GTI Energy Ltd (ASX:GTR) shares surged 50% higher intra-day to 0.9 cents after declaring the maiden uranium resource at the Lo Herma Project in Wyoming’s prolific Powder River Basin uranium production district.

The mineral resource estimate (MRE) assumes mining by in-situ recovery (ISR) methods and is reported at a cut-off grade of 200 ppm U3O8 (triuranium octoxide) and a minimum grade thickness (GT) of 0.2 per mineralised horizon as:

4.12 million tonnes of mineralisation at an average grade of 630 ppm U3O8 for 5.71 million pounds (Mlbs) of U3O8 contained metal.

In addition, the initial Lo Herma exploration target range has also been updated and increased.

The updated exploration target range for the Lo Herma Project is between 5.3 to 6.7 million additional tonnes at a grade range of between 500 ppm to 700 ppm U3O8 containing an estimated 5.9 to 10.3 million pounds of U3O8.

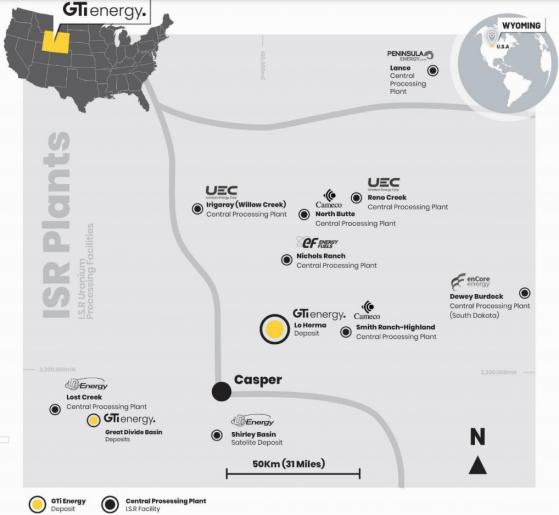

Lo Herma is ~10 miles from the US’s largest ISR U3O8 production plant at Cameco Corporation (TSX:CCO)’s Smith Ranch-Hyland and ~60 miles from Uranium Energy Corp. (NYSE:UEC)’s Irigaray and Energy Fuels Inc. (TSX:EFR, NYSE-A:UUUU)’s Reno Creek.

Uranium processing plants in Wyoming and GTI project locations.

GTI executive director Bruce Lane said: “We are very pleased to declare an initial JORC inferred U3O8 mineral resource estimate with an updated exploration target at Lo Herma in the Powder River Basin.

“The reported estimates are based solely on significant historical drilling information.

“This initial MRE highlights the exciting potential at Lo Herma with an initial inferred resource of 5.7 Mlbs at average grade of 630 ppm.

“The exploration target for the project has also been updated with an additional 5.87 to 10.26 Mlbs potential at average grade of 500 – 700 ppm.”

Lane added: “This initial resource validates our belief that Lo Herma, which is located within 60 miles of ISR production plants owned by Cameco, UEC & Energy Fuels, holds real potential to become a producing deposit.

“GTI’s immediate goal is to integrate the results of our ariel geophysics survey into the exploration targeting model and to secure approvals for a drilling program timed for late 2023 or H2 of 2024.

“Drilling will aim to verify, upgrade and extend the resource.

“As highlighted by the exploration target, there appears to be material potential to increase the resource along trend but also possibly at depth within the highly productive Fort Union formation.”

Read more on Proactive Investors AU

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.