* Graphic: World FX rates in 2017 http://tmsnrt.rs/2egbfVh

* Euro falls after ECB keeps rates on hold

* Nasdaq closes at record high, Dow hits record intraday high

* Sterling slides as poll predicts May failed to win majority

* Top European share index briefly touches 3-week low

* Oil prices touch 1-month lows (Adds poll predicting outcome of UK election)

By Noel Randewich

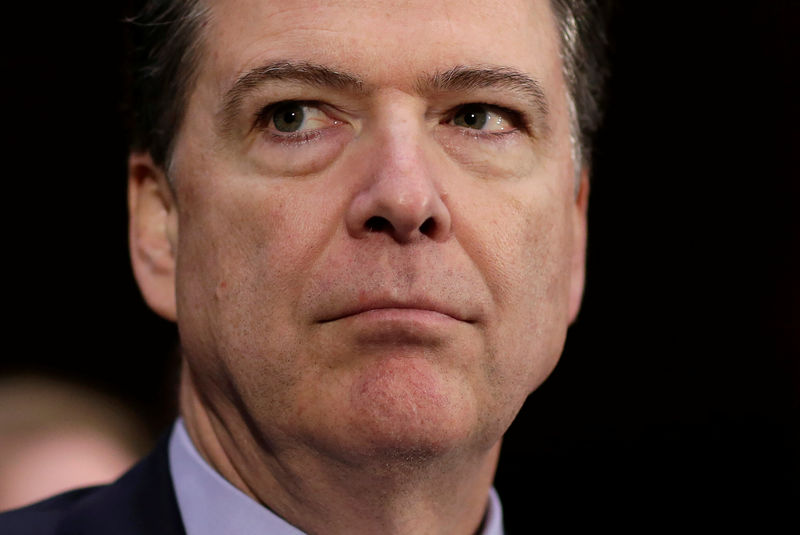

June 8 (Reuters) - U.S. and European stocks were little changed on Thursday as investors digested testimony from former FBI Director James Comey, while Britain's pound fell after an exit poll predicted Prime Minister Theresa May has lost in her electoral roll of the dice.

Sterling weakened by nearly 2 cents to $1.27 after the poll suggested May's Conservative Party would not win enough seats in Parliament to take office alone, a result that would plunge domestic politics into turmoil and could delay Brexit talks. told U.S. lawmakers in a congressional hearing he had no doubt that Russia had interfered with the 2016 election but was confident that no votes had been altered. The Dow briefly hit a record intraday high of 21,265.69 during his testimony, while the Nasdaq Composite closed at a record high after a boost from Yahoo YHOO.O and Nvidia NVDA.O shares. FTSEurofirst 300 of top European equities briefly hit a three-week low of 1,526.29 after the ECB said subdued inflation meant it would continue to pump more stimulus into the region's economy. reference to Comey's testimony, Jefferies & Co money market economist Thomas Simons said: "I think the market is taking less of an alarmist review of this situation because there is no smoking gun here. So it's not particularly impactful for thinking about... Trump's economic agenda to go through."

MSCI's all-country world equity index .MIWD00000PUS was last down 0.08 percent, at 467.24.

The Dow Jones Industrial Average .DJI closed up 0.04 percent at 21,182.53. The S&P 500 .SPX closed up 0.03 percent at 2,433.79. The Nasdaq Composite .IXIC ended up 0.39 percent at 6,321.76. broad FTSEurofirst 300 index .FTEU3 closed down 0.04 percent at 1,528.71.

May had called the snap election in a bid to strengthen her hand in Brexit negotiation, and she been expected to win a larger parliamentary majority.

"Theresa May appears to have lost her electoral gamble," wrote Karl Schamotta, director of global product and market strategy at Cambridge Global Payments, in a briefing note. "Major risks lie ahead for the pound, and for risk-sensitive assets globally."

ECB DECISION

The euro hit its lowest since May 31 against the U.S. dollar, of $1.1196 EUR= , after the ECB announcement. The dollar index, which measures the greenback against a basket of six major rivals, was last up 0.4 percent at 97.143. prices edged lower, with benchmark Brent crude and U.S. crude prices hitting respective one-month lows of $47.56 and $45.20 after an unexpected surge in U.S. inventories and the return of more Nigerian crude aggravated concerns about a worldwide glut. crude LCOc1 settled down 20 cents, or 0.42 percent, at $47.86 per barrel. U.S. crude CLc1 settled down 8 cents, or 0.17 percent, at $45.64 per barrel.

U.S. Treasury yields edged higher as investors focused +on next week's expected interest rate increase by the Federal Reserve, with benchmark 10-year yields US10YT=RR last at 2.195 percent, compared with 2.180 percent late on Wednesday. dollar's gains pushed gold prices lower. Spot gold prices XAU= were last down 0.6 percent at $1,278.50 an ounce. Reuters Live Markets blog on European and UK stock markets

reuters://realtime/verb=Open/url=http://emea1.apps.cp.extranet.thomsonreuters.biz/cms/?pageId=livemarkets

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>