Investing.com - Throughout the week, tech behemoths including Microsoft Corporation (NASDAQ:MSFT), Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), and Meta Platforms Inc (NASDAQ:META) are set to release their quarterly reports.

So far, it hasn't been a favorable season for tech, as evident with Tesla (NASDAQ:TSLA), Netflix (NASDAQ:NFLX), and Alphabet (NASDAQ:GOOGL) all experiencing stock declines post their Q2 reports.

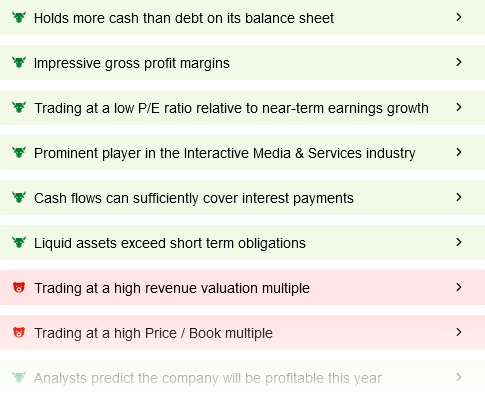

Alphabet, in particular, saw a drop despite outperforming earnings expectations. One likely factor behind the tech sell-off could be their high valuations, which necessitate exceptional performance to validate their premiums.

Amid this downturn, Meta Platforms has experienced a 13% decline from its 52-week highs, entering correction territory with a more than 10% fall from its peak.

The pressing question now is whether Meta, which was the only major tech stock to drop after its Q1 earnings and lost $132 billion in market cap in just one day, can recover its recent losses with the upcoming Q2 earnings release. This article looks at what Wall Street expects from Meta’s Q2 results.

⚠️Track your favourite companies with InvestingPro! use coupon code INVPRODEAL and save over 50%!⚠️

Analysts predict Meta will report revenues of $38.3 billion for Q2, marking a year-over-year increase of 19.6%. During their Q1 earnings call, Meta's management forecasted Q2 revenues between $36.5 billion and $39 billion, with the midpoint being $37.75 billion—slightly below the $38.3 billion expected by analysts.

Besides the main numbers, there are a few key aspects to watch when Meta reports its Q2 earnings on Wednesday:

Q3 Guidance: In the previous quarter, Meta's tempered guidance shook investor confidence. The spotlight will be on the company's Q3 guidance. Consensus estimates suggest a 14.7% rise in Q3 revenue, with further slowing expected to 12.6% in the year's final quarter.

Chinese Advertisers: Increased spending by Chinese advertisers targeting Western consumers has been a crucial revenue driver for Meta. With the U.S. presidential elections approaching and Republican candidate Donald Trump's proposed additional tariffs on Chinese imports, investors will be keen to hear Meta’s insights on any shifts in ad spending by Chinese advertisers.

AI Monetization and New Open-Source Model: Recently, Meta introduced its Llama 3.1 405B, an advanced open-source AI model, which Mark Zuckerberg described as “the first frontier-level open-source AI model.” He reassured stakeholders that making the model open source wouldn’t negatively impact revenue or investments in research.

During the earnings call, further details about the monetization timeline for this new model are anticipated.