The Australian dollar gold price punched above a new all-time high of $3,100 in October, spurred by worried investors seeking safe haven investments from potential repercussions of the conflict in the Middle East.

The precious metal has typically appealed in times of crisis, as demonstrated recently by the weekly rise in the price of gold since the Israel-Hamas war began on October 7.

Even during peaceful times, it is seen as the ultimate asset to help build and preserve wealth for generations.

Watch the human story of gold produced by the World Gold Council below and discover how the precious yellow metal has transformed societies and economies the world over.

“October was a big month for gold,” said the council largely considered the authority on the metal.

“The sharp sell-off at the end of September was forcibly rejected by week two of October and since then, gold hasn’t looked back.”

The World Gold Council’s latest market commentary attributed the rally to the Middle East flare-up but did not discount the possibility that central bank activity may also have been a strong contributor.

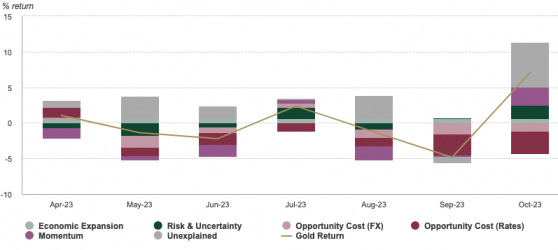

Gold driven higher by geopolitical risk and safe-haven buying. (Sources: Bloomberg, World Gold Council).

For prices to stay high, it says one or more of the following needs to happen:

- A continuation or intensification of the geopolitical environment, which will have far-reaching consequences, including a negative impact on economic sentiment, disruptions in supply chains and the potential for increased energy prices. What distinguishes the current tension from the Russia-Ukraine war is the likelihood that it will compound, rather than replace, existing tensions.

- Equally concerning is the situation in equity markets, particularly the Nasdaq, where prices are showing signs of decline. The index has already fallen by more than 10% from its mid-year peak, a notable shift from what is traditionally the strongest period for equities. Should this decline exceed 20%, a “bear market” will likely drive increased interest in gold, as history has shown.

- Bond yields may need to peak, and along with it, the US dollar.

“The past two years have cemented not only gold’s ability to maintain its cool in a turbulent environment (but) it has shown that demand for gold can come from various uncorrelated sources and help prices defy over-simplified notions of what drives them,” the council added.

With Australia being one of the world’s largest suppliers, ASX-listed gold miners and producers hunkered down in search of their next major ore source and minted their first gold bars during the September quarter.

In the spotlight: ASX gold stocks

Auric Mining

Auric Mining Ltd (ASX:AWJ) marked a watershed quarter by becoming a gold producer and generating its first free cash of $2.2 million from the sale of gold from its Jeffreys Find Gold Mine in Western Australia (WA) in just three years after listing on the ASX.

More than 180,000 tonnes of ore have been extracted and hauled to the Greenfields Mill from Jeffreys Find, a joint venture between Auric and Kalgoorlie-based gold mine developer BML Ventures Pty Ltd, as part of the first stage of mining at the short-life project.

The Perth-based company began its second gold toll milling at Greenfields Mill on September 10, a campaign Auric managing director Mark English termed as the “money round”.

“Our main focus in the quarter was mining of Jeffreys Find Gold Mine near Norseman and advancing the Munda Gold Project,” English said in his quarterly review.

“Through BML Ventures Pty Ltd, we completed two gold campaigns and achieved our ambition in becoming a gold producer in just three years since listing on the ASX.

“We have produced cash and Auric now becomes self-funding.

“We are marching on towards our bigger picture with the Munda Gold Project.”

Auric has begun a grade control drilling campaign at Munda, where 380 holes for 11,500 metres will be completed to meet targeted production from a starter pit late next year.

A scoping study published in June for the project defined a production target of between 1.67 million tonnes at 2.2 g/t gold and 2.18 million tonnes at 1.9 g/t, producing between 112,000 ounces and 129,100 ounces of gold, respectively, at prices ranging from A$2,400 to A$2,800 an ounce.

Jeffreys Find Mine Site at completion of the stage 1 pit – note run of mine ore stockpiles on lower right.

Astral Resources

This Perth-based gold exploration and base metals company declared its Mandilla Gold Project in WA’s northern Widgiemooltha greenstone belt “a highly profitable standalone gold operation” when it published the project’s inaugural scoping study in September.

