Perseus Mining Ltd (ASX:PRU, TSX:PRU, OTC:PMNXF) has extended the life of mine plan (LOMP) for its Yaouré Gold Mine in Côte d’Ivoire, West Africa to at least 2035, after proving and estimating 37.2 million tonnes of ore and 2.07 million ounces of gold in reserves.

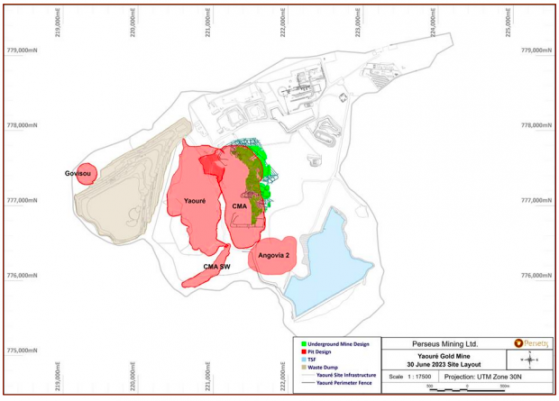

The LOMP extension includes an underground mining operation below the CMA open pit for the first time since the company acquired the project in 2016, as well as the existing CMA open pit and an expanded Yaouré open pit.

The African gold miner expects to produce more than 1 million ounces of gold from Yaouré over the next five years.

Significantly, there is potential to extend the LOMP through additional resource discoveries adjacent to existing infrastructure and further drilling of known deposits, including the Yaouré open pit and CMA underground structure.

Being consistent

Perseus poured first gold at Yaouré in December 2020 from ore primarily mined from the CMA open pit.

Since then, Perseus has estimated the measured and indicated mineral resources at 54.7 million tonnes, grading 1.59 g/t for 2.8 million ounces of gold. Its inferred resources are estimated at 11.3 million tonnes, grading 1.9 g/t for 700,000 ounces of gold.

Ore reserves total 37.2 million tonnes grading 1.73 g/t, containing 2.07 million ounces of gold from open pits and underground, and estimated at a gold price of US$1,500 per ounce.

The overall LOMP includes processing of 41.9 million tonnes of ore, at an average grade of 1.58 g/t and average metallurgical recovery of 90.8%.

Gold production is expected to be 1.9 million ounces of gold at an all-in-sustaining-cost (AISC) of US$1,116 per ounce, while the LOMP revenue is evaluated at a gold price of US$1,700 per ounce.

The LOMP is based upon ore reserves and does not include inferred resources within the processing feed.

Yaouré gold mine layout.

Rising up to the challenge

Perseus managing director and chief executive officer Jeff Quartermaine said: “Our increase to the life of Yaouré Gold Mine to 12+ years announced today ensures Yaouré will continue to be an important part of Perseus’s geopolitically diverse asset portfolio for many years to come and will enable us to continue delivering on our corporate mission of generating material benefits for all of our stakeholders, including our host governments and communities.

“When Perseus acquired Yaouré as a development project in 2016, the possibility of extending the life of the mine through development of an underground operation was not part of the plan.

“However, our discovery, and subsequent engineering and planning, that has led to today’s announcement, bears testament to Perseus’s in-house ability to create significant value through organic growth.

“An underground mine planned for Yaouré, will be Perseus’s first foray into underground mining, with all previous operations having been open cut operations.

“While the underground mine represents a new style of mining and a new challenge for us as a company, it is certainly not new to many of our technical team members, who are very keen to demonstrate their skills in an underground mining setting.

“With the prospect of further extending the mine life through further exploration success, we expect that the Yaouré Mine will live up to its reputation as one of the leading mines in Côte d’Ivoire, if not in all of West Africa.”

Click here for more information on the LOMP extension.

Read more on Proactive Investors AU