The ASX fell sharply to 7,161 points in morning trading today as the sell-off continued but rallied throughout the afternoon to finish just 0.46% or 33.00 points down at 7,201.70, crossing below its 50-day moving average.

Weaker-than-expected wage growth data (0.8% quarter-on-quarter rather than 0.9%) still broke records for annual wage growth rates, hitting 3.7% and surpassing the expected 3.6%.

While this historically represents strong growth for the Australian wage sector, it comes nowhere close to inflation levels, meaning it’s unlikely to push the RBA toward another rate hike next month, although the central bank has been very difficult to predict recently.

Sectors were mostly down bar Information Technology (+1.03%), Utilities (+0.34%) and a small bump for Communication Services (+0.11%).

Materials (-0.87%), Consumer Staples (-0.55%) and Financials (-0.57%) took the biggest hits, with commodities also in the red across the board.

Not a single mineral escaped the drop, but tin (-2.36%) and copper (-2.02%) fell the most, while nickel (-0.36%) and platinum (-0.23%) lost the least.

In the news today

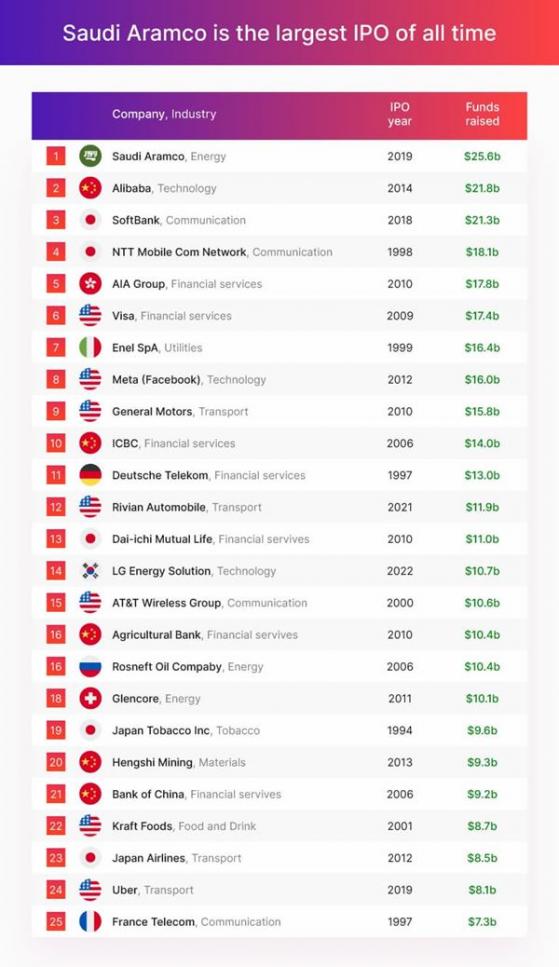

Top 25 biggest IPOs of all time

Initial public offerings or IPOs enjoyed a particularly good run on the market in 2021. Global IPO markets delivered 2,682 IPOs in that year.

The largest IPO globally in 2021 was the $13.7 billion IPO of Rivian Automotive on the Nadaq, an American electric vehicle automaker.

The IPO market has since turned the other way as global inflation, financial uncertainty and bearish markets weigh on investment sentiment.

Research by City Index has revealed the biggest IPOs of all time, offering a look back at the most successful listings globally, and giving us something to aim for as the markets begin to show signs of recovery.

Rivian Automotive’s 2021 IPO comes in at number 12 on the list, just missing out on a top-10 placement.

Communication, Technology and Financial Services make up the large majority of highly successful IPOs on this list, followed by Transport (including automotive) companies and Energy.

Some more recent IPOs have had particularly successful trajectories since listing, with a more than 300% gain to the companies’ stock prices:

In fact, following Prometheus’ lead, biotech and health-related companies have made a good run of it in recent years, topping the chart for gains since initial listing:

While past performance certainly doesn’t guarantee future gains, it’s a good reminder to seek out value stocks that won’t petre out quickly after making a big splash on initial offering.

The Five at Five

International Graphite stakes claim on site for battery anode material manufacturing plant near Collie, WA

In an important step forward for its planned integrated graphite value chain, International Graphite Ltd (ASX:IG6) has selected a site just 5 kilometres northeast of Collie, Western Australia, for a proposed battery anode material manufacturing plant.

Read more

Toubani Resources strikes gold in never-before drilled target next to Kobada Main; shares jump

Toubani Resources Inc (ASX:TRE, OTC:AGGFF) has made a new shallow gold discovery at a never-before drilled target right next door to Kobada Main deposit within the 3.1-million-ounce Kobada Project in southern Mali.

Read more

Elixir Energy eligible for R&D tax credit at Daydream-2 appraisal well in Grandis Gas Project

Elixir Energy Ltd (ASX:EXR) has received an advanced finding that the Daydream-2 appraisal well planned for later this year at the 100%-owned Grandis Gas Project in Queensland is eligible for R&D tax credits.

Read more

Queensland Pacific Metals lands $80 million in initial debt funding to secure gas for TECH Project

Queensland Pacific Metals Ltd (ASX:QPM) business QPM Energy (QPME) has concluded a commercial agreement with Incitec Pivot Ltd (ASX:IPL) to facilitate the completion of the Moranbah Project acquisition and fast-track gas production growth.

Read more

Strickland Metals hits 4.3 metres at 27% zinc at Iroquois Base Metals Project ahead of demerger

The Iroquois Zinc-Lead Project of Strickland Metals Ltd (ASX:STK) in the Earaheedy Basin of WA has yielded ‘fantastic’ results in recent diamond drilling, including 4.3 metres at 27% zinc

Read more

Read more on Proactive Investors AU