The explorer’s commercial strategy for Mandilla, one of the largest undeveloped free-milling open pit gold development projects in the Kalgoorlie region, is based on a standalone development, including a 2.5 million tonnes per annum (Mtpa) CIL processing plant and associated infrastructure.

The study, based on the project’s mineral resource estimate (MRE) of 37 million tonnes at 1.1 g/t gold for 1.27 million ounces of contained gold, uses the following cost and revenue assumptions:

- 100,000 ounce per annum gold production;

- 11 years of mine life;

- Net present value (8%) of $442 million;

- Free cashflow of $740 million;

- Internal rate of return of 73%;

- Gold price of A$2,750 per ounce; and

- All-in sustaining cost (AISC) of $1,648 per ounce.

Astral said the study has further upsides from ongoing exploration at Mandilla as well as from the inclusion of its nearby high-grade Feysville Gold Project as a potential future satellite ore source.

It had cash of $4.1 million as at September 30, after raising $3.0 million (before costs) from a share placement to institutional and sophisticated investors in August and $1.6 million (before costs) from a share purchase plan in September.

Alto Metals

September was a strong quarter of exploration results for Alto Metals Ltd (ASX:AME) following a major update to its mineral resource in the previous three months.

The explorer owns the Sandstone Gold Project in WA with an unconstrained MRE of 1.05 million ounces of gold, of which 80% or 832,000 ounces at 1.5 g/t were in the constrained category.

“This was another strong quarter for Alto, following our major resource update in the previous quarter, with exploration results continuing to demonstrate the significance of our Sandstone Gold Project,” Alto managing director Matthew Bowles said.

“Our targeted drilling programs are focused on growing our gold inventories by extending the boundaries of the known mineralisation, paving the way for further resource growth.

“This exploration is complemented by our low-cost regional exploration, focused on advancing early-stage prospects within our project pipeline.”

The company received final assay results for the remainder of a 5,000-metre RC drilling campaign at Indomitable Camp, showing high-grade gold mineralisation, including 15 metres at 3.1 g/t gold near the surface and in fresh rock at depth.

The program has extended the shallow oxide gold mineralisation to more than 3.5 kilometres and is open, leading Alto to believe that the discovery is potentially part of a much larger gold system at depth.

Separately at the Bull Oak Gold Mine, Alto drilled a hole to validate deeper historical results, which intersected multiple stacked lodes in an overall intercept of 260 metres at 0.41 g/t gold from 36 metres.

Bull Oak’s limited exploration is an exciting opportunity for the company.

Adding to the news flow was the addition of a new mining lease between the existing Lord Nelson and Lord Henry deposits in the Lords Camp region in WA, which boasts an indicated and inferred mineral resource of 400,000 ounces at 1.6 g/t gold.

Securing this new mining lease will further de-risk the Sandstone Project and provide options for future mining scenarios.

The company closed off the quarter with $4.5 million in cash after spending slightly more than $1 million on exploration activities.

Brightstar Resources

Brightstar Resources Ltd (ASX:BTR) was another gold play that charted a milestone quarter with the re-start of mining activities at the Selkirk deposit within the Menzies Gold Project.

The company is eyeing joining the ranks of WA’s gold producers in the first quarter of 2024 when first gold is poured at Selkirk.

The re-start follows the publication of a scoping study for the Menzies and Laverton gold projects in the Eastern Goldfields during the quarter, which projects a net revenue of $899.6 million using a gold price of A$2,900 per ounce.

The study has pegged an initial production target of about 5.28 million tonnes at 2.0 g/t gold for 322,617 ounces over an eight-year life of mine (LoM) and a net present value (8%) of about $103 million at a gold price of A$2,900 per ounce.

The study has also laid out an internal rate of return of about 79%, a payback period of 1.5 years and an all-in sustaining cost (ASIC) of about $2,041 per ounce.

It outlines average recovered ounces of 45,000 ounces per annum in the first five years, with average LOM production of about 40,000 ounces per annum and a strong potential to increase production profile and mine life.

Summary of the mining physicals.

Early cashflow from Menzies is expected to organically fund the restart of the Laverton project.

About $3.5 million has been raised via a share placement to accelerate the company’s exploration and development activities.

Carnavale Resources

Fresh from a $3.1 million capital raise in July, Carnavale Resources Ltd (ASX:CAV) fast-tracked exploration at its Kookynie Gold Project in WA during the quarter, focusing on expanding high-grade zones at the McTavish East Prospect.

