Drill and geophysical data have defined a “highly promising” shelf zone within the South Basin at the Rhyolite Ridge Lithium-Boron Project of Ioneer Ltd (ASX:INR, OTC:GSCCF, NASDAQ:IONR) in Nevada USA, prompting an update to the project’s mineral resource estimate (MRE).

Ioneer has also received commitments to raise US$25.1 million (A$38.4 million) via a placement to institutional, professional and sophisticated investors at A$0.18 per share.

The raise saw strong commitments from new and existing shareholders, reflecting the world-class quality of Rhyolite Ridge.

With this, Ioneer is now well-funded to progress Rhyolite Ridge through to a final investment decision, which is expected in December 2024.

"Strong US engagement"

“Rhyolite Ridge continues to demonstrate it is a world-leading lithium project, helping accelerate the electric vehicle transition and securing a cleaner future for our children and grandchildren," said Ioneer’s executive chairman James Calaway.

"This placement represents another step forward towards ensuring this world-class project operates efficiently and sustainably.”

Managing director Bernard Rowe added: “Ioneer is pleased to announce the successful completion of the placement with strong engagement from US cornerstone investors, signalling market confidence in the significant progress at Rhyolite Ridge as we head towards FID at the end of the calendar year and continue our journey towards becoming a market leading supplier to the US EV supply chain.”

About Rhyolite Ridge

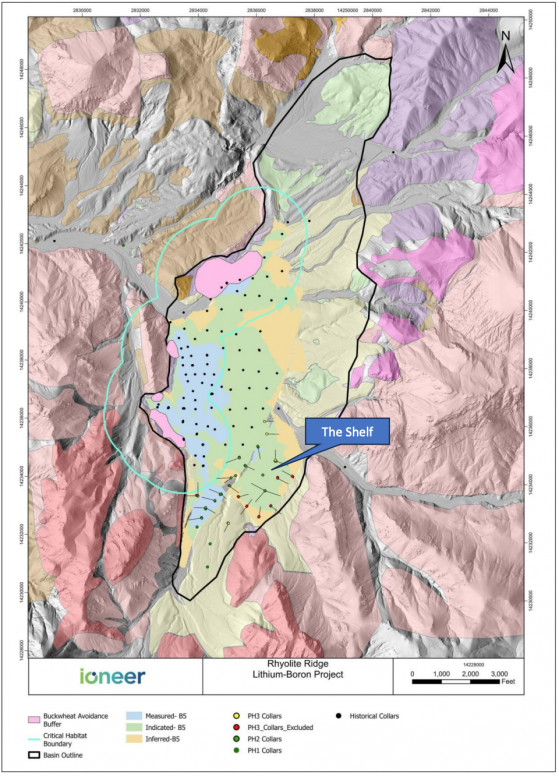

Rhyolite Ridge is a sediment-hosted lithium and boron deposit in the Silver Peak Range of southwest Nevada. At least four sub-basins have been identified within the project’s South Basin, with the “shelf zone” being the primary focus of the most recent drilling.

This promising shelf zone is particularly notable as the lithium-boron mineralisation is shallower than elsewhere in the basin and its lithium grades are significantly higher compared to the resource average.

The mineralised sedimentary layers within the zone are relatively flat lying with favourable geotechnical characteristics and, importantly, it lies completely outside of Critical Habitat. It is also largely within the pit shell being permitted by the Bureau of Land Management.

Resource estimate upgraded

Given the significance of this zone, Ioneer has updated the resource estimate and plans to further update the MRE within the next three months as pending drill results are received and finalised. Twelve holes are now pending from drilling that was completed in January 2024.

Rhyolite Ridge South Basin showing the areal extent of the B5 Resource coloured by resource category – measured, indicated and inferred. The basin outline is shown as a black line.

The previous resource estimate was completed in March 2023 and an ore reserve estimate was completed in April 2020 for the Rhyolite Ridge definitive feasibility study (DFS).

Measured resource up 71%

In the update, the overall measured resource has increased by 71% from last year’s MRE, rising from 44 million tonnes to 75 million tonnes.

The updated South Basin MRE comprises:

- Total mineral resource of 351 million tonnes.

- Contained lithium carbonate equivalent (LCE) of 3.25 million tonnes.

- Contained boric acid equivalent (BAE) of 12.82 million tonnes.

- Measured and indicated resource for streams 1 and 2 of 214 million tonnes.

- Cut-off grades unchanged at 5,000ppm boron (Stream 1) and 1,090ppm lithium (Streams 2 & 3)

Now, for the first time, the MRE is being reported as three separate streams:

- Stream 1 - high-boron lithium mineralisation (low clay content) 153 million tonnes resource containing 1.33 million tonnes lithium carbonate equivalent (LCE) and 11.26 million tonnes boric acid equivalent (BAE).

- Stream 2 - low-boron lithium mineralisation (low clay content) 142 million tonnes resource containing 1.20 million tonnes LCE and 1.16 million tonnes BAE.

- Stream 3 - low-boron lithium mineralisation (high clay content) 56 million tonnes resource containing 0.72 million tonnes LCE and 0.39 million tonnes BAE.

Each of the three streams contains high levels of lithium. Stream 1 is differentiated by having high boron content (>5,000ppm) and low clay content. Stream 2 is differentiated by having low boron content (

Streams 1 and 2 are both suitable for vat leach processing. Only Stream 1 is included in the 2020 DFS mine plan and economic analysis.

Due to the high clay content of Stream 3, it cannot be processed through the same vat leach flowsheet and requires an alternative processing path. This material is subject to a research partnership with Eco Pro.

The total resource decreased slightly compared to 2023 due to:

The total number and spacing of drill holes has resulted in a material increase in the measured and indicated portion of the resource — the two highest confidence categories.