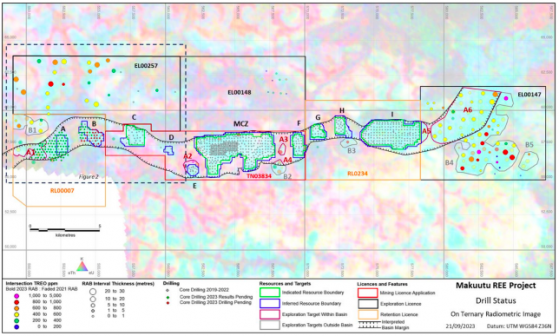

Ionic Rare Earths Ltd (ASX:IXR, OTC:IXRRF) has confirmed additional resource growth potential at its 60%-owned Makuutu Heavy Rare Earths Project in Uganda with the receipt of the second batch of positive assays from Phase 5 rotary air blast (RAB) drilling in the northwest of the project.

The latest assays from drilling across Exploration Licence (EL) 00257 and Retention Licence (RL) 00007 at the western end of Makuutu reported thick clay-hosted rare earth intersections in 26 out of 31 drill holes above the 2022 resource estimate cut-off grade of 200 parts per million (ppm) total rare earth oxide minus cerium oxide (TREO-CeO2).

Some of the best intersections include:

- 8 metres at 975 ppm TREO from 7 metres in RRMRB117;

- 20 metres at 865 ppm from 6 metres in RRMRB115;

- 20 metres at 789 ppm from 4 metres in RRMRB116;

- 24 metres at 781 ppm from 4 metres in RRMRB129; and

- 20 metres at 756 ppm from 4 metres in RRMRB120.

This brings the total number of rare earth intersections in the completed Phase 5 RAB program to 69 out of 76 holes drilled across tenements EL00147, EL00257 and RL00007.

IonicRE’s local Ugandan operating entity Rwenzori Rare Metals Ltd (RRM) has initiated metallurgical test-work on the samples to feed into a revised exploration target for Makuutu planned for later this year.

Investors have welcomed the news, with IonicRE shares up about 8.7% to A$0.025 in mid-morning ASX trading.

Clay rare earths front-runner

“EL00257 has now confirmed clay-hosted rare earth mineralisation in 21 of 26 RAB holes drilled in this program,” IonicRE managing director Tim Harrison said.

“The project now moves to metallurgical test-work on a selection of sample intervals to map the potential of this tenement and EL00147, (which is) expected to add significantly to the Makuutu Project development plan.

“Our focus on the delivery of the Makuutu Heavy Rare Earths Project in Uganda positions us to provide a secure, sustainable and traceable supply of magnet rare earth oxides.

“Along with our Belfast recycling facility, Makuutu is key to us harnessing our technology to accelerate mining, refining and recycling of magnets and heavy rare earths that are critical for the energy transition, advanced manufacturing and defence.”

Makuutu project drill status plan showing location of RAB results and current core drilling program location.

Ongoing drilling

Infill drilling is ongoing in some areas of the Makuutu mineral resource estimate (MRE) to increase the confidence from inferred to indicated status.

To date, 103 holes for 2,032 metres have been drilled and it is expected that the program will be completed later this month.

Additionally, pending drill assays will determine the economic potential of the rare earth intersected for adding into an updated exploration target.

Makuutu’s conceptual exploration target, which is separate from the current Makuutu MRE, estimates additional mineralisation at 216-535 million tonnes grading 400-600 ppm TREO.

This is based on reasonable grounds and assumptions made by the company.

Read more on Proactive Investors AU