OD6 Metals Ltd (ASX:OD6) has revealed rare earth results described as "outstanding" with grades up to 4,159 ppm total rare earth oxides (TREO) from phase 3 drilling at the Splinter Rock clay-hosted rare earth element (REE) project, northeast of Esperance in Western Australia.

To date, the company has completed 78 holes from its 145-hole aircore program, returning in excess of 1,000 ppm TREO in 61% of the drill holes with extensive clay thickness of up to 56 metres.

Significant high-grade clay-hosted rare earth intersections include:

- 56 metres at 1,111ppm TREO (23.4% MREO) from surface, including 30 metres at 1,646ppm TREO (24% MREO) from 24 metres;

- 40 metres at 1,308ppm TREO (21.9% MREO) from 21 metres, including 28 metres at 1,646ppm TREO (21.8% MREO) from 33 metres; and

- 36 metres at 1,206ppm TREO (22.7% MREO) from 30 metres.

Furthermore, there exists significant potential for mineral resource expansion based on these preliminary findings.

“Globally significant discovery”

OD6 managing director Brett Hazelden said: “These outstanding drill results have further confirmed the high-grade clay-hosted rare earth nature of the Prop Prospect.

“With the combination of clay thicknesses of up to 56 metres, grades in excess of 1,000ppm total rare earth oxides and consistency across several kilometres of width and length, the Prop Prospect continues to validate this globally significant discovery.

“It is important to recognise how materially these results expand the extent of the current footprint of high-grade mineralisation at the Prop Prospect, offering real and substantial potential for resource expansion.

“Results remain outstanding for 67 holes of the drilling program at our Centre Prospect, which also stepped out from the existing extent of the MRE boundary.

“We are eagerly awaiting these assay results and expect them to be progressively received over the coming weeks.

“OD6 is grateful for the continued support from the Department of Mines, Industry Regulation and Safety whose funding, via the Exploration Incentive Scheme, helped facilitate the expedition of this drill program.”

$OD6 OD6 Metals identifies 16-kilometre clay-hosted REE target at Centre and 11-kilometre target at Prop in Phase 3 Splinter Rock drilling https://t.co/lS41gJ7A8c @Od6Metals #OD6 #ASX #ASXNews— Proactive Australia (@proactive_au) August 15, 2023

Drill program

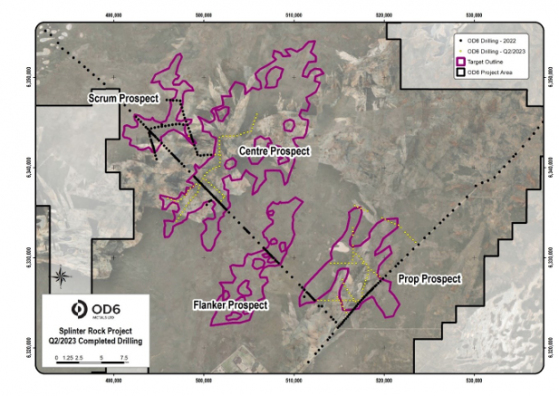

The company’s phase 3 aircore program was designed to test the localised consistency of clay type, thickness and grades at the Centre and Prop prospect areas.

The drill program received funding through the Western Australian Government’s Exploration Incentive Scheme co-funded drilling program.

A total of 145 holes for 7,435 metres were drilled at an approximate average depth of 51 metres and a maximum depth of 104 metres at 400-metre spacing intervals.

Importantly, 96% of holes encountered clays with rare earth concentrations >300ppm TREO, with 61% of holes intercepting rare earth concentrations >1,000ppm TREO.

Phase 3 drilling confirmed clays across an 11km length at Prop with widths between 4 to 5 kilometres.

These drill results strongly correlate with interpreted data from AEM, validating geological modelling and exploration program design.

Splinter Rock Project completed drilling locations.

Potential for resource expansion

The current Splinter Rock maiden inferred mineral resource estimate stands at 344 million tonnes at 1,308ppm TREO at 1,000ppm cut-off grade at 22.8% MREO.

The Prop Prospect represents 33 million tonnes at 1,180ppm TREO at 1,000ppm cut-off grade at 20.7% MREO of the Splinter Rock MRE.

The drill results strongly correlate with interpreted data from the Airborne Electromagnetic Survey (AEM), validating geological modelling and exploration program design.

Read more on Proactive Investors AU