Goldman Sachs (NYSE:GS)’ commodities seer Jeff Currie foresees crude oil heading above US$100 (£83) per barrel by the end of the year, the influential analyst stated at an industry conference in Riyadh, Saudi Arabia on Sunday.

A confluence of factors, specifically Russian export sanctions and higher demand in a resurgent China, may cause the Organisation of Oil Exporting Countries (OPEC) to unwind the production limits imposed on member states back in 2022 in order to boost oil prices.

While agreeing that “right now, we’re still balanced to a surplus because China has still yet to fully rebound", Currie noted that a lack of spending on improving production capacity may cause a supply-chain bottleneck.

“Are we going to run out of spare production capacity? Potentially by 2024 you start to have a serious problem,” he warned.

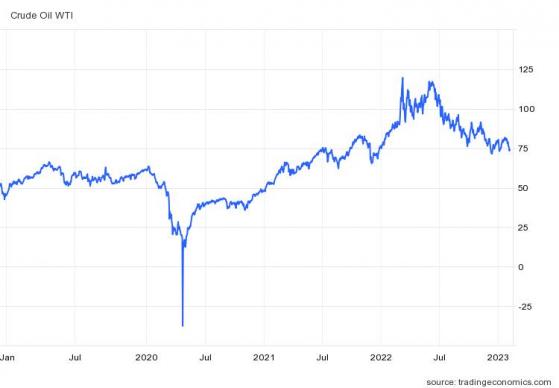

Crude oil is currently selling for US$74 a barrel -- Source: tradingeconomics.com

Oil isn’t the only commodity on Currie’s bullish list.

“You cannot come up with a more bullish concoction for commodities,” he said last month. “Lack of supply is apparent in every single market you look at, whether it is inventories at critical operating levels or production capacity exhausted.”

The one exception is European natural gas prices, which have been compressed amid a particularly warm winter across the continent.

Mixed messages from The Street

Not all corners of Wall Street are as bullish on the price of oil as Currie.

While acknowledging a pending surge in Chinese demand in the second half, JPMorgan Chase (NYSE:JPM) head of Asia energy and chemical research Parsley Ong today reiterated the bank’s US$90 forecast.

Citibank's Ed Morse has gone on record to suggest that Brent crude will finish 2023 as low as $76 a barrel.

G7 sanctions could cause disruptions in the short term, but analysts expect Moscow to reroute barrels to China, India, the Middle East and Africa, while the US exports have played a “really significant role in filling the gaps," noted Morse.

Currie’s golden calls

Jeffrey Currie became an outspoken voice in the commodities market for making bold, contrarian calls, many of which proved to be right.

His reputation took off in 2007, when his bullish recommendation on oil yielded a 23% return.

In April 2013, he famously issued a sell recommendation on gold, right before the commodity plunged 13% in just two sessions, the biggest decline since 1980.

“You had a whole group of observations that should have created a substantial rally in gold prices, but they didn’t,” Currie said at the time, adding: “The fact that gold did not rally on Cyprus amid the bad US data that occurred in that time period created the conviction we needed.”

More recently, in early 2020, Currie called for a “commodities supercycle” of sustained growth. The Dow Jones Commodity Index proceeded to rally until peaking in mid-2022.

Read more on Proactive Investors AU