From cell therapies and cancer research to COVID-19 and CBD capsules, healthcare stocks are hard at work developing the next generation of diagnostic and therapeutic solutions.

It’s only the start of the year, but ASX-listers have continued to progress their clinical vision over 2023’s March quarter, expanding and refocusing their pipelines to meet major unmet medical need.

So as technology evolves and more drug candidates hit the clinics, what do healthcare stocks plan to achieve in the quarters to come?

Market movers

Despite a slowdown in the annual inflation rate, Australia’s latest round of CPI data shows the cost of health services continues to rise.

In the last three months, the price of medical and hospital services jumped 4.2% due to an increase in private health insurance premiums and increases in non-hospital medical services.

Pharmaceutical products also spiked, up 4.5% thanks to a cyclical reduction in consumers who qualify for subsidies.

“Prices for medical and hospital services typically rise in the March quarter as GPs and other health service providers review their consultation fees, and the Medicare Safety Net is reset at the start of the calendar year,” ABS head of prices statistics Michelle Marquardt explained.

“This year some private health insurance premiums also increased in January, adding to the price rise for medical and hospital services.”

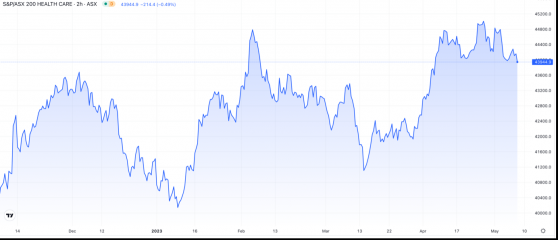

On the ASX, healthcare players are keeping the sector in the green. Year-to-date figures indicate the industry is up 6.13%, while the XHJ index has jumped 9.09% since this time last year.

Amid rising health costs and a flurry of clinical activity, the stage is set for ASX-listed biotechs to deliver dynamic, cost-effective solutions that combat modern healthcare woes.

In the spotlight: ASX healthcare stocks

AdAlta

AdAlta Ltd (ASX:1AD) spent the March quarter making plans to bring lead asset AD-214 back to clinical trials ahead of schedule.

The next generation antibody therapeutic is expected to return to the clinic under a Phase 1 extension study in the September quarter — more than a year earlier than previously forecast.

AdAlta CEO and managing director Tim Oldham said the company made significant progress on its AD-214 roadmap, bringing the drug candidate one step closer to clinical studies.

“We are pleased with the growing partner interest in this asset as exemplified by more potential partners asking deeper and more sophisticated questions,” he explained.

At the end of March, AdAlta had A$5.57 million to support its clinical pipeline, but it’s just announced a A$3.15 million rights offer to further boost its bank balance.

“Our major shareholders have been enormously supportive of AdAlta and the rights offer provides all our existing shareholders with an attractively priced opportunity to help progress the company towards transactions and transformational new therapies for fibrosis and cancer patients,” Oldham concluded.

Anteris Technologies

Anteris Technologies Ltd (ASX:AVR, OTC:AMEUF) kicked of the March quarter with strong follow-up results one year after the first five-patient cohort received its DurAVR™ transcatheter heart valve.

In essence, the follow-up results demonstrated the heart valve’s safety profile, with each of the five patients reporting stable, improved valve function at the 12-month mark.

During the quarter, the Food and Drug Administration (FDA) also granted expanded approval for DurAVR’s early feasibility study (EFS), which will provide crucial data as Anteris weighs its commercialisation options.

The EFS is expected to kick off this quarter, followed by interim and 30-day data in Q3 and 3-month data in Q4.

To support its clinical development, Anteris completed a A$35 million placement in February, cornerstoned by its two largest shareholders.

And just before the quarter’s end, the biotech entered the All Ordinaries Index, cementing its place as one of the ASX’s 500 largest companies.

Paradigm Biopharmaceuticals

Five months into 2023, Paradigm Biopharmaceuticals Ltd (ASX:PAR) is making headway on its mission to address significant unmet need in the global osteoarthritis market.

In its March quarter highlights, the biotech recapped 6-month data from its Phase two PARA_OA_008 study, which examines the disease modifying effects of injectable pentosan polysulfate sodium in patients with knee osteoarthritis.

Paradigm also secured regulatory and ethics approval for a pivotal PARA_OA_002 trial in Europe, paving the way for site start-up initiatives in Belgium, Poland and the Czech Republic.

The late-stage drug development company has more than A$73 million in the bank to support its clinical pipeline. Later this quarter, it plans to present at the Bio International Conference in Boston and meet with key stakeholders.

Arovella Therapeutics

Arovella Therapeutics Ltd (ASX:ALA) used the March quarter to progress its invariant Natural Killer T (iNKT) cell therapy vision for cancer treatment.

In the last three months, the oncology-focused stock released new data for its lead product, ALA-101, and had the data accepted for presentation at the prestigious American Association for Cancer Research’s (AACR) Annual Meeting.

Interestingly, the data indicates ALA-101 has the potential to be a novel ‘off-the-shelf’ cell therapy to treat CD19-expressing leukemias and lymphomas, teeing the company up for a Phase 1 clinical trial.

