There’s a lot of misunderstanding – some of it wilful – around the gender pay gap.

The gender pay gap is a percentage or dollar figure that expresses the difference between the earnings of men and women, and is a way of measuring how we value their respective contributions to the economy.

But it’s a problem much more difficult to address than by applying the ‘equal pay for equal work’ argument.

Behind the numbers is a complex set of issues that reflect systemic disparities in employment roles and entire sectors, often reflecting societal norms.

Former sex discrimination commissioner Elizabeth Broderick says structural inequity related to the unequal distribution of household and caregiving responsibilities and a higher number of men in well-paying fields is a primary driver of these disparities.

These societal norms are notoriously hard to shift and government, industry and other stakeholders acknowledge there are no easy fixes.

Why should we care?

There are obvious participation and inclusion reasons why we should aim to close this gap in earnings across all industries and sectors but reducing it is also important for Australia's economic future.

Diversity of gender, along with many other markers of difference, has long been shown to contribute to the innovation and diversity of ideas that fuel a healthy economy and society.

A recent initiative from the Australian Government has shone a bright light on the extent of the gender pay gap.

It stems from nearly a decade of data collection by the Workplace Gender Equality Agency (WGEA) aimed at fostering industry-wide comparisons and encouraging companies to assess their standings within their sectors.

The work has culminated in a list that names – and in some cases, shames – companies employing more than 5 million Australians.

The government hopes that legislating the annual publication of these pay gaps will hold companies publicly accountable for their gender pay gap performance, giving stakeholders a metric to advocate for change, and encouraging companies to take accountability and improve.

Drawing from the UK's experience, where similar disclosures have led to a reduction in the gender pay gap, Australia's initiative is expected to apply both internal and public pressure on companies to address and rectify these disparities.

Who’s on the list?

The list itself reveals significant disparities at some of the country's most well-known firms and pinpoints the industries and sectors that lag in closing the gender pay gap.

The median pay gap for base salaries in companies with more than 100 employees stands at 14.5%, rising to 19% once bonuses, overtime and allowances are factored in.

This disparity is more stark at some of Australia's leading companies, with a2 Milk, Ventia, IPH and Qantas boasting the largest gaps among ASX200 entities.

The data illustrates stark differences in pay between men and women across various sectors, from aviation to banking.

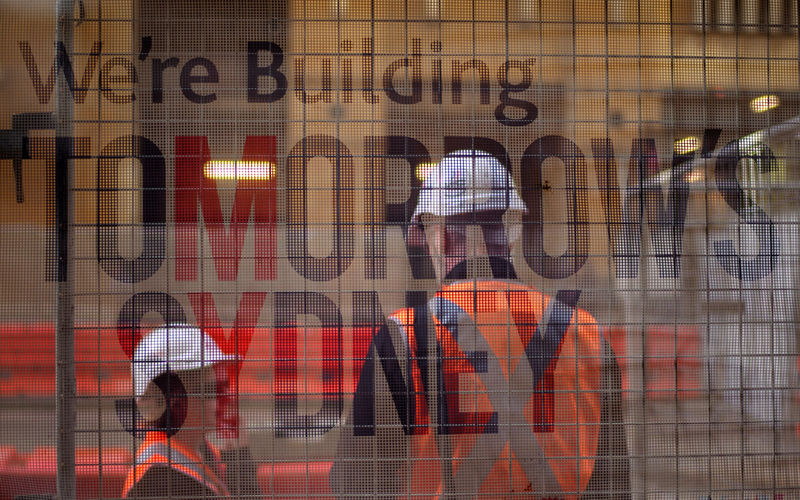

The construction industry has the highest average median total salary gap at 31.8%, with professional, scientific and technical services, and financial and insurance services trailing closely. Meanwhile, industries with a higher representation of women, such as education and healthcare, report lower average pay gaps.

Aviation fares particularly badly, with Jetstar notching up an astonishing median gender pay gap of 53.5%, with women earning 46.5 cents for every dollar earned by men. Virgin Australia (41.7%) and the aforementioned Qantas (37%) don’t fare much better.

White-collar industries such as banking, accounting and consulting predominantly employ men in their most demanding and lucrative roles, contributing to a significant gender pay gap where women earn 20% less than men.

How does mining fare?

When it comes to the mining sector, oil and gas majors are the biggest offenders when it comes to the pay gap. This is sheeted home to a higher proportion of men being in operational roles, often in remote locations, which command additional allowances and elevated salaries – and are prohibitive to women who are more likely to have carer obligations.

WGEA reported a 15.1% median pay disparity between men and women in mining for the 2022-23 period, noting this as an improvement over other industries like construction and manufacturing.

Despite this, some 20 leading resources companies in Australia, including Woodside Energy, Santos, Chevron (NYSE:CVX), Hancock Prospecting – run by a woman – and BHP (ASX:BHP) subsidiaries, surpassed the industry average in total pay gaps.

Inpex Australia emerged as the company with the most significant median total pay gap among major resource entities, with a 41% discrepancy between male and female employees' remuneration.

But low salaries for women in mining are not a foregone conclusion. Major mining firms like Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) Metals Group recorded gaps =13.5% and 14.6%, respectively – below the industry and national medians, indicating a more balanced approach towards gender pay equity.

The methodology behind these figures uses a comparison of median base pay, with some adjustments for total remuneration, which encompasses bonuses, allowances and other benefits.

Efforts to address the highlighted disparities are underway, with BHP, for example, more than doubling its female workforce since 2016 and investing substantially in pay adjustments for women.

Elsewhere companies are reducing their pay gaps by adopting various strategies such as increasing the proportion of women in management, enhancing parental leave policies and conducting audits on lower-paid roles.