Kinetiko Energy Ltd (ASX:KKO, OTC:KKOEF) has received the green light to drill five appraisal production gas wells in the southern part of exploration right 271 (ER271) in gas-hungry South Africa's Mpumalanga Province.

The drilling aims to validate the commercial viability of multiple large-scale gas field developments in the area.

Kinetiko also has plans for extended flow tests, which are designed to inform financial assumptions and potentially increase the gas reserve certifications.

Meanwhile, applications for a production right over ER271 and the granting of ER320 are progressing.

Identify optimal development sites

Kinetiko CEO Nick de Blocq said: “We expect to commence drilling five appraisal production wells to the west and north of Volksrust in February 2024.

“These sites have already undergone environmental site assessments and have been approved by the Regulator. They will be appraisal wells in nature but completed for production.

“The objectives are to identify optimal development sites for clusters of wells for the Industrial Development Corporation (IDC) joint venture as well as to perform extended well flow testing.

“This data will more accurately inform our regional economic models as they will provide us with a more precise understanding of plateau flow rates and longevity.”

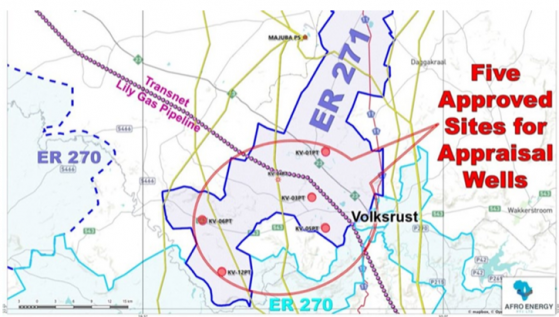

Map showing the locations of the appraisal well sites in southern ER271

Production well drilling

Kinetiko recently awarded a drilling contract to Infill Drill to deliver five appraisal production wells in the Volksrust region to the south of ER271.

These wells, scheduled to begin in mid-March quarter of 2024, are targeting a geological region in between explored areas where some of the company’s most gassy core wells were drilled over the last 12 months.

The superior sample analysis results from core wells to the south (270-03C, 270-05C, and 270-06C) achieved gas desorption rates around 103/t and gas pay zones of approximately 150 metres.

Slightly to the north, Kinetiko achieved desorption testing on samples of 143/t in the slightly shallower mid-block area, with stratigraphical gas cuts in excess of 130 metres.

The planned wells are also proximate to the Lily gas pipeline, potentially providing available infrastructure for local off-takers or infield LNG plants for virtual pipelines.

ER320 progress

ER320 covers an area of 2,383 square kilometres and will increase the exploration acreage of the company by over 60%.

Given the contiguous nature of the geology that has been drilled over significant portions of the granted exploration rights, the company anticipates that ER320 will add substantially to existing gas resources and reserves.

The environmental impact assessment to support the application is progressing and anticipated to be completed by late March quarter, 2024, with the application then estimated to be assessed and granted by the South African regulators within the quarter as well.

Read more on Proactive Investors AU