Arovella also generated promising in vitro data for ALA-101 in combination with fellow ASX-lister Imugene Ltd (ASX:IMU, OTC:IUGNF)’s CF33 oncolytic virus. Both parties have since progressed the joint research program to in vivo testing.

In recent months, the company has also brought on more clinical and executive leadership to advance its therapeutic pipeline — expertise that will come in handy ahead of manufacturing scale up and proof-of-concept studies.

Chimeric Therapeutics

Chimeric Therapeutics Ltd (ASX:CHM) kept busy over FY23’s third quarter as it evaluated cancer-combatting CAR-T cell therapies in the clinic.

In its pipeline are three major programs, including CHM 1101 (CLTX CAR T) for the treatment of solid tumours, CHM 2101 (CDH17 CAR T) for gastrointestinal tumours and the CHM 0201 (CORE-NK platform) for blood cancers and solid tumours.

Most notably, the Australian developer dosed its first patient in a CHM 0201 combination trial and hit other dosing milestones in its CHM 1101 Phase 1A study.

Chimeric also reported positive feedback from the US FDA at a pre- Investigational New Drug (IND) meeting for its CHM 2101 treatment candidate.

On the financial front, the ASX-lister cashed in with a A$3.06 million R&D refund, recognising the company’s work over the 2022 financial year.

With an emphasis on bringing the promise of cell therapy to life for more patients with cancer, Chimeric remains focused on discovering, developing and commercialising therapies with curative potential.

Prescient Therapeutics

Focused on developing PTX-100 and the next generation of its OmniCAR platform, Prescient Therapeutics started the new year with plenty of clinical activity.

Headlining the quarterly, the oncology stock reported encouraging clinical results from a trial evaluating its PTX-100 compound in T Cell Lymphoma patients and secured orphan drug designation from the FDA.

The Prescient team is now working to schedule a Phase 2 trial in the same patient population and will seek accelerated approval with the US FDA in an orphan indication.

And while much of the focus last quarter remained on PTX-100, Prescient continued to develop its OmniCAR platform to target a wide range of cancers.

The cell therapy innovation is moving towards first in-human trials, but the ASX-lister believes slow and steady will win the race as it focuses on responsible and systematic development.

With $19.9 million in the bank and new results at hand, Prescient believes the March quarter underscored its position as an emerging global leader in the next generation of personalised cancer therapies.

MGC Pharma

The first few months of the year proved instrumental for European pharma stock MGC Pharmaceuticals Ltd (LSE:MXC, OTC:MGCLF, ASX:MXC), which is building up to an IND submission for its CimetrA™ and ArtemiC™ drug candidates.

The pharmaceutical company conducted pre-clinical studies for CimetrA in January and March, opening the door to studies that will evaluate the candidate’s efficacy against further indications. MGC plans to incorporate the study results into its IND submission.

In other news, ArtemiC — MGC’s proprietary, clinically tested COVID-19 treatment — was granted over-the-counter status on the FDA’s National Drug Code Database.

Following the update, MGC’s US-based supply and distribution partner placed a US$2 million order for ArtemiC, teeing the company up to deliver its COVID treatment later this year.

“We are excited by the opportunities with our partner AMC as we are very heavily focused on meeting unmet medical needs across all of our pipeline by developing novel and affordable products,” MGC chief commercial officer Robert Clements said in March.

Emyria

Emyria Ltd (ASX:EMD) celebrated a key milestone during the March quarter: the Therapeutic Goods Administration’s (TGA) rescheduling of MDMA and psilocybin.

The down scheduling decision will serve as an expansion catalyst for the biotech’s MDMA-assisted therapy programs, with plans laid to support a network of authorised prescribers around Australia as they deliver these innovative new programs.

“As the only ASX-listed company offering a clinical service for unregistered medicines and real-world data generation, we have a distinct advantage in supporting MDMA-assisted therapies in Australia,” Emyria MD Dr Michael Winlo said.

“We have already developed a comprehensive therapy protocol, secured drug supply and partnered with specialist psychiatrists to benefit patients.”

Alongside its MDMA programs, Emyria began dosing for a Phase 3 clinical trial of EMD-RX5, an ultra-pure CBD capsule aimed at treating stress and anxiety symptoms.

Subsequent to quarter end, the biotech signed a binding term sheet with Aspen Pharmacare (JSE:APN) Australia to commercialise the EMD-RX5 medication.

Incannex Healthcare

Like Emyria, Incannex Healthcare Ltd (ASX:IHL, NASDAQ:IXHL) used the March quarter to act on the TGA down scheduling MDMA and psilocybin.

The pharmaceutical stock has laid plans to commercialise its psychedelic-assisted psychotherapy business, and it estimates the domestic addressable market for this kind of service will grow to more than $2 billion per annum in three years.

Together with Clarion Clinics Group, the company plans to open clinics across Australia and overseas, with the flagship Melbourne clinic expected to open its doors in Q3 FY23.

To realise that vision, Dr Paul Liknaitzky, Professor Suresh Sundram and Sean O’Carroll have joined the Board of Directors at an Incannex subsidiary, where they’ve taken up key roles within the venture.

With A$37.1 million in the bank to support its clinical vision, Incannex also plans to continue its Phase 2 psilocybin-assisted psychotherapy trial and a Phase 2 rheumatoid arthritis study.