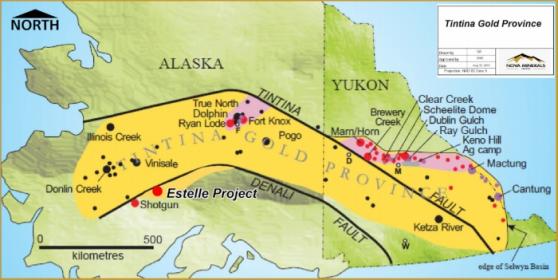

Nova Minerals Ltd (Nova Minerals Ltd (ASX:NVA, OTCQB:NVAAF)) (ASX:NVA) (FRA:QM3) is on track to deliver an interim scoping study for the Korbel Main deposits at its Estelle Gold Project in Alaska’s prolific Tintina Gold Province in July.

CEO and executive director Christopher Gerteisen said the company’s year-round operations meant it had been drilling since the beginning of 2020.

He said: “Over the course of last year, we drilled 64 diamond holes and in April we released a 4.7-million-ounce resource.

“That resource will be a key component to the upcoming interim scoping study, but it represents just one small part of Korbel – because the deposit remains wide open and will continue to grow as we push forward.”

The company is not wasting any time and expects to release the interim scoping study to the market potentially as early as July and proceed to PFS soon after to maintain their aggressive timeline.

Economical milling opportunity

Gerteisen said the scoping study was really just a “snap-shot in time” and the primary objective was mainly to prove the conceptual flowsheet, which was developed from metallurgical test-work that started last year.

He said: “We looked at all kinds of options - heap leach, CIP, CIL – and this flowsheet will be a key input to the interim scoping study.

“We’ve always compared ourselves to our peers here in the Tintina Gold Province - Kinross Gold Corporation’s (NYSE:KGC) (TSE:K) (FRA:KIN2) Fort Knox Gold Mine and Victoria Gold Corp’s (TSE:VGCX) (OTCMKTS:VITFF) (FRA:VI9A) Dublin Gold Project on the Yukon side, which are very large, bulk mineable, heap leach style operations.

“So, we always envisioned ourselves as a bulk mineable heap leach operation, however, our test-work has shown that, while we're still a bulk mineable operation, our path is leading towards a milling operation.”

The reason being that ore sorter technology has come a long way in recent years and utilized with great effect on many mines globally.

Due to the style of mineralization at Korbel, the XRT laser technology is able to separate the material efficiently.

Gerteisen said: “With ore sorting our results are just exceptional, we're able to upgrade the material we put to the ore sorters up to 10 times.

"The test material that we put into the ore sorters was half a gram per tonne, and on the other side it spit out material that was up to six grams per tonne - that's a significant upgrade.

“If we can upgrade things that much, the economics drive us towards a milling operation.”

The company is also looking at flotation and gravity after milling, then performing an intensive leach with recoveries of over 90%.

The company’s Estelle Project is in the Tintina Gold Province.

Pathway to production

Once the interim scoping study is complete, the company will move on to the pre-feasibility study (PFS) and is already planning the next stage of metallurgical test-work for later this year and has commenced baseline environmental studies.

Gerteisen said: “Our goal is to complete the PFS in 2022-2023, then we'll start in the feasibility in 2023-2024.

“We want to have a decision to mine by 2025 and then be digging up dig up the first dirt and first gold pour by 2025- 2026.

“Now, that’s very ambitious, but everything starts with a plan and certainly at this rate, operating year-round, we're definitely on track to be able to achieve that. It's full-steam ahead for us.

“So, in 2025-2026 we're aiming to be in production whilst we continue to unlock the Estelle Gold District and add significantly to our resource inventory across our other prospects.”

Streamlined environmental permitting

Gerteisen said one of the main reasons the company would be able to stick to this timeline was because it would complete an Environmental Assessment (EA) as opposed to an Environmental Impact Assessment (EIA).

He said: “This is because we are up in the mountains and will have very minimal wetlands impact, which is a main factor in deciding between an EA and an EISA.

“An EA environmental assessment is much more streamlined, less time consuming, less resources required than a full-blown EISA.

“The environmental permitting should not hold us back, with the long-lead-time baseline monitoring data collection starting now.

“Also, we are on state land, we don't have any federal mining claims and no native corporation land, which really works in our favour for our production timeline.”

Korbel Main and satellite targets with update resource.

Resource growth potential

Notably, the company has almost doubled the resource at Kobel Main to 4.7 million ounces since it commenced drilling and this trend looks set to continue.

Gerteisen said: “From the maiden resource to the resource in October 2020 (so one year) we increased the resource by almost a million ounces.

“And in six months since then, we've increased the resource again by over a million ounces.

“So, in 18 months from the maiden resource, we've increased the resource by 2 million ounces from 2.5 to 4.7 million ounces.

“Now that is very rare, if not unique in the industry these days.

“At this rate, every six months, we seem to be increasing the resource by a million ounces.

“We hope that trend line continues.”

Ongoing drilling programs

The company is drilling non-stop with up to 50,000 metres plan this year with four rigs on-site and plenty of upside in the Korbel Valley to the north, west and southeast.

Gerteisen said the first rig would be infill drilling at Korbel main to get the inferred resources up to indicated level – especially as the company gears up for the PFS.

He said: “The second rig will continue stepping out to the northwest of Korbel main towards the Isabella block - and if Korbel main is any indication where we had the original block A and Block B which eventually converged to comprise what we now call Korbel Main - there's a good chance that Isabella block to the north also converges with the Korbel Main deposit.

“If that's the case, then we will determine that with the step-out drilling this year to the northwest.”