The explorer completed 29 holes for 5,364 metres in September, testing a strike length of 250 metres and 200 metres below surface.

“Carnavale is very pleased with progress at the Kookynie Gold Project this quarter with the high-grade zones being expanded at McTavish East,” its chief executive officer Humphrey Hale said.

“Results from the initial metallurgical testing demonstrated that the mineralisation at McTavish East has projected recoveries of between 97% and 99% enhancing the potential economics of the project.”

Hale was referring to the 16 oxide and fresh rock samples taken from four separate high-grade intersections that were put through a 24-hour conventional leach test-work at the Perth laboratories of ALS.

The results give a good indication as to what can be expected from the oxidised and fresh rock areas of McTavish East, which is showing a mineralisation style, grade and scale that are similar to the nearby historical Cosmopolitan Gold Mine.

Further metallurgical tests are being planned to enhance the results.

Carnavale’s goal at Kookynie is to establish a quality gold resource similar in size to Cosmopolitan and one where ore can be trucked and processed at a nearby processing plant.

Plan of McTavish East with gold contours over magnetic image.

Great Boulder Resources

Great Boulder Resources Ltd (ASX:GBR) spent the July to September months sustaining resource definition and extension drilling at the Mulga Bill prospect within its Side Well Gold project in preparation for an updated MRE.

Work here has continued to deliver fantastic results in and around the prospect, extending mineralisation along strike and adding confidence within gap areas between two Mulga Bill resource zones.

The company also added 5 kilometres of highly prospective strike south of Side Well on the Ironbark Corridor, where it also completed two heritage surveys.

Once signed off by the Yugunga Nya Board, an aircore and RC drilling campaign will commence on all the geochemical anomalies identified along the 14-kilometre corridor.

Yugunga Nya heritage survey team at Ironbark South in September 2023.

At the same time, Great Boulder has also pegged four other vacant prospecting leases in the area in the hopes of increasing Side Well’s 154 square kilometres of highly prospective project area in the Meekatharra-Wydgee greenstone belt, including more than 30 kilometres of strike.

The Side Well Gold Project has an inferred mineral resource of 6.192 million tonnes at 2.6 g/t gold for 518,000 ounces within the Mulga Bill and Ironbark deposits.

The company spent $1.5 million on exploration-related activities during the quarter and had $2.5 million in cash at the end of it.

Maximus Resources

Maximus Resources Ltd (ASX:MXR, OTC:MXRRF) took its gold inventory at Spargoville in WA to 320,600 ounces during the quarter, thanks to a 250% lift in resources at the Wattle Dam Gold Project to 251,500 ounces.

While this was a positive development, the even better news was the considerable potential for more growth across a large mineralised system within the project.

The Wattle Dam MRE update has resulted in 5.4 million tonnes at 1.45 g/t gold for 251,500 ounces, with 61% of this in the higher-confidence indicated category, which provides a strong foundation for future development studies.

Elsewhere, a resource expansion drilling program was completed at the Hilditch Gold prospect, with assays pending as at the time of this quarterly reporting.

Hilditch is one of the highly prospective regional gold deposits in the company’s Spargoville tenements and currently comprises a shallow inferred resource of 132,000 tonnes at 1.77 g/t for 7,511 ounces of gold.

Maximus ended the quarter with about $2.5 million in cash.

Ora Banda Mining

Ora Banda Mining Ltd (ASX:OBM) benefited from operational improvements implemented as part of its 'DRIVE to 100' strategy — a roadmap to grow its production profile to more than 100,000 ounces per annum by FY2025 during the September quarter.

The West Aussie gold stock sold 16,319 ounces at an AISC of $2,953 per ounce, which was 35% higher than the prior quarter. About 2,575 ounces came from a third-party toll treating campaign.

Ore processed for the quarter was at an average grade of 2.0 g/t, a 22% increase from the previous quarter.

“The September quarter performance is pleasing as it demonstrates that we are continuing to deliver operational improvements as planned, underpinned by the 39% increase in ounces produced and a grade increase of 22% through the Davyhurst plant,” Ora Banda managing director Luke Creagh said.

“Going forward, we are excited to be fast approaching further catalysts to value, with open pit costs reducing, mined ounces increasing and the plant receiving a crushing circuit upgrade.

“This, coupled with the Riverina underground advancing on schedule to higher grade ore and further exploration drilling at Siberia, means there is a lot for shareholders to look forward to."

