely seventh one to come later in 2024.

“This record provides assurance for the delivery of further goals, such as enlarging the scale of the Mt Chalmers project by incorporating resources from its many other assets, particularly Develin Creek.”

With a planned 10.4-year mine life, Mt Chalmers is expected to produce 105,000 tonnes of copper equivalent, benefiting from low processing costs and initial capital expenditure.

Proximity to infrastructure and strong management

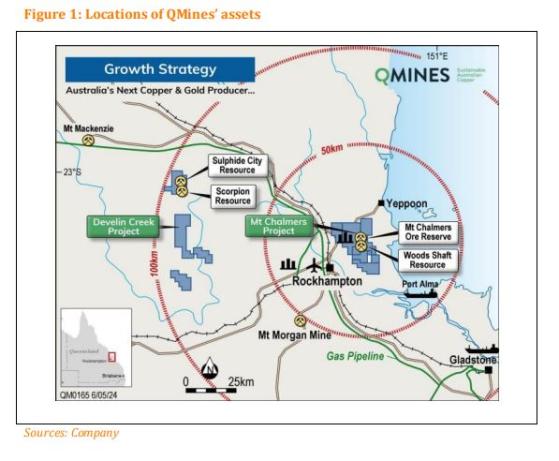

The project’s proximity to infrastructure and management's proven track record in resource upgrades positions QMines for future scale enhancements, particularly through the incorporation of its Develin Creek assets, which will potentially increase the mine's output and economic value.

The company’s strong metrics have given East Coast confidence that it is performing “at the top of its copper explorer peer set” of explorers that have also conducted feasibility studies.

“There are many causes for this, from being favourably exposed to both copper and gold, effectively being a brownfield project and being well connected to infrastructure, given the proximity to Rockhampton,” the report continued.

“These metrics are set to become even better if, as is expected, QMines brings in additional scale to Mt Chalmers.”

QMines’ prospects continue to be bolstered by rising demand for copper and gold, driven by supply deficits and structural market growth in the renewable energy and technology sectors.

Read more on Proactive Investors AU