In its latest gold market report, the World Gold Council reported that gold had another month of strong returns in August, helped by expectations of a first Fed rate cut, which drove down the US dollar and Treasury yields.

After a strong monthly gain in July, gold rose further in August to finish 3.6% higher at US$2,513 per ounce. The precious metal reached a new all-time high on August 20, before a very marginal decline into the end of the month.

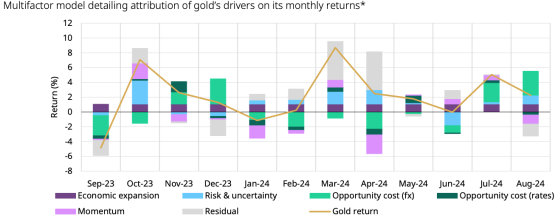

According to the World Gold Council’s Gold Return Attribution Model (GRAM), gold was pulled higher by a material drop in the US dollar and, to a lesser extent, lower 10-year Treasury yields as the Fed signalled the time had come for rate cuts.

It identified the main negative contribution as coming from a “momentum factor”, where a high gold return in one month is typically followed by a lower return and vice versa.

The report also noted a significant cut in import duty on gold in India in late July, which came as “a shot in the arm” for gold demand in the country. It is reported that the duty reduction was followed by strong buying interest from jewellery retailers and consumers.

Meanwhile, global physically-backed gold ETFs extended their inflow streak to four months, with Western funds contributing a majority of flows.

A material drop in the US dollar and lower interest rates helped propel gold higher in August.

Macro environment a tough read

The report contests that the current macro environment is tough to read due to a “swirl of contradictory economic data releases”.

The upcoming US election is adding to the uncertainty, which is being seen in options markets. Specifically, gold ‘spreading’ positions in options, which tends to be quieter corner of the gold market, are at a multi-year high.

This suggests that investors are either hedging or speculating on both a rate-cutting cycle and the US election outcome. The report recognises that, globally, top-line economic data still “looks quite good”. In the US, the stock market continues its strength yet unemployment has risen.

This leaves the Fed in a position where it will have to navigate between preemptively avoiding a recession and risking inflation picking up.

The World Gold Council says it is no surprise that investors have taken to the options market to hedge against or speculate on these outcomes. It continues to see elevated flows into equity options, which have now surpassed the previous all-time high back in Q4 2023.

Global gold ETFs: inflows continue

Global gold ETFs have now seen net inflows four months in a row. Western funds led the way but all regions recorded positive flows in August,

Global physically backed gold ETFs added US$2.1 billion during the month, extending their inflow streak to four months.

All regions reported positive flows but Western funds once again contributed the lion’s share. The 3.6% rise in the gold price, paired with further inflows, lifted

Global assets under management (AUM) lifted by 4.5% to another month-end peak of US$257 billion, driven by the 3.6% rise in the gold price and further inflows.

Collective holdings continued to rebound, increasing by 29t to reach 3,182t by the end of the month.

Given the non-stop inflows to global gold ETFs between May and August, losses further narrowed to US$1 billion in the year to date. Meanwhile, the total AUM jumped by 20% during the first eight months of 2024.

Regional gold ETF flows and the gold price.

Looking ahead

The World Gold Council acknowledges that it can only speculate on how broader macro data might influence market reactions but says, “it seems likely that both election dynamics and expectations of rate cuts have increased activity in gold, as seen in options ‘spreading’ positioning.

“Under these circumstances it is reasonable that investors are more focused on the near-term outlook. Their behaviour suggests that they view gold as a hedge against immediate event risks while also positioning it as a beneficiary of lower interest rates.”

Outside of the US, it is expected that the continuing slowdown in China is likely to impact consumers’ capacity and willingness to buy gold, certainly when it comes to jewellery. However, China’s gold ETFs also saw outflows last month, as compared to the pickup in Indian ETF demand and welcome return of Western ETF inflows.

Read more on Proactive Investors AU