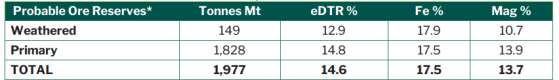

Magnetite Mines Ltd (ASX:MGT) has bolstered its Razorback Iron Ore Project economics upon delivering a maiden 362 million tonnes at 16.8% mass recovery probable ore reserve for its Iron Peak Deposit, increasing Razorback reserves to 2 billion tonnes.

Situated within Braemar Iron Ore Province in South Australia, Iron Peak is the highest-quality deposit within the Razorback Project to date and has made a significant positive impact on overall project economics.

In the spotlight is the deposit’s high-grade 20% mass recovery, which is a critical driver for Razorback's operations during the first ten years.

Looking ahead, optimisation studies are now complete, with geology and metallurgy completed to definitive feasibility study (DFS) level standards, and ore reserves re-estimated to include Iron Peak.

Next-generation magnetite producer

Magnetite CEO Tim Dobson said: “We are positioning our 100%-owned, high-value and long-life Razorback Iron Ore Project to align with the transition occurring in the global iron and steelmaking sector.

“South Australia is fast emerging as a desired Tier 1 location for regional steel producing nations to establish ‘green iron’ hubs based on proximity, existing infrastructure, stable regulatory environment, mandated 100%-renewable energy, emerging green hydrogen availability and abundant potential for high-grade magnetite concentrate production.

“Within this transition, Razorback is ideally positioned at the front of the pack of next generation magnetite producers.

“This project update combines the successful delivery of the optimisation study phase with the just announced maiden Ore Reserve for the high-quality Iron Peak deposit, which is now prioritised for production in the project plan and improves the first ten years' economics significantly.

“Our financial modelling has been deliberately conservative, incorporating adequate contingencies and acknowledging the recent inflationary cycle, while also reflecting emerging product price premiums for premium-grade iron ore products that are forecast to increase over the coming years as the global steel industry delivers on its urgent decarbonisation commitments.

Razorback Iron Ore Project Ore Reserves estimate at June 2023.

Improved project economics

Magnetite has re-estimated Razorback’s project economics to deliver:

- high-grade 20% mass recovery for the first ten years of operations;

- competitive US$46- $55 per tonne value-in-use operating cost (62% Fe equivalent);

- 91-year mine life;

- direct entry to emerging premium-price DR-grade pellet feed market; and

- US$1.0 – $1.3 billion pre-production capital requirement

“South Australia is fast emerging as a desired tier one location for regional steel producing nations to establish ‘green iron’ hubs based on proximity, existing infrastructure, stable regulatory environment, mandated 100%-renewable energy, emerging green hydrogen availability and abundant potential for high-grade magnetite concentrate production.

“Within this transition, Razorback is ideally positioned at the front of the pack of next-generation magnetite producers.”

Forward plan

Magnetite is now undertaking the following activities to enable the completion of a DFS and project partnering process:

- securing / de-risking critical infrastructure including water supply and port capacity;

- value engineering to further reduce project capital and operating costs for the new project configuration; and

- confirming land access arrangements.

Read more on Proactive Investors AU