The ASX was higher today. The S&P/ASX200 gained 25.40 points or 0.35% to 7,336.50. Over the last five days, the index is virtually unchanged but is currently 3.06% below its 52-week high.

The top-performing stocks in this index were InvoCare Ltd and Coronado Global Resources Ltd, up 5.94% and 4.81% respectively.

InvoCare was nearly 6% higher today, following a 1.8 billion takeover bid from TPG Capital.

The funeral provider's board urged shareholders to back the revised bid, which TPG has cut from $13 to $12.70 cash a share, saying it still represents a “significant premium”.

TPG is InvoCare’s biggest shareholder. It indicated it was lowering its offer after finalising its due diligence.

The cash consideration represents an implied equity value of $1.8 billion.

“The transaction represents a significant premium of 42% to InvoCare’s undisturbed closing share price,” InvoCare chairman Bart Vogel said.

He added that it implied a transaction multiple of 18 times last year’s earnings."

Looking at the sectors, Financials was the best performed at 1.25% higher, while Communication Services was 0.84% higher. Health Care and Real Estate were the biggest losers down 0.95% and 0.68% respectively.

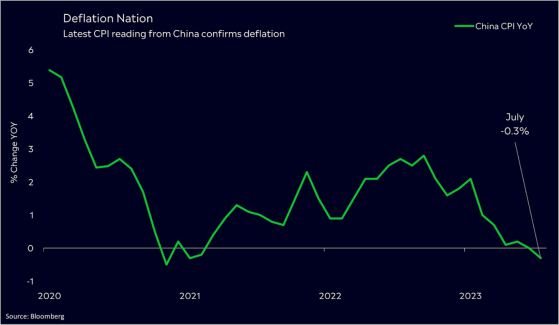

China deflated

China's monthly CPI data has confirmed the country is now in a period of deflation.

CPI fell 0.3% on-year versus a 0.4% fall expected.

Here’s eToro analyst Josh Gilbert’s take.

"China’s economy showed further signs of weakening today as consumer and producer prices declined in July. The region is now experiencing deflation, with subdued consumer spending, a property slump, and falling demand.

“This reading, alongside yesterday’s trade data, puts more pressure on the PBOC to stimulate the economy. The silver lining to this bad news is that this might be enough to prompt a response from policymakers in China. More meaningful support is key for keeping China on track for its 5% growth this year.

“The worry for investors is that the effect of deflation in the world's second-largest economy has global repercussions. Close to home, Australian miners could see some hardship if a period of deflation prolongs, given it would drive China’s demand for raw materials down, amongst other areas such as energy and even Australian-grown produce.

“A rebound in inflation is expected to occur next month, but the current CPI reading is far from the target rate of 3% and will only weigh on China’s economic struggles of late."

Five at five

The S&P/ASX Small Ordinaries (XSO) was down 0.19% on a slow news day.

Highfield Resources’ Muga Potash Mine: ESG credentials make it a mine at the forefront of sustainability

Highfield Resources Ltd (ASX:HFR) recently completed the preliminary works for the construction of the Muga Mine in Aragón, Spain with zero accidents and zero environmental incidents.

Read more

Immuron receives TGA GMP Clearance in Australia for packaging supplier

Immuron Ltd (NASDAQ:IMRN, ASX:IMC) has received Therapeutic Goods Administration (TGA) GMP Clearance for its packaging supplier allowing Travelan® to be released for sale in Australia to retail pharmacy wholesalers and other customers.

Read more

CuFe welcomes high-grade gold, manganese and base metal results from Morck Well investment

CuFe Ltd (ASX:CUF) is buoyed by strong gold and base metals drilling results returned by Auris Minerals Ltd (ASX:AUR) at the Morck Well Project in Western Australia, which enhance the company’s 20% interest in the project.

Read more

Anteris Technologies' DurAVR™ transcatheter heart valve shows “excellent outcomes” in US study

Anteris Technologies Ltd (ASX:AVR, OTC:AMEUF) is making strides towards obtaining United States Food and Drug Administration (FDA) approval for its flagship DurAVR™ transcatheter heart valve (THV) after positively treating patients as part of an early feasibility study (EFS) on the device.

Read more

AuTECO Minerals finds high-grade gold up to 73.6 g/t in rock chips at Canada’s Sioux Lookout

AuTECO Minerals Ltd (ASX:AUT, OTC:MNXMF) may literally be sitting on a gold mine following the discovery of high-grade gold up to 73.6 g/t close to the surface at its Sioux Lookout property in Ontario, Canada.

Read more

On your six

What are cyclical stocks, why have they outperformed recently and is it time to pivot?

Cyclical stocks often mirror the performance of the broader economy. Historically, these shares have prospered during economic highs but have faced devaluations during downturns.

Read more

The one to watch

Novo Resources lodges prospectus for ASX dual-listing

Novo Resources Corp (TSX:NVO, OTCQX:NSRPF) co-chairman and acting CEO Mike Spreadborough speaks with Proactive after the company lodged its prospectus to dual-list on the ASX.

Watch

Read more on Proactive Investors AU