Initial Public Offerings (IPOs) have been thin on the ground this year in pretty much every market on the globe.

The London Stock Exchange (LSE) has taken a particularly hard hit this year, with the volume of applications made to float on the LSE dropping by 50% from previous years to just 56 companies.

A freedom of information request to the LSE’s regulator, the Financial Conduct Authority (FCA), reveals just 30 of those companies were given the green light to list their shares.

“This data shows just how rapidly a stock market can lose its popularity,” XTB fintech investment platform director Joshua Raymond said.

“The decline in activity on the IPO market is particularly concerning for private investors. The listed stock market is the easiest and most widely understood way for retail customers to invest their money.

“We need a steady flow of new companies coming to the market, including businesses that can drive innovation and change while offering fresh opportunities and ideas to the investor community.”

Sharp decline from previous years

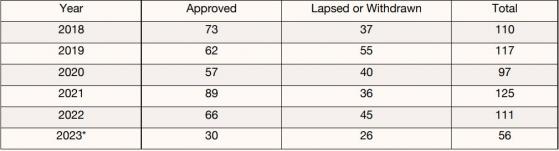

Data from the FCA highlights that an average of 122 companies submitted IPO requests to the FCA per year between 2018 and 2022, more than double the number of companies in 2023.

Mirroring that trend, the regulator also approved less than half the yearly average of 70 companies this year, demonstrating that nearly half of applications do not make it through the approval process.

While companies can withdraw their applications for a number of reasons, the most common tend to be changes in external factors – namely markets – that reduce the viability of an IPO.

“While we are concerned by this data, we should also acknowledge that London remains one of the great financial centres of the global economy,” Raymond recognised.

“The constituents of the FTSE index include some of the best-known names in the global investment market.

“The London market has had its problems before but is hugely resilient and has the talent and resources to bounce back strongly.”

Applications for listings on main market of London Stock Exchange received by the Financial Conduct Authority

Read more on Proactive Investors AU