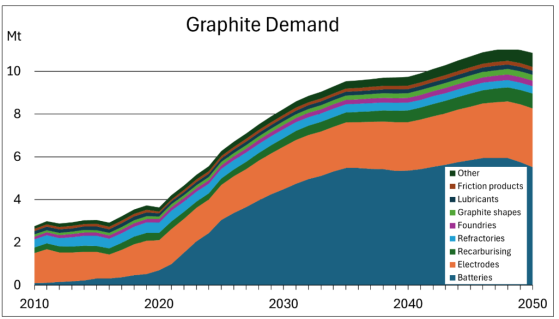

The graphite market is experiencing significant growth and is projected to continue to expand for decades to come, primarily driven by the rising demand for lithium-ion batteries used in electric vehicles (EVs) and the broader energy transition from fossil fuels to renewables.

Yet traditional applications of graphite also remain crucial and will continue to be important markets for graphite. These applications encompass a diverse range of industries, and each market segment requires extensive product qualification, a wide base of customers, many with smaller consignment sizes.

The demand from emerging technologies and established uses highlights the evolving landscape of the graphite market, and underlines the need for suppliers to adapt to diverse requirements and maintain flexibility in their offerings.

Chinese market

Graphite certainly has a large role in EV batteries for the foreseeable future. However, significantly increased supply out of China is keeping prices muted of both synthetic and natural graphite (in the form of spherical graphite), which are used in the anodes of lithium-ion batteries.

China has access to its own graphite, mining around 70% of the world’s graphite supply and producing practically all of the world’s lithium-ion anodes today.

Fastmarkets battery raw materials analyst Georgi Georgiev highlighted China’s increased supply and dominance in the space, saying that the country had a particularly strong role last year.

“China has been the main producer of natural graphite, especially in 2023. China accounts for almost 78% of the global supply for graphite, which in 2022 was different.

“When the prices were going up, we were seeing more supply from Africa. But with the price collapsing at the end of 2022 and throughout 2023, we saw less supply coming from African projects and more supply coming from China.”

China's graphite output jumped from 762,000 tonnes in 2020 to 1.2 million tonnes in 2023 and has increased further since then, with most of the increased capacity coming from state-owned companies and from one province. All up, as much as 94% of global graphite mine supply is coming out of China, with that number lifting to 99% when considering spherical graphite supply.

Since China increased production, graphite prices have retreated and remained depressed. Georgiev explained that had been “especially difficult for projects in North America”, where there was only one operating mine, and also for graphite mines in Europe and in South America.

However, the export of China's graphite production is restricted, while the USA Inflation Reduction Act does not provide tax credits for EVs with battery minerals from China.

And while there is strong competition from Chinese synthetic graphite in lithium-ion anodes, natural graphite presents a better environmental, economic and strategic choice — an important factor when OEMs are increasingly looking to clean up their supply chains.

Sarytogan Graphite: multi-product strategy

Development of the giant, exceptionally high-grade Sarytogan Graphite Project of Sarytogan Graphite Ltd (ASX:SGA) in Kazakhstan could bring much-needed supply from a source outside of China.

The project’s central Asian location, the unique micro-crystalline nature of its graphite and the positive graphite market outlook has shaped the planned development of the company’s project.

Kazakhstan is a modern and favourable mining jurisdiction, ideally located between Europe and China — two of the three biggest markets for graphite and batteries (the other being USA).

Amid global geopolitical concerns around China’s control of the market, the European Union identified graphite as a critical raw material and in 2022 the EU signed a Memorandum of Understanding with Kazakhstan to cooperate on the supply of battery raw materials. In addition, export from Kazakhstan to the USA is also feasible via Chinese ports or the Black Sea.

A recently released pre-feasibility study (PFS) for the Sarytogan Graphite Project anticipates that development could see the project emerge as “a very serious contender to play an important role in meeting the world’s energy storage needs”. The PFS determined a project net present value (NPV) of up to US$518 million, or A$797 million.

The PFS outlines a staged development strategy and conservative ramp-up at the project, that contemplates a low capex initial entry point for an upstream-only development, and then expansion downstream to allow higher-value products with further capital investment.

Driving the company’s strategy will be the production of three product types, from the production of 50,000 tonnrs per annum of flotation concentrate.

Some of that will be sold as the micro80C product, which is at 80% carbon and goes into traditional uses for things like lubricants, drilling fluids, brakes, rubbers and plastics.

Sarytogan will also produce some ultra-high purity fines, knowing that it can purify its graphite to five nines (99.9992%). That product will be available for sale into more advanced industrial uses — things like non-rechargeable batteries and a very small amount into the very high-value nuclear market.

The third product family is the spherical purified graphite, which is for lithium-ion batteries for electric vehicles.

The 10-year weighted-average sales prices for those products are:

- Microcrystalline graphite at >80% carbon (Micro80C) at US$746 to $791/tonne,

- Ultra-high purity fines (UHPF) at up to five nines purity at US$4,468 to $5,577/tonne, and

- Spherical purified graphite (USPG and CSPG) at US$2,500 and $8,000/tonne.

Early works on the DFS already underway, while Sarytogan is in a strong position to drive the project forward.

Read: Sarytogan Graphite PFS envisages low-cost project with "exceptional" returns

Read more on Proactive Investors AU