A study commissioned by the financial publisher The Lazy Trader has leveraged google search data to determine the most popular personal investment search terms for people in the United States, with gold taking the number one spot.

Gold has always had a reputation for stability and liquidity, an always-in-demand mineral viewed as a ‘safe-haven’ investment to wait out inflation and market instability.

This year, it was the most searched-for investment, in no small part due to the Gold Council’s recent public relations efforts.

Gold garnered a monthly average search volume of almost 1.2 million, as high interest rates and lingering concerns about recession intensified gold’s appeal.

Gold reached new heights late last year, setting a new record at US$2,152.30 per ounce in December.

Analysts are now predicting gold to move higher to US$2,200 this year and US$2,500 after a pullback in 2025.

Precious metals and fossil fuels dominate

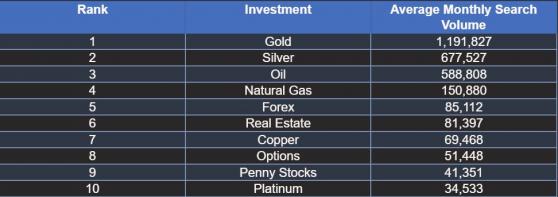

The full top 10 most popular personal investments by google search volume are:

Silver came in second, occupying a sort of 'gold like' position in investor’s minds, as a fairly inflation-resistance commodity that’s significantly cheaper to invest in than gold.

Silver mining has also gradually decreased since 2015, according to The Lazy Trader, meaning the asset will slowly appreciate as it becomes rarer – at least until miners take advantage of the profit opportunity.

Oil was third, with natural gas close behind in fourth, indicating the US public is certainly not ready to part with hydrocarbons just yet. Oil has also been on an upward trend in recent weeks, as conflict in the Middle East threatens supply chains and diplomatic relationships.

Natural gas has stepped into something of a ‘green hydrocarbon’ option for some investors, who perceive its lesser environmental impact and ability to transform into other energy types like hydrogen gas to be more desirable than other fossil fuels.

Beware of market fluctuations

Rounding out the final six options were foreign currency exchange, real estate, copper, stock options, penny or micro-cap stocks and platinum, indicating a tendency towards emerging markets such as personal real estate investment through vehicles like real estate investment trusts (REITs) and long-term opportunities like micro-caps and stock options.

“When it comes to choosing the right personal investment for yourself, it can be difficult weighing up the pros and cons,” The Lazy Trader CEO Robert Colville said.

“It is important to be well educated on where you invest your money, as some methods will be more successful than others; make sure you have conducted extensive research and remain aware of what your choice of investments will entail.

“It is interesting to see which investments Americans are most eager to try and learn more about.

“With an unpredictable economy and the constant changes in prices of stocks and commodities, people should be warier of fluctuations in these environments and ensure they put their money into a reliable form of personal investment.”

Read more on Proactive Investors AU