Global Lithium Resources Ltd (ASX:GL1) has enjoyed further success in the second stage of ore sorting trials at its 100%-owned Manna Lithium Project, 100 kilometres east of Kalgoorlie in Western Australia.

Stage two achieved a 1.64% Li2O spodumene ore concentrate (SOC) and complements earlier trials performed on Manna pegmatite ore.

These trials show ore sorting technology can be utilised at Manna to upgrade the pegmatite ore to boost concentrate production at the Manna Processing Plant.

It can also produce a high-grade SOC product.

Stage one and stage two combined achieved a final product greater than 1.5% Li2O with an average lithia recovery of 92%.

DFS progresses

The trials are part of a wider scope of work, as GL1 progresses its definitive feasibility study (DFS) towards completion by Q1, CY24.

“Both trials have demonstrated that the Manna pegmatite ore body is highly suited to ore sorting. This work will unlock further value for the Manna Project through potential early production of a SOC product and increase spodumene production for the main concentrator,” Global Lithium project director Tony Chamberlain said.

“The high-grade SOC product will be a very attractive product for potential offtake partners. The company is nearing completion of a pre-feasibility study in relation to SOC and is in discussions with several potential partners.

“With ore sorting now being incorporated into the main flowsheet, this will enhance the economics of the project due to the expected generation of additional revenue. The Manna Lithium Project DFS is due for completion in the first quarter of CY24.”

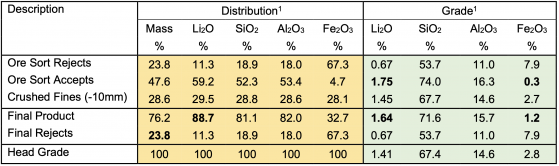

Summary of ore sorting results – high-grade ore.

Testing garners good results

The latest ore sorting test program was performed on a 700-kilogram high-grade pegmatite test sample, which was composited using 50 metres of PQ diamond drill core selected from five drill holes within the proposed Manna stage one pit.

This core included approximately 30% waste to simulate expected full-scale mining operations. The sample was crushed to –50 millimetres and screened to remove fines (-10mm), with the screened ore separated into a coarse (-50+25mm) and a mids (-25+10mm) size fraction which were then processed through the ore sorter in consecutive runs.

The trials conducted achieved a 24% increase in lithium grade, indicating strong potential for upgrading both low and high-grade ores. The tests also revealed significant iron rejection, laying the groundwork for the incorporation of ore sorting technology into the company's main processing plant.

Under controlled conditions, the ore sorting trial realised a lithium grade of 1.75% Li2O and 0.27% Fe2O3 in the ore sorter 'Accepts', up from an initial grade of 1.41% Li2O. This 24% increase in lithium grade was maintained at a high level of 1.64% Li2O when recombined with fines fractions smaller than 10 mm. The overall lithium recovery rate stood at 89%.

Simultaneously, the trial demonstrated high iron rejection, reducing the iron content from an initial 2.80% to 0.27% Fe2O3 - 90% of the contained iron - in the ore sorter feed. When recombined with fines, the resulting iron grade registered at 1.2% Fe2O3, with a total waste mass rejection of 24%.

High-grade ore being processed through the Steinert ore sorting facility.

In earlier test work, the ore sorting technology had shown its ability to upgrade low-grade pegmatite ore from 0.9% to 1.5% Li2O. The second trial proves its efficacy in producing high-grade SOC products, confirming strong customer demand for such products.

As a result of these findings, the company has elected to integrate ore sorting technology into its process flowsheet. This will increase the mill feed grade from 1.0% to 1.2% Li2O and enhance the concentrate production capacity of the main Manna Processing Plant by 20%.

GL1 will also undertake further financial and technical evaluation of the option to produce SOC for a period of up to 24 months during construction and commissioning of the Manna Processing Plant.

What’s next?

The company will start ore sorting variability test work using bulk PQ diamond drill core to establish a grade recovery curve for proposed SOC production and over life-of-mine (LOM) for the Manna Processing Plant.

Manna ore being processed through Steinert ore sorting facility.

The company has made a strategic alteration to the main process flowsheet underpinning its DFS by integrating ore sorting into the crushing circuit.

The milling circuit will continue to operate with a capacity of two million tonnes annually. However, this modification is expected to elevate the feed grade going into the concentrator, thereby leading to the production of additional spodumene concentrate.

The change aligns with GL1's trials, which demonstrated the technology's ability to upgrade ore grades, promising enhanced concentrate production and overall operational efficacy.

Read more on Proactive Investors AU