Poseidon Nickel Ltd (ASX:POS, OTC:PSDNF) has taken further steps to reduce the cost of doing business following its decision in July to put on hold the final investment decision (FID) on the restart of its Black Swan Nickel Project in Western Australia.

These cost-cutting measures, comprising board and senior executive changes along with a revised care and maintenance operating model at Black Swan, will result in savings of $3 million annually.

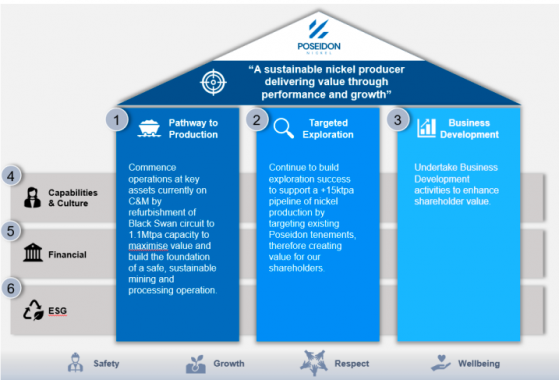

Black Swan’s restart remains a key strategic initiative for the company, but in the meantime, exploration activities will focus on its Lake Johnston Project, where Poseidon has identified strong vectors to nickel sulphides at several areas along the Western Ultramafic Unit, which include platinum and palladium values.

READ: Poseidon Nickel identifies potential new target at Lake Johnston; progresses work streams

“While we have made significant progress on project financing, concentrate quality and offtake, approvals, and planning in relation to the Black Swan restart, as previously advised, we are not in a position to make the final investment decision for a number of reasons, including the current weaker-than-anticipated nickel price, the short-term outlook for commodity prices and the need to complete additional metallurgical testwork,” Poseidon managing director and chief executive officer Peter Harold said.

“Since the decision was made, in mid-July 2023, to defer the restart, the board and executive team has been looking at ways to reduce costs in the business both at the corporate and asset levels.

“To that end, some major personnel changes will be made, including myself, to significantly reduce the corporate overhead while preserving the knowledge base of the company.

“In addition, we have revised the care and maintenance operating model at Black Swan, which will result in a material reduction in annual operating costs without impacting the restart timetable for the mine and processing plant when a decision to restart is made.

“Our aim is to ensure costs are reduced while at the same time putting Poseidon in the best position for the restart.”

Leadership changes

Harold, who has served as Poseidon’s managing director and CEO since March 2020, will transition to the role of chair from October 2, 2023.

During his tenure, he has managed the company through challenging times while simultaneously helping to achieve significant milestones, including the delivery of Black Swan’s feasibility study in November last year.

Craig Jones, currently the general manager of Mining, will become the new CEO of Poseidon.

He brings more than 28 years of experience in Western Australian underground hard-rock mining, having worked for various mining companies, including Bellevue Gold and Northern Star Resources (ASX:NST).

Further, Derek La Ferla, who has been the chair of Poseidon since November 2019, will retire from his position, while Dean Hildebrand, a non-executive director originally representing major shareholder Black Mountain Metals, will also retire from the board.

Hildebrand had been serving independently since his departure from Black Mountain in 2022.

La Ferla and Hildebrand’s retirement will take effect from October 27, 2023.

Expressing gratitude

“I would like to take this opportunity to thank Derek and Dean for their efforts and dedication since they joined the company,” Harold said.

“I would also like to thank Craig for his commitment to the company and for stepping up into the CEO role.

“I am passionate about Poseidon, its assets and its people and will transition from my current role to non-executive chair.

“I look forward to assisting Craig and the executive team over this transition period.”

Black Swan cost cuts

To further reduce site operation costs, Poseidon will change the pumping and ventilation regime at the Silver Swan project, part of the wider Black Swan project, from the current continuous operation to a more sustainable periodic operating model.

This change will involve transitioning to a smaller workforce, lowering power consumption for ventilation and pumping, and reducing various other onsite expenses.

More importantly, the initiative will preserve the key underground infrastructure so as not to impact the restart timetable given there is a 12-month plant refurbishment period between the decision to restart and the first ore going through the processing plant.

Moving forward

“Our primary focus remains to restart Black Swan in the right nickel price environment,” Harold continued.

“Our immediate priorities are to confirm the metallurgical recoveries for the smelter grade concentrate project, complete the expansion project pre-feasibility study, continue exploration activities at Lake Johnston along the highly prospective Western Ultramafic Unit and keep reviewing our assets and costs and make further adjustments where necessary.”

Read more on Proactive Investors AU