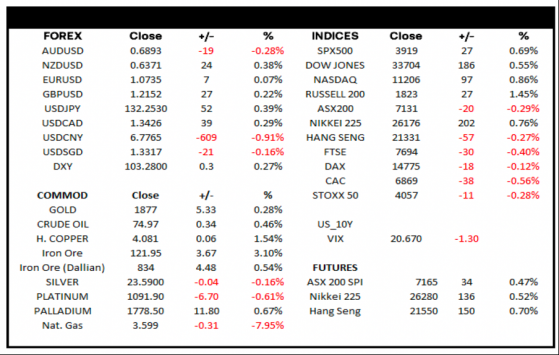

IG's Tony Sycamore returns with a new Trader's View report, covering overnight moves and the day ahead in US stock indices, the ASX200, commodities and FX. Prices are current as of 8:00 am AEDT.

US stocks

US stock markets gained ahead of the release of crucial US inflation data tomorrow night which is expected to show inflation extended its decline from the 9.1% peak of June 2022.

To prevent a premature declaration of victory over inflation, Federal Reserve member Michelle Bowman was the latest Fed speaker to say higher rates are required and that rates will need to remain elevated for some time.

Elsewhere, Fed chair Powell, speaking at a forum in Stockholm, stressed the need for central bank independence and provided no new updates on the outlook for rates and the US economy.

The S&P500 needs to see a sustained break above resistance at 3,910/20, followed by a sustained break above the 200-day moving average at 3,996 and downtrend resistance at 4,040 (from the Jan 2022 bull market high) to negate downside risks.

On the downside, a sustained break below support at 3,800/3,780 would warn that another leg lower towards 3,650 has commenced.

ASX200

The ASX200 fell 20 points (-0.28%) yesterday to close at 7,131, snapping a four-day winning streak. The Materials (-0.5%) and Industrial (-0.53%) sectors were the main drag, while Consumer Discretionary (+0.18%) and Consumer Staples (0.05%) were the only two sectors to gain on the day.

At a stock-specific level, Core Lithium Ltd and retailer Premier Investments both fell more than 5%, the latter on weak website traffic in the retail sector during December. Fund manager Platinum added 4.15% as December FUM dropped by just $10 million to $18,165 million, traders appear to have been positioned for a bigger drop in FUM.

Providing the ASX200 remains above the 200-day moving average at 7,000 and last week’s 6,905 low, the view remains that the pullback from the 7,375 high is a correction rather than a reversal lower. SPI futures point to a higher open today at 7,165. Support on the day is viewed at 7,125 and resistance at 7,186.

The AUD/USD is trading lower at 0.6892 (-0.29%), easing from its four-month high earlier in the week ahead of the release of monthly inflation data in Australia. Providing the AUD/USD holds onto its break above 0.6900 and support coming from the 200-day moving average at 0.6843, it should enable the AUD/USD to ride the tailwinds of China’s reopening and higher commodity prices towards the mid-August 0.7137 high.

The EUR/USD is trading higher at 1.0737 (0.08%), consolidating just below a six-month high ahead of the release of US inflation data tomorrow. We remain positive the EUR/USD as it looks to tackle resistance 1.0785/05. A break above here would then open up a move towards 1.1000.

GBP/USD is trading slightly lower at 1.2154 (-0.29%) ahead of the release of US inflation data tomorrow. Technically the rebound on Friday above the 200-day moving average at 1.2025, along with the formation of a bullish engulfing candle, was a positive development. Providing GBP/USD remains above Friday’s 1.1841 low, a test of December’s 1.2447 high is possible.

USD/JPY is trading higher at 132.24 (0.38%), finding support as US yields gained ahead of tomorrow’s US inflation data release. Following the BoJ's surprise tweak to its Yield Curve Control Program in December, we think the risks in USD/JPY are to the downside and favour selling bounces.

Commodities

WTI Crude is trading higher at $75.23 (1.38%) on hopes of a rebound in demand and hopes that the Fed will soon step down the pace of rate hikes in 2023. Technically crude oil looks to be in a US$82-US$70 type trading range, with the downside supported by the prospect of the US government continuing to refill its reserves at around US$70 a barrel.

Gold is trading at US$1878 (0.33%), holding just below seven-month highs ahead of tomorrow night’s US inflation data release. Gold is trading in the middle of its long-standing US$2070 - US$1670 range and not far below resistance at US$1896, coming from the 61.8% fibo retracement of the decline from 2070 to US$1616.

Source: TradingView.

What else is catching the eye this week

- AU-Monthly CPI data November (today): In October, Monthly headline CPI increased by 6.9% Y/Y, slowing from September’s record high of 7.3%. Despite the Monthly CPI indicator only including updated prices for between 62% and 73% of the weight of the CPI basket, it will be closely watched as the interest rate market sits on a knife edge ahead of the February RBA meeting (60% priced for a 25bp rate rise to 3.35%).

- US-CPI data December (Thursday): The market is looking for headline inflation to fall to 6.5% Y/Y from 7.1% Y/Y in November, continuing its decline from the 9.1% peak in June. Core CPI is expected to fall to 5.7% Y/Y from 6% Y/Y in November.

- US-Q4 Earnings Season (Friday): The Q4 2022 earnings season kicks off this week with the big Wall Street Banks once again getting the ball rolling.

IG's Tony Sycamore has more than 25 years of experience working in financial markets, including 10 years at Goldman Sachs (NYSE:GS). He spent six of those years as part of the Goldman Sachs Macro Proprietary Trading team, based in Sydney, trading the bank’s capital. Tony has also worked in Senior Sales Roles at top-tier banks, including BNP Paribas (EPA:BNPP), the Commonwealth Bank of Australia and Macquarie Bank, and has twice been shortlisted for the Global Technical Analyst Awards.

Read more on Proactive Investors AU