Galena Mining Ltd (ASX:G1A, FRA:GM6) (ASX:G1A) (FRA:GM6) continues to progress exploration and pre-development work at the Abra Base Metals Project in Western Australia, targeting the start of construction in the first half of this year and first production in 2022.

The company recently released more broad high-grade lead-silver results in the fifth and final batch of assay results from the 2020 drilling program at Abra which are expected to support the upcoming mineral resource update.

This program had three objectives - lead-silver orebody infill, drilling into selected prospective metal-rich zones for potential life of mine plan optimisation and gold-copper exploration.

“Establishing mineable zone”

Galena managing director Alex Molyneux told Proactive's Andrew Scott that the company had completed a 57-hole drilling program for about 25,000 cumulative linear metres of drilling.

He said: “To put that in perspective, it takes Abra to about 100,000 metres of drilling overall – so 25% of all of the drilling that’s ever been done on Abra.

“The copper-gold assays that we put out are really significant because we hit copper and gold in the first hole we targeted and that copper hit was 26.9 metres at 1.4% which is a very wide intersection and within that was 8.9 metres at 2.3% copper.

“These are the kinds of thickness and grades you’re looking for if you want to establish that there’s a mineable zone down there.

“We also had more than eight holes in the silver drilling that had cumulative significant thicknesses of more than 50 metres - and we only declare something significant if it has a +5% lead grade - so all in all the drilling program did really well.”

Resource update pending

The company has retained Optiro Pty Ltd to incorporate the extensive data received from the 2020 drilling program into an independently prepared updated mineral resource estimate.

With the inclusion of the final assays into the model, an updated estimate is expected to be completed within the coming weeks, enabling the commencement of an updated mine plan.

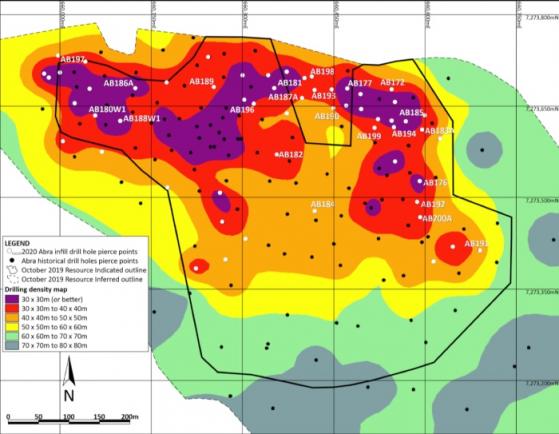

Abra Project drilling density following completion of the 2020 Abra drilling program.

Pre-construction work underway

Following finalisation of the US$110 million Taurus Debt Facilities and receipt of a further A$20 million investment tranche from Toho Zinc, construction tasks at Abra were recommenced in December 2020.

Molyneux said that project development works were now around 15% complete.

He said: “We have been doing pre-construction activities and what we might call site enabling activities which include things like constructing the mine site village, site road works, site clearing and constructing the box cut.

“Out of the overall total capex budget probably by the end of this month, we’ll be about 15% done for the whole project.

“The works that we’ve done are quite material and the main pieces of the remainder of the project are really just the construction of the plant and the commencement of the underground mining.”

Galena continues to target the commencement of the procurement/construction phase of Abra’s plant and deployment of the underground mining contractor in the first half of 2021.

Funding agreements

Molyneux said: “In November we signed a debt facilities agreement with Taurus Funds Management for the provision of US$110 million worth of debt.

“That facility is broken into two parts, the first piece of that facility is unconditional and a US$70 million piece of that facility has a condition that we complete our infill drilling – which we did.

“We now need to complete a resource update and put that through the model and as long as the model shows we’re in compliance with their financial covenants – then the whole facility becomes unconditional.

“Together with the Taurus facility, we’ve also got our cash resources ($30 million cash in bank as at the end of December), we also have another $40 million of investment tranche coming from Toho Zinc of Japan.”

Targeting first production in 2022

The feasibility study for the project envisages the development of an underground mine and conventional flotation concentration processing facility with a 16-year life producing a high-value, high-grade lead-silver concentrate containing around 95,000 tonnes of lead and 805,000 ounces of silver per year after ramp-up.

Molyneux said: “We’ve got the funding in place and the resource announcement will be really interesting because shareholders can see if we’re on track to release the rest of the facility.”

The company will then progress the final investment decision which will allow it to move forward with the plant and the underground mine construction.

Based on the current schedule, first production of high-value, high-grade lead silver concentrate at the Abra project will commence in 2022.

Read more on Proactive Investors AU