To the southeast, the company is also undertaking step out drilling where it had some of its highest grades at the You Beauty anomaly and is confident the area could eventually be where the mine starter pit is located.

In addition, the company will drill towards the You Beauty target which it believes has potential to be a blowout zone to the southwest of Korbel Main.

Gerteisen said: “Additionally throughout the Korbel Valley there’s several other prospects that we will target with drilling this year, namely the Cathedral prospect.

“We released some rock chip samples at the end of last year that produced several ounces per tonne there and this prospect is a very strong anomaly.

“We feel it could be the core feeder to the greater Korbel Valley mineralised system, so we'll be drilling that this year.”

15 targets in Tintina Gold Province

And the prospects don’t end in the Korbel Valley, which only represents around 2% of the company’s 324 square kilometre block claim.

There are a further 15 other known prospects at various stages of advancement which represent medium to long term upside for the company.

Gerteisen said: “We're really unlocking a district here, with a pipeline of prospects moving forward.

“The next cab off the rank is the RPM prospect which sits 20 miles along mineralised strike to the south of Korbel.

“I say mineralized strike because it's a mineralized intrusive corridor, and as you fly from Korbel to RPM it's just littered with prospects that are named as well as yet unnamed.

“There’s not much vegetation and when you look down, there are just these screaming colour anomalies everywhere.”

The company anticipates a team on the ground in July to begin mapping and sampling the Stoney Vein, T5, Shoeshine and Train prospects, to name a few, as well as identify additional prospects to add to the Estelle portfolio.

RPM prospect location along strike from Korbel Main.

RPM drilling underway

At the RPM prospect, the company will follow up with drilling on an historical hole of 120 metres at over a gram plus new rock chip samples which it generated last year which returned 9-10 ounces per tonne.

Gerteisen said: “With that sampling program we also identified a new zone.

“There’s RPM proper and then there's also the RPM South prospect which sits a few hundred metres to the south.

“We feel that those two zones will connect at depth as we drill.”

The company expects to begin drilling 5,000-10,000 metres with the drill rig being mobilised in the coming weeks.

Gerteisen said that, while he didn’t want to speculate, he expected to release a maiden resource for RPM later this year and believes it will add significantly to the global resource inventory.

He said: “We feel from what we're seeing from the geological fundamentals out here, with a maiden resource at RPM, as well as what we have at Korbel, this adds some serious depth to the Estelle Gold Project, which is shaping up to be world-class.

“We'll have two resource areas, two deposits that we will be advancing as the year progresses.”

Gerteisen expects a major re-rate in the near term, particularly with the much-anticipated RPM drilling underway, the first results from Korbel and RPM, the interim scoping study release – plus a maiden resource for RPM to be released along with a resource upgrade for Korbel later this year.

Range of power options

As well as being in an extremely mining-friendly jurisdiction in Alaska, the company also has a variety of access and power options – which are always an important consideration with remote resource projects.

Gerteisen said: “We have many options here.

“There's a gas pipeline that will be going out to the Barrick Gold Corp (NYSE:GOLD) (TSE:ABX) (FRA:ABR) and NovaGold Resources Inc’s (NYSE:NG) (TSE:NG) (FRA:NGR) Donlin Creek mine (40 million ounces) to the west of us which is in the last stages of being approved.

“We could potentially tap into that.

“Once the pipeline is built, it will pass about five miles to the north of us, so there's potential there for natural gas to power us.

“There’s also a coal project, which is about 20 miles to the east of us which is also a very low-cost opportunity.

“We’ve also looked into renewables, water, wind and solar - but that’s not so favourable in terms of being able to generate the amount of continuous power we will require.

“In addition, there are several operators to the south of us in the Mount Spurr geothermal fields that are starting to really advance those projects.

“We've also looked at ammonia with hydrogen fuel cells and conventional diesel generators.

“Bottom line, there's lots of options for power that are very advanced and we'll see which one makes sense for the business and fits our timeline.”

West Susitna access road

In terms of access, the company has an impressive 4,000-foot airstrip on-site which it plans to expand in short order to accommodate much larger planes.

Gerteisen said: “In the wintertime, we establish a snow road to access and support the site.

“This is how we bring in all of our heavy equipment, drill rigs, camp units, etc and while we feel that we can construct and operate the mine just using a snow road, which is common in this part of the world, we have also just recently completed phase two last year of the West Susitna access road - which will tie into Port Mackenzie near Anchorage.”

The year-round access road will tie into the port, the rail system, the Alaska Highway System, and then it'll come out about 100 miles with the terminus at the Estelle Gold Project.

Gerteisen said: “We are about to start phase three studies now this year before this gets submitted for an EIS next year.

“And it's not just us on this road, that’s the beauty of it moving forward so quickly, there's a whole consortium of potential beneficiaries.

“There are several other resource projects out there, the Borough here is very interested in it for land sales, agricultural land, fire breaks and fire control, opening it up for recreation - there's big fishing and hunting here in Alaska -so the everyone is very keen to get this road done.

“The state is very supportive as it's part of the government's road to resources projects.

“Building this road also means a bridge from Anchorage over to port Mackenzie which has been proposed for a long time, would now make sense, as it opens up all that land for the urban sprawl and other economic activity.

“We're well on track to have this road come online within our production timeline.”

Strategic investments

Together with the Estelle gold project, Nova has built up strategic investments for very little outlay that hold significant value for the company.

Nova holds 74% interest in Canadian lithium explorer Snow Lake Resources Ltd currently going through regulatory filings in the USA for a New York listing.

The demand for electric vehicles is soaring high, and in turn, is ratcheting up the demand for battery minerals.

Nova has also acquired a 12.99% interest in an Australian gold explorer company – Torian Resources Limited (ASX:TNR).

Read more on Proactive Investors AU