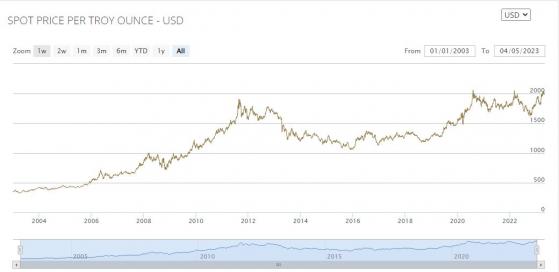

Gold has always been a first port of call for central banks, multinational corporations, and the savvy investor in tumultuous times.

Generally seen as a safe-haven investment that hedges against inflation (and the US dollar) due to its intrinsic value, its unsurprising that gold’s spot price has seen a sharp uptick in recent times.

Gold spiked to US$2038.40 in the midst of the COVID-10 pandemic almost three years ago and has spiked again to US$2,041.21 in recent days due to a combination of inflationary pressure, which encouraged investment in gold, and central banks buying up the precious metal to maintain their held asset value.

The XAU/USD (Gold/US dollar) ratio hit a new all high at around US$2081.82 last week, although it dipped back into the US$2,050 range following a rash of profit taking.

That hasn’t stopped the central banks, with the amount of gold bought by the institutions rising by 152 tonnes year-on-year in 2022 to 1,136 tonnes and more gold purchases made already this year.

All in all, while high inflation and a sinking US dollar make for difficult financial circumstances, they also make for an attractive gold production environment.

That hasn’t gone unnoticed by Aussie gold producers of course, some of whom have added hedges to their books as high as US$3,200 per ounce.

Gold market movements

Now we’ll take a look at the ASX gold explorers and producers making moves in the market this quarter.

Meeka Metals

Meeka Metals Ltd (ASX:MEK) kept the drills spinning this quarter, conducting drilling campaigns at the Murchison Gold Project’s St Anne prospect, and the Circle Valley Project’s Anomaly A gold target and rare earth targets.

The company released an updated mineral resource for Murchison’s Turnberry deposit, delivering a 12% increase and growing the total Murchison Gold Project mineral resource to 12.4 million tonnes at 3.0g/t gold for 1.2 million ounces.

Drilling results of note during the quarter included:

St Anne’s:

- 7.8 metres at 2.69g/t gold from 50.2 metres including 2.0 metres at 8.20g/t gold;

- 20.7 metres at 3.29g/t gold from 54.3 metres including 12.8 metres at 5.21g/t gold; and

- 19.3 metres at 1.27g/t gold from 39.7 metres including 2.5 metres at 7.04g/t gold.

- 5.6 metres at 4.63g/t gold from 76.4 metres including 1.0 metre at 17.70g/t gold;

- 4.2 metres at 2.90g/t gold from 132.0 metres including 0.4 metres at 13.57g/t gold;

- 16 metres at 1.50g/t gold from 36 metres including 4 metres at 3.89g/t gold; and

- 8 metres at 2.79g/t gold from 124 metres including 4 metres at 5.15g/t gold.

MEK is targeting the June 2023 quarter for an initial rare earth mineral resource for the project.

The company is also targeting release of an initial mineral resource for the St Anne prospect on May 5, and expects to field rare earth element results from the remaining Circle Valley drill holes this month.

Alto Metals

Alto Metals Ltd (ASX:AME) was focused on the Sandstone Gold Project’s mineral resource this quarter, producing an updated estimate that outlined an optimised, pit-constrained resource of 17.6 million tonnes at 1.5 g/t gold for some 832,000 ounces of gold.

Importantly, about 80% of the total Sandstone resource of 23.5 million tonnes at 1.5 g/t gold for 1.05 million ounces has been captured within pit-optimisation work, and 90% of the constrained resource is shallow, within 150 metres from surface.

Also at the Sandstone Project, Alto achieved an almost 3-fold increase to the Indomitable Camp (a separate resource from the main Sandstone deposit), defining mineralisation at the prospect along a more than 3-kilometre-long northwest-southwest corridor for a resource of 5.4 million tonnes at 1.2 g/t gold, or 210,000 ounces of gold.

