Following a comprehensive operations review, Genetic Technologies Limited (ASX:GTG, NASDAQ:GENE, OTC:GNTLF) has implemented a strategic restructure which will allow it to focus on US sales growth.

The company will move to a capital-light operations model intended to focus on sales growth in its largest market. This will see operations move to an outsourced/collaborations approach, instead of the more expensive in-house laboratory operations GTG currently uses.

The move is expected to result in an immediate material reduction in operating costs, but the company has stressed that this will not impact existing partners, distribution channels or manufacturing capabilities.

GTG has active channel partners in the USA with geneType sales growth. It also enjoys EasyDNA sales of $7 million, which continues to grow.

EasyDNA and geneType™, remain GTG’s core focus, with its work helped by a short-term $800,000 secured loan (from lenders, including directors). The company is set to launch an entitlement offer to further boost its bank balance.

Growth strategy

EasyDNA and AffinityDNA are projected to grow, with EasyDNA currently generating over $7 million globally.

The GeneType serious disease risk test platform, which has received over $50 million in R&D investment, is ready for commercialisation through both new and established US sales channels.

This platform offers unique non-invasive tests, combining genetic and clinical risk data into comprehensive reports that consider genetic predispositions and environmental factors contributing to serious diseases.

GTG’s growth strategy in the USA leverages its existing channel partners, including Stayhealthy and Wellworx, to drive B2B and B2C sales via the "Gene by Gene" high throughput lab. Results will be cloud-based and controlled by GTG, facilitating scalability and potential licensing while protecting intellectual property.

Changing board roles to drive expansion

The board of directors will assume executive roles, leveraging their extensive commercialisation expertise to drive expansion in the United States. This restructuring enables its global leadership team to concentrate on maximising opportunities in the US market. Consequently, current CEO, Simon Morriss, will transition out of the organisation in September.

As part of this transition, GTG will relocate its Melbourne laboratory and adopt an outsourced collaboration approach, with third-party contractors providing a portion of our laboratory testing. The redundancy costs associated with this transition will be covered by the loan facility.

The board members have agreed to defer their director fees until the year-end (at the earliest) and, subject to shareholder approval, to receive their director fees in equity.

The transition and associated cost reductions are projected to decrease the company's monthly cash burn from approximately A$800,000 to below A$200,000, with an annual burn anticipated to come under A$2.5 million. The company aims to achieve positive cash flow by the end of calendar year 2025 or shortly thereafter.

$800,000 loan and (up to) $3.85 million rights Issue

GTG has secured commitments for a short-term loan of $800,000. This loan is partially secured by the anticipated balance of the R&D refund due in late September. The loan includes standard terms, including events of default, and must be repaid by the earlier of the R&D refund receipt or December 31, 2024.

The loan is secured but ranks behind existing secured creditors, with an effective annual interest rate of 20%. Lenders, including board members, have committed to applying part or all of their loan entitlements to the first $500,000 under the entitlement offer.

The loan will be used for working capital and initial costs related to transitioning to a capital-light operations model.

GTG is also launching a two-for-three rights issue at 4 cents per share, with a 1:1 attaching option at the same exercise price. This aims to raise between $2 million and $3.85 million.

The entitlement offer does not require shareholder approval and is available to eligible shareholders. The board has committed to underwriting the first $500,000.

The offer price represents a 9.09% discount to the last closing price and a 13.85% discount to the 5-day VWAP. The offer is non-renounceable and non-transferable.

Around 97 million new shares may be issued, which will rank equally with existing shares. Eligible shareholders can also apply for additional securities under a top-up offer. The company has three months post-closing to place any shortfall.

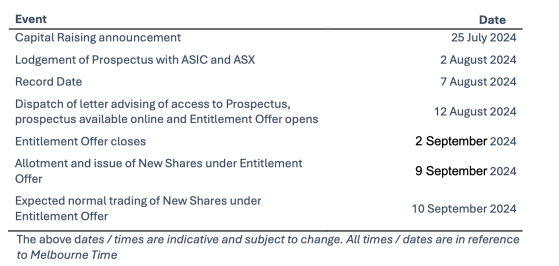

Timetable for entitlement offer

Genetic Technologies remains steadfast in its vision to lead in personalised preventative genomics, innovate in genetic testing, and expand its global presence and this change in strategy is designed to reflect that vision.

Read more on Proactive Investors AU