Metals Acquisition Ltd (ASX:MAC, NYSE:MTAL) started trading on the ASX today following the completion of its heavily oversubscribed IPO (initial public offering) in Australia of CDIs (chess depositary interests).

MAC raised A$325 million via the issue of 19,117,648 CDIs at the top of the indicative price range, being A$17.00 per CDI.

Given the level of demand under the bookbuild process in connection with the offer, MAC determined to upsize the raise from A$300 million to A$325 million.

Based on the final price of A$17.00 per CDI, at listing MAC has an implied total market capitalisation of ~A$1.18 billion. This makes MAC’s IPO as the biggest ASX mining listing based on market capitalisation in over five years.

CSA Copper Mine

Also listed on the New York Stock Exchange (NYSE), MAC’s goal is to acquire and operate metals and mining assets in high-quality, stable jurisdictions around the world that are critical in the electrification and decarbonisation of the global economy.

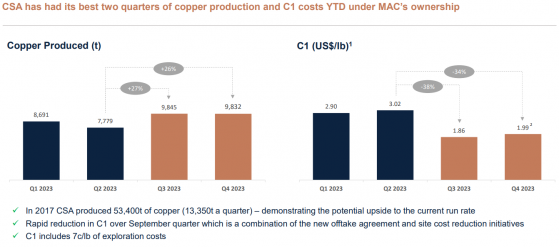

The company’s foundational asset is the CSA Copper Mine (near Cobar, western New South Wales, which MAC acquired from Glencore (LON:GLEN) last year. CSA is the highest-grade copper mine in Australia.

MAC will use the IPO proceeds to repay a A$127 million (US$82.9 million) deferred consideration facility to Glencore in connection with the A$1.64 billion (US$1.1 billion) acquisition of CSA (which was paid in full on 16 February 2024).

It will also commit further working capital to improve the mine’s production, development opportunities and undertake in-mine, near-mine and regional exploration.

Backed by a strong board and management team, MAC is led by CEO Mick McMullen, who grew up in western NSW and was previously CEO and President of Canadian gold producer, Detour Gold Corporation, where he increased Detour’s market capitalisation from C$2.1 billion to C$4.9 billion over seven months leading to the C$4.9 billion acquisition of Detour by Kirkland Lake Gold Inc. (TSX:KGI)

McMullen was also CEO at US palladium and platinum producer, Stillwater Mining Company, increasing its market capitalisation from US$1.3 billion to US$2.2 billion, and its eventual US$2.7 billion sale to Sibanye Gold Ltd.

McMullen said: “We are very pleased to have achieved an ASX listing and thank our new shareholders for their support for MAC. An Australian IPO and listing will allow us to pursue a range of organic and inorganic growth opportunities in Australia and globally to continue building shareholder value.

“While we have made significant progress in improving overall operational performance at our CSA Copper Mine to date, our initial focus will be to assess further exploration, development, and production improvement opportunities.”

“With a disciplined M&A strategy, we will continue to evaluate prospects for growth through acquiring and operating assets in stable mining jurisdictions that will benefit from a turnaround and optimisation program to enhance value.

“The listing is an important milestone for the company as we continue to expand and work towards our long-term goal of owning and operating multiple metals and mining assets that are critical to the electrification and decarbonisation of the global economy and become a notable player in the industry.”

Read more on Proactive Investors AU