Ora Banda spent $2.8 million on exploration during the quarter, including a diamond drilling campaign at the Riverina underground mine, which significantly extended the deposit to the south and at depth and well beyond the current underground mineral resource boundary.

The drill program also included the Missouri and Sand King open pits to target the underground potential at the current mining areas.

Komatsu 1250 Digger loading Caterpillar (NYSE:CAT) 777 LHD Truck at Missouri Open Pit.

Rounding up the news for the quarter was the completion of the Lady Ida sale to Lamerton Pty Ltd and Geoda Pty Ltd, for which the company received the remaining $9 million of the total $10 million consideration.

As of end-September, it was well-funded with cash of $22.7 million.

Sunstone Metals

Sunstone Metals Ltd (ASX:STM) spent much of the quarter driving exploration across its two main projects in Ecuador: the Bramaderos Gold-Copper Project and the El Palmar Copper-Gold Project, where the company has modified its operations to remove duplication in costs, including reducing the number of employees.

Drilling at Bramaderos’ Limon discovery continued to enhance the quality of the wide and shallow high-grade gold-silver deposit.

Some of the noteworthy intersections that will support a fresh exploration target in November include:

- 269 metres at 1.05 g/t gold equivalent (AuEq) from 74 metres in LMDD040, including 124 metres at 1.93 g/t AuEq from 190 metres;

- 180.1 metres at 0.96 g/t AuEq from 6 metres in LMDD038;

- 243 metres at 1.32 g/t AuEq from 46 metres in LMDD030;

- 185 metres at 2.85 g/t AuEq from 90 metres in LMDD026, including 31 metres at 12.93 g/t AuEq from 146 metres; and

- 176.7 metres at 1.09 g/t AuEq from 6.8 metres in LMDD017.

These intersections are outside Bramaderos’ current 2.7 million ounce gold equivalent MRE and 3.3-8.6 million ounce gold equivalent exploration target.

Over at El Palmar, drilling of a second hole to test the large T3 target intersected a strongly mineralised porphyry gold-copper system that is at least 120 metres wide and remains open in all directions.

Results include 294.7 metres at 0.51 g/t AuEq from 918 metres and a higher grade zone of 26 metres at 0.96 g/t AuEq from 1,014 metres.

The company’s updated magnetic modelling suggests a significant magnetic body in this area of about 700 metres wide.

The broader T3 target measures up to 1.5 kilometres in diameter and is part of the 2.5-kilometre cluster of gold-copper porphyry systems, T1 to T5.

T3 has only had three holes drilled into it, two of which were well mineralised and point to the very significant upside opportunity at El Palmar.

The company spent $4.7 million on these drilling campaigns during the quarter, but has forecast a drop in the next two quarters as drilling is reduced to allow for assays to be compiled and exploration targets to be prepared.

It had about $4.9 million in cash at the end of September.

Yandal Resources

Similarly, Yandal Resources Ltd (ASX:YRL) got plenty of activity completed at its highly prospective Yandal Belt projects in WA.

At the Ironstone-Barwidgee Project, a conceptual exploration target of 12.9-38.6 million tonnes grading 1.1-1.4 g/t gold for 0.44-1.78 million ounces was generated for the Oblique, Quarter Moon, Flushing Meadows and New England Granite prospects.

Reverse circulation drilling was completed at Oblique and New England Granite, where mineralisation was extended for a total strike length of 1,100 metres at the former and historical intercepts and further understanding of the controls and geometry of the mineralisation at the latter were confirmed.

The busy quarter also saw the gold explorer delivering maiden MREs for the HMS Sulphur and Gilmore deposits at its Mt McClure Project, increasing the total gold inventory by 34% to 182,200 ounces at 1.7 g/t.

The HMS Sulphur MRE contained a total of 1.01 million tonnes at 1.2 g/t gold for 39,000 ounces at more than 0.5 g/t lower cut-off grade, while the Gilmore MRE contained a total of 134,000 tonnes at 1.7 g/t gold for 7,200 ounces at more than 1 g/t lower cut-off grade.

At the 100%-owned Gordons Gold Project in Kalgoorlie, a heritage survey was completed over key southern tenements covering the high-priority Gordon Sirdar Shear Zone, and approval received to begin exploration activities.

In the coming months, some of the priority exploration activities will include follow-up RC and diamond drilling at the Oblique prospect, refinement of targets for follow-up RC drilling at New England Granite in 2024 and finalisation of an exploration strategy across the Gordons Project.

Read more on Proactive Investors AU