Latin Resources Ltd (ASX:LRS, OTC:LRSRF) has increased the global mineral resource estimate at its Salinas Lithium Project in Brazil by 56%, lifting the project’s resource to 70.3 million tonnes grading 1.27% lithium oxide.

The company today announced an updated mineral resource estimate for the Colina Deposit, along with a maiden mineral resource estimate at its Fog’s Block target, both within the company’s 100%-owned Salinas Project.

Colina mineral resource

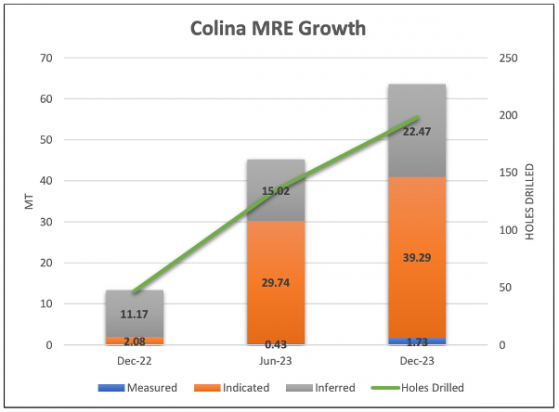

The resource at the project's large-scale, high-grade Colina deposit increased by 41% to 63.5 million tonnes at 1.3% lithium oxide — now one of the largest scale tier-one undeveloped lithium resources globally.

That resource includes 1.7 million tonnes at 1.5% lithium oxide in measured and 39.3 million tonnes at 1.4% lithium oxide in the indicated JORC category and around 22.5 million tonnes at 1.2% lithium oxide inferred. The measured resource saw a significant 11% increase in its grade, from 1.34% to 1.47%.

The 65% of the resource being in measured and indicated categories, reflects the high levels of confidence in both the geological continuity and grade of the Colina pegmatites.

Also increased was the contained lithium carbonate equivalent (LCE), from 1.47 million tonnes to 2.05 million tonnes.

The significant uplift of grade in both measured and indicated JORC resource categories was a result of close-spaced infill drilling at Colina.

Fog’s Block mineral resource

The maiden mineral resource at the Fog’s Block target, which is around 12 kilometres southwest of Colina, came in at around 6.8 million tonnes at 0.9% lithium oxide, at a cut-off grade of 0.5%.

Latin first commenced drilling at Fog’s Block in August 2023 and has since completed 15 diamond holes for 5,021.34 metres of drilling.

The company notes the significant upside growth potential at Fog’s Block, with independent resource consulting firm SGS confirming an estimated JORC exploration target range of 7-18 million tonnes at a grade of 0.8% to 1.1% lithium oxide. The company says this points to Salinas’ potential target of more than 80 million tonnes with further drilling.

Fog’s Block remains open up-dip, at depth and along strike. Drilling continues to test for extensions to the defined deposit and build on the maiden resource.

Colina MRE resource growth timeline showing JORC resource classification breakdown and drillholes completed.

“Fast becoming Tier-1 lithium resource”

Latin Resources managing director Chris Gale said: "What a great effort from our exploration team. Another significant milestone met with our upgraded MRE to over 70 million tonnes. This project is fast becoming a Tier-1 lithium resource as we predicted. We are also very encouraged by the consistent uplift in grade as we infill drill. This is a great sign of a quality mineral resource.

“The increase in size of the JORC resource will have an extremely positive impact on our DFS economics as the resource increase allows us to evaluate building phase 3 of the project lifting output significantly.

"The lithium market sentiment is low at the moment; however, no one can say Latin hasn’t delivered what it has promised over the last two years. I thank the shareholders that have stuck with us through these difficult times!”

An “outstanding result”

Latin Resources vice president of operations - Americas Tony Greenaway said: “Once again, our highly skilled and extremely dedicated exploration team at the Salinas Project have delivered an outstanding result for the company.

“With our combined mineral resource inventory coming in at over 70 million tonnes and significant upside from the 7.0 to 18.0 million tonnes exploration target range at Fog’s Block, we are fast approaching defining a resource in excess of 80 million tonnes and developing one of the largest global lithium projects.

“It has been a busy 12 months on-site at Salinas in 2023 to achieve this exceptional result, and the whole team is looking forward to continuing our efforts in 2024.

“Our initial focus early in the new year will be to further upgrade the Colina Deposit to enable the declaration of mineral reserves as part of the DFS process, after which we will eagerly resume our exploration focus specifically targeting the emerging Fog’s Block Deposit, and our newly discovered Planalto Prospect where our first hole has intersected a wide pegmatite system.”

Looking towards a DFS

Latin intends to commence drilling with 16 diamond drill rigs in January 2024 at Colina and Fog’s Block. It will then expand the program through 2024, which is expected to continue to focus on upgrading the Colina resource, leading into the definitive feasibility study (DFS) and testing the new Planalto discovery over the Salinas Project tenure.

The company expects today’s substantial increase of the project’s mineral resource to have a positive effect on the economics within the DFS, which is due for completion in mid-2024.

The initial preliminary economic assessment (PEA) mining plan allowed for phase 1 production, commencing in 2026, anticipating phase 2 average production of 525,000 tonnes per annum of higher value SC5.5 and 159,000 tonnes per annum of SC3 commencing in 2029.

This increased resource will now include a phase 3 extension and expansion to production, which will be evaluated in the DFS.

Plan view of the Colina Deposit with MRE area, drill collars and section locations.

Read more on Proactive Investors AU