The ASX rallied today, hitting a nine-month high on solid unemployment numbers.

The S&P/ASX200 gained 44.20 points or 0.60% to 7,437.60, setting a new 100-day high. The top-performing stocks were Nanosonics Ltd and Viva Energy Group Ltd, up 7.17% and 4.56% respectively.

Over the last five days, the index has gained 2.16% and is currently 2.46% off of its 52-week high.

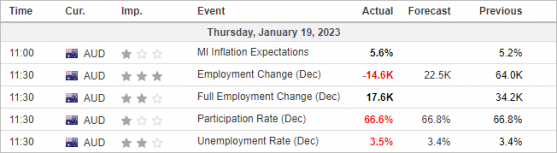

Unemployment held steady at 3.5% leading Federal Treasurer Jim Chalmers to say the Australian economy is in a “position of genuine strength" despite continuing global uncertainty.

We've created around 212,000 jobs under the life of this relatively new Albanese Labor government and that puts us in good stead," he said.

"I think that means we are in relatively good nick as we enter what might be a difficult year in the global economy in 2023.”

As a caveat, Chalmers did warn the economy was likely to soften as the impact of a global downturn made its presence felt.

Overall, Australia's December labour force data is weaker than expected.

"The falls in employment and hours worked in December followed strong growth through 2022, with an annual employment growth rate of 3.4% and hours worked increasing by 3.2%," the ABS says.

"The strong employment growth through 2022, along with high participation and low unemployment, continues to reflect a tight labour market."

In the news

Unemployment rate steady, but won’t stop rate hikes

Australia's unemployment rate is likely to rise to 3.9% by the end of the year – higher than the 3.7% forecast by the RBA.

It is expected to hit 4.5% by 2024, according to Moody's Analytics economists.

Economists said the Reserve Bank of Australia (RBA)’s rate hikes were now taking effect and we would see another rise in February when the RBA meets for the first time in 2023.

"The combination of higher borrowing costs, elevated inflation and very weak consumer confidence will make it harder for the labour market to outrun its challenges," Moody's Analytics economist Harry Murphy Cruise said.

"Forward indicators are showing glimpses of what is to come; new job ads are going backwards, while vacancies have been trending lower since the middle of 2022.”

Economists at Betashares (ASX:BBUS) say rate hikes remain inevitable despite today’s data.

"The slowing in employment, however, is consistent with the 4.9% decline in officially recorded job vacancies over the three months to end-November. Business surveys in general, however, still suggest firm underlying labour demand," Betashares chief economist David Bassanese said.

"It’s conceivable that some signs of slowing in employment demand – and weaker jobs growth – could reflect the growing difficulty in finding suitable staff. That said, with immigration now ramping up again, pockets of extreme labour shortage could start to ease, which could underpin economic growth though potentially limit further upside in wage growth."

Employment miss adds to the Aussie's woes

City Index senior market analyst Matt Simpson has his take on the employment figures.

Finally - an interesting employment report arrives for Australia, which could be good for traders but less so for the economy. We have three ‘misses’ with employment change and the participation rate below expectations and the unemployment rate above.

The standout figure is employment falling -14.6k, which is its worst since July and below its 3 and 12-month averages of 38.1k and 31.1k respectively. It’s unlikely to derail the RBA from another 25bp hike in February (especially with inflation continuing to rise) but the RBA will keep a close eye on employment change and unemployment to see if it is the beginning of a trend.

For now, the weak lead from Wall Street - which toppled commodity FX overnight – today’s employment figures are another reason to sell the Aussie, following its rally of the past three months.

Five at five

Provaris Energy MoU with Norwegian Hydrogen likely to result in European offtake deal for H2Neo carrier: Edison

Provaris Energy Ltd (ASX:PV1)’s recently announced collaboration with Norwegian Hydrogen AS may result in the company signing an offtake agreement that will see its H2Neo green hydrogen (GH2) carrier set sail on its maiden voyage in Europe in 2027, according to Edison Investment Research Ltd.

Read more

QMines takes to the skies for EM survey at Mt Chalmers Copper-Gold Project

QMines Ltd (ASX:QML) has begun an airborne VTEM Max electromagnetic (EM) survey at its flagship Mt Chalmers Copper-Gold Project, 17 kilometres northeast of Rockhampton in central Queensland.

Read more

Flynn Gold strikes visible gold in new zones at Trafalgar Prospect in Tasmania

Flynn Gold Ltd (ASX:FG1) has expanded the Trafalgar Prospect at the 100%-owned Golden Ridge Project in northeast Tasmania with visible gold revealed in new zones during diamond drilling.

Read more

Chimeric Therapeutics doses first patient in Phase 1B colorectal and blood cancer trial

Chimeric Therapeutics Ltd (ASX:CHM) has dosed the first patient in its Phase 1B CHM 0201 + Vactosertib clinical trial.

Read more

Frontier Energy embarks on sustainability journey with new ESG initiatives

Frontier Energy Ltd (ASX:FHE) has set a series of sustainability and environmental, social and governance (ESG) initiatives in motion, laying the foundation to develop its green hydrogen project.

Read more

On your six

2023 health outlook: cautiously optimistic about a rebound

The health sector, like the rest of the market, took a battering in 2022, but experts say there’s reason to feel positive about its prospects in 2023.

Read more

The one to watch

Vulcan Energy (ASX:VUL) Resources deepening ties with Stellantis

Vulcan Energy Resources Ltd (ASX:VUL, OTC:VULNF, ETR:VUL) CEO Francis Wedin speaks to Proactive's Thomas Warner after concluding the company's third agreement with leading global automaker Stellantis.

Watch

Read more on Proactive Investors AU