The company also intersected high-grade gold in maiden drilling at the Oroya Mine, a regional target at Sandstone, fielding results up to 3 metres at 13.8 g/t gold from 65 metres, with a higher grade portion of 1-metre at 37.1 g/t gold.

“Our major drilling program for 2023 is underway, with the first 5,000 metres of reverse circulation drilling completed and those samples are already with the laboratory for assaying,” Alto Metals managing director Matthew Bowles said.

“Our systematic approach to exploration is delivering and we are confident further drilling will continue to grow the resource and unlock the value of this entire gold field.”

Auric Mining

Auric Mining Ltd (ASX:AWJ) is gearing up to graduate from explorer to producer in the near future, having executed the Decision to Mine notice with local mining contractor BML Ventures Pty Ltd for the Jeffrey’s Find Gold Project.

In an important step toward that goal, the company also executed a toll treatment agreement with Greenfields Mill at Coolgardie to process ore from Jeffreys Find Project.

“During the quarter, our main focus was the steps required to start mining at Jeffreys Find,” Auric Mining managing director Mark English said.

“We have completed all the necessary work and arrangements to commence the starter pit at Jeffreys Find and have now started mining activities.

“We will in the foreseeable future attain one of the company’s key ambitions and objectives in becoming a gold producer.

“Generating cash within the next six months with negligible downside risk to Auric is a terrific result.”

The company has also been exploring rare earth element (REE) and nickel potential at the Widgiemooltha Gold Project’s Chalice West and further gold at the Miitel South Gold prospects, where the company struck an intercept of 2 metres at 2.84 g/t gold from 39 metres below surface.

Chalice West results include:

- 6 metres at 0.35% nickel, including 1-metre at 0.44% nickel, 788 parts per million (ppm) cobalt and 7,366ppm Total Rare Earth Oxides (TREO); and

- 36 metres at 1,253ppm TREO from surface in ACRC005 with 20.0% of the TREO as the more valuable Magnetic Rare Earth Oxides (MREO).

Great Boulder Resources Ltd (ASX:GBR) achieved a maiden inferred resource estimate for the flagship Side Well Project this quarter, with 431,000 ounces at 2.5g/t gold at the Mulga Bill prospect and 87,000 ounces at 2.9g/t gold at the Ironbark prospect for a total of 518,000 ounces at 2.6g/t gold.

Not the type of company to rest on its golden laurels, GBR resumed drilling at Side Well the very same month, drilling 101 holes for a total of 13,460 metres across reverse circulation (RC) and aircore (AC) drilling programs.

The company was able to identify new exploration targets north of the Ironbark prospect, with highlight results from Side Well drilling including some exceptionally high-grade gold:

- 6 metres at 589.44g/t gold from 114 metres, including 1-metre at 3,160 g/t gold from 114 metres;

- 6 metres at 396.58g/t gold from 154 metres, including 1-metre at 2,250.00g/t gold from 158 metres;

- 19 metres at 12.83g/t gold from 229 metres;

- 9 metres at 27.29g/t gold from 240 metres;

- 20 metres at 9.41g/t gold from 111 metres, including 5 metres at 17.47g/t gold from 125 metres; and

- 8 metres at 9.89g/t gold from 115 metres.

AuKing Mining

AuKing Mining Ltd (ASX:AKN) expanded its mineral asset portfolio this quarter, acquiring a 100% interest in six projects in Tanzania – four prospective for uranium, and two with potential for copper.

The company also acquired a further 7.48% interest in the Koongie Park joint venture (JV) project with Astral Resources NL (ASX:AAR), bringing its total operating interest to 87.48%.

Under the terms of the joint venture, Astral’s holding in the project will revert to a 1% smelter royalty should the company’s interest fall below 10%, which AKN says is likely to occur this year.

