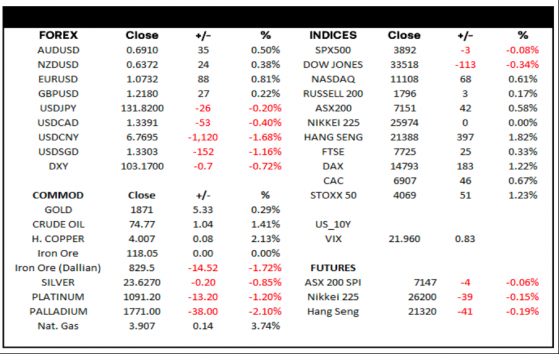

IG's Tony Sycamore returns with a new Trader's View report, covering overnight moves and the day ahead in US stock indices, the ASX200, commodities and FX. Prices are current as of 8:00 am AEDT.

US stocks

US stock markets gave back early gains after Fed Speakers threw cold water on flickering flames of hope that Friday’s “goldilocks” jobs report might be enough to prompt the Fed to temper its rate-tightening cycle.

San Francisco Fed president Mary Daly and Atlanta Fed colleague Raphael Bostic said they expected the Fed to raise rates above 5% and then go on hold for a “long time”.

The comments signal a continued commitment by Fed members to keep a lid on financial conditions (and inflation) that a premature stock market recovery would undo.

In stock-specific news, embattled EV maker Tesla (NASDAQ:TSLA) added 5.95% to $119.77 after it found support last week ahead of $100.00.

The overnight reversal lower leaves the S&P500 still requiring a sustained break above resistance at 3,910/20, followed by a sustained break above the 200-day moving average at 3,998 and downtrend resistance at 4,040 (from the January 2022 bull market high) to negate downside risks.

On the downside, a sustained break below support at 3,800/3,780 would warn that another leg lower towards 3,650 has commenced.

ASX200

The ASX200 added 42 points (0.59%) yesterday to close at 7,151. The Energy (1.41%), Real Estate (1.1%), and Material (1.03%) sectors outperformed, while the Health Care (-0.19%) and IT (-0.59%) sectors closed lower on the day.

At a stock-specific level, Paladin Energy (ASX:PDN) added 9.56% to close at $0.745 cents as it looks to recover the 32% its share price has lost since September.

Index heavyweight BHP (ASX:BHP), which accounted for 8.4 points of yesterday’s move at an index level, traded to its highest price in 17 months, eyeing its all-time $48.57 high, just 1.3% away. Gold miner Northern Star added 1.7% to $11.96, its highest close since February 2021.

Providing the ASX200 remains above the 200-day moving average at 7,000 and last week’s 6,905 low, the view remains that the pullback from the 7,375 high is a correction rather than a reversal lower.

SPI futures point to a flattish open today at 7,147 (-0.06%). Support on the day is viewed at 7,110 and resistance at 7,180.

The AUD/USD is trading higher at 0.6910 cents (0.5%), benefitting from China’s re-opening, media reports of an easing in Sino-Australian relations and Friday’s jobs report in the US, which raised hopes of a soft landing.

Providing the AUD/USD holds onto its break above 0.6900 cents and Friday’s rally above the 200-day moving average at 0.6846, it should be enough to see the AUD/USD ride the tailwinds outlined above towards the mid-August 0.7137 high.

The EUR/USD is trading at 1.0732 (0.81%), a fresh six-month high supported by Friday’s US jobs data that sparked hopes the Fed will move to smaller 25bp rate rises in 2023 and as mild weather in Europe has eased energy crisis concerns. We remain positive on the EUR/USD as it looks to tackle resistance 1.0785/05. A break above here would then open up a move towards 1.1000.

GBP/USD is trading higher at 1.2180 (0.75%) as Friday’s US jobs data continues to weigh on US yields and the US dollar. As noted yesterday, Friday’s rebound above the 200-day moving average at 1.2025, along with the formation of a bullish engulfing candle, was a positive development. Providing GBP/USD remains above Friday’s 1.1841 low, a test of December’s 1.2447 high is possible.

USD/JPY closed lower at 131.82 (-0.20%), continuing to weaken in line with the selloff in US yields that followed the US jobs data on Friday night. As a result of the BoJ's surprise tweak to its Yield Curve Control Program in December, we think that the risks in USD/JPY are to the downside and continue to favour selling bounces.

Commodities

WTI Crude Oil is trading higher at US$74.75 (1.38%) on hopes of a rebound in demand from the China reopening and on hopes that the Fed is set to step down the pace of rate hikes in 2023. Technically crude oil looks to be in a US$82-US$70 type trading range, with the downside supported by the prospect of the US government continuing to refill its reserves at around US$70 a barrel.

Gold is trading higher at US$1,871 (0.24%), supported by the continued sell-off in US yields and the greenback that has followed the US jobs data release on Friday night. Gold has rallied back to the middle of its long-standing US$2,070-US$1,670 range. The preference is to buy corrective pullbacks.

Source: TradingView.

What else is catching the eye this week

- US-Fed chairman Powell (Tuesday): The Fed chairman will participate in a discussion in Stockholm, Sweden, titled Central Bank Independence. The market will watch the Fed Chair (probably more in hope than anything else) for any dovish comments following last week’s jobs and soft PMI data.

- AU-monthly CPI data November (Wednesday): In October, monthly headline CPI increased by 6.9% Y/Y, slowing from September’s record high of 7.3%. Despite the monthly CPI indicator only including updated prices for between 62% and 73% of the weight of the CPI basket, it will be closely watched as the interest rate market sits on a knife edge ahead of the February RBA meeting (about 60% priced for a 25bp rate rise to 3.35%).

- US-CPI data December (Thursday): The market is looking for headline inflation to fall to 6.7% Y/Y from 7.1% Y/Y in November, continuing its decline from the 9.1% peak in June. Core CPI is expected to fall to 5.8% Y/Y from 6% Y/Y in November.

- US-Q4 Earnings Season (Friday): The Q4 2022 earnings season kicks off this week with the big Wall Street Banks once again getting the ball rolling.

IG's Tony Sycamore has more than over 25 years of experience working in financial markets, including 10 years at Goldman Sachs (NYSE:NYSE:GS). He spent six of those years as part of the Goldman Sachs Macro Proprietary Trading team, based in Sydney, trading the bank’s capital. Tony has also worked in Senior Sales Roles at top-tier banks, including BNP Paribas (EPA:BNPP), the Commonwealth Bank of Australia (ASX:CBA) and Macquarie Bank, and has twice been shortlisted for the Global Technical Analyst Awards.

Read more on Proactive Investors AU