AuKing is in the midst of producing a scoping study for the Sandiego deposit at Koongie Park – which combined with the Onedin deposit to the northeast, holds a resource estimate of 8.9 million tonnes at 1.01% copper, 3.67% zinc, 0.16 g/t gold, 32 g/t silver and 0.77% lead.

The company engaged Wave International to assist with the preparation of the study, which AKN expects will be completed imminently.

Finally, AuKing raised $2.16 million in a T2 share capital placement, and filed an appeal with the Tanzanian Minister of Mines after two prospecting licences at Manyoni were revoked.

Tietto Minerals

Tietto Minerals Ltd (ASX:TIE) expects the Abujar Gold Mine to produce between 25,000 and 30,000 ounces of gold in the second quarter this year, as the ramp-up to commercial production continues and the plant processes remaining ore from artisanal workings.

TIE is predicting a sharp uptick in production for the second half of the calendar year, up to 105,000 to 120,000 ounces gold with an all-in sustaining cost (ASIC) of US$857 to US$975 per ounce.

Tietto’s production for the full year is 134,000 ounces to 154,000 ounces of gold, a solid output for the mine’s first year, especially given the mine is currently enjoying 3.1 million hours lost-injury-time-free.

With 9,626 ounces of gold produced in the March quarter, Tietto will now turn its attention to reaching nameplate production levels (expected in the June quarter), executing its mining plan and maintaining steady mill performance, progressing its APG Heap Leach feasibility study activities and finalising exploration strategies for regional tenements.

Perseus Mining

Perseus Mining Ltd (ASX:PRU, TSX:PRU, OTC:PMNXF) has continued its strong operating performance this quarter, producing 130,275 ounces of gold at an ASIC of US$971 per ounce at its three operating gold mines: Yaouré and Sissingué in Côte d’Ivoire, and Edikan in Ghana.

Gold sales amounted to 135,111 ounces, at a weighted average gold price of US$1,821 per ounce, US$73 per ounce more than the December 2022 quarter price.

This places PRU’s average cash margin at US$850 per ounce, an 11% increase from the precious quarter.

The company’s coffers are also fuller, with another US$10 million added to the existing bank of US$111 million.

On the development side of PRU’s portfolio, the company is preparing for a possible final investment decision at the Meyas Sand Gold Project in Sudan, formally the Block 14 Project.

During the quarter Perseus:

- completed front-end engineering design (FEED) studies;

- drilled 20,000 metres of 100,000 metres of planned infill and sterilisation drilling at the Gulat Sufur South (GSS) deposit;

- conducted a passive seismic survey to identify local sources of construction water;

- progressed construction on site access roads, currently at 10 kilometres out of 100 kilometres planned;

- completed initial design review for a tailings facility;

- began the tender process for a Hybrid-Renewable power station;

- upgraded onsite facilities in preparation to host some 300 workers for initial construction stage; and

- advanced procurement of construction vehicles and tools.

Pantoro

Pantoro Ltd (ASX:PNR) achieved several milestones this quarter, as the company transitions its Norseman Gold Project from exploration to production.

PNR says the OK Underground Mine is performing above grade expectation within the Star Of Erin Lode with exceptionally high grades of up to 569 g/t recorded in ore zones on several development levels.

Example faces from the Star of Erin; 253E and 105E very high-grade ore faces typical of high grade zones developed in the mine to date.

The OK Mine has also been dewatered, with rehabilitation of the decline nearing completion, ready for the new decline’s development in the June quarter.

The processing mill at Norseman is now running a full capacity, and the company made progress at the Scoita open pit, where PNR expects to generate good ore volumes in the second half of the June quarter.

Pantoro produced 6,631 ounces of gold during the quarter, and expects a substantial increase in production going forward.

The company is also continuing its wind down of the Halls Creek Project, which produced 5,800 ounces at an AISC of A$2,147 yielded positive cashflow of A$2.4 million for the quarter.

PNR is also considering divesting the project, although the company is certainly not hurting for cash at the moment – following a $75 million capital raise, Pantoro had some $83.2 million in the bank as of March 31.