The ASX crept into the red today, almost managing a positive showing and only losing 3.70 points, less than 0.1% to 7,125.90.

Overall, the index has gained 0.49% for the last five days and 1.24% for the year to date.

The sectors were a mixed bag, with Real Estate (-0.42%), Energy (-0.66%) and Financials (-0.49%) slipping as Consumer Discretionary came out on top, up 0.90% alongside Info Tech (+0.72%) and Utilities (+0.53%).

Commodities followed suit, mostly flat with stand-out gains from zinc (+1.33%) and losses for aluminium (-1.60%) and West Texas Crude (-0.64%).

The worst performing stocks were Beach Energy (ASX:BPT) Limited, down 7.39%, and Incitec Pivot Limited, down 4.92%.

AUD/USD spikes higher

City Index senior analyst Matt Simpson breaks down the Reserve Bank’s latest interest rate hikes and examines its effect on the AUD-USD exchange rate.

“The RBA decided to pull the trigger once more and hiked their cash rate by another 25bp to a 13-year high of 4.1%,” Simpson said.

“Once again, cash rate futures and the majority of economists seemed to underestimate the potential for a hike, although were arguably caught less off guard than they were in May.

“If May's decision to hike was ‘finely balanced’, then today’s hike should have been a no-brainer given their monthly inflation gauge ripped higher and around a quarter of Australia’s workforce is about to receive a bumper pay rise.

“And with inflation now back at 6.8% y/y, we’re sure some ‘further tightening’ will indeed be required, as mentioned in today’s statement.

“I doubt this will force the BOC to hike this week, although their economic data is also heating up to potentially justify one further down the track.

“But with the Fed in pause mode and possibly at or near their terminal rate, AUD/USD could appear oversold to many.

“And we’ve already seen buyers pile into the Australian dollar and push AUD/USD a 3-week high and send AUD/JPY briefly to a fresh YTD high.

“The hike has seen the ASX 200 unwind all of yesterday’s gains to fall back below 7,200, as equity investors come around to the reality that the peak rate may not be as close as originally hoped (and cuts are even further back into the future).

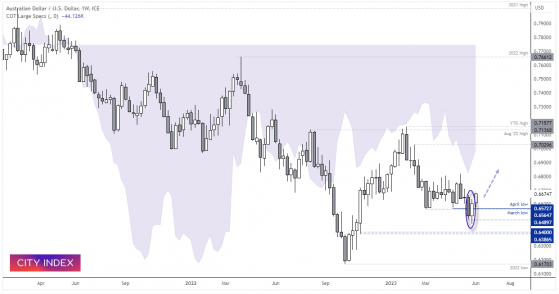

AUD/USD weekly chart:

“If we compare price action on the weekly chart to positioning of large speculators since they reverted to net-short exposure, it could be argued that prices are lower than they should be.

“And that could be due to expectations that the RBA was done with hiking and could begin cutting rates sooner than some other central banks.

“But the RBA seem to have run with a ‘last in, last out’ approach to their monetary policy which leaves them susceptible to hiking later relative to the early birds who hiked sooner.

“As for price action, the decline from the YTD high has come in third waves.

“Whilst it is too soon to confirm if a corrective low has been seen, a two-bar bullish reversal pattern formed (a bullish piercing line) to suggest a swing low may have formed over the near term.

AUD/USD daily:

“AUD/USD spiked higher following the rate increase, rising almost immediately to the upper target outlined in this morning's reports around the daily R1 pivot and upper average daily range band.

“Given prices have failed to push higher, I suspect a pullback could be due.

“The VPOC cluster around 0.6550 is the first area I would look for potential support, as it could allow bulls a cheeky swing trade as we head towards/beyond the European open (as those traders are yet to react to the RBA’s decision).

“But with price action around London’s open being notoriously fickle, we’d also consider bullish setups within today’s daily range should it produce a deeper pullback.

“But overall, a strong bullish trend is now developing on the daily chart, and it could favour dips given the RBA’s hawkish hike.”

Five at Five

MetalsGrove Mining soars on confirming magnetic and heavy rare earth anomaly at Bruce prospect, Arunta Project

MetalsGrove Mining Ltd (ASX:MGA) has soared on identifying high-value magnetic and heavy rare earth elements (REE) at Bruce prospect within the Arunta Project in the Northern Territory, with outcropping carbonatite and high-grade REE mineralisation now extending over 9 kilometres of strike.

Read more

Latin Resources poised to upgrade Colina lithium deposit resource; system remains open

With major resource definition drilling complete at the Colina Lithium deposit in Brazil, Latin Resources Ltd (ASX:LRS, OTC:LRSRF) is targeting a mineral resource estimate (MRE) upgrade for this month, seeking to grow the contained lithium within the Salinas Project.

Read more

Andromeda Metals signs binding offtake agreement for kaolin products

Andromeda Metals Ltd (ASX:ADN) will supply high-quality kaolin products to China's Foshan Gaoming Xing-Yuan Machinery Co. Ltd.

The companies have signed a binding term sheet which will see ADN supply products from the Great White Project (GWP) during the first five years of production into China.

Read more

Krakatoa Resources returns to the field for Mt Clere and Tower rare earths exploration

Krakatoa Resources Ltd (ASX:KTA) has taken the magnifying glass to rare earth targets across its Mt Clere property in WA’s Yilgarn Craton.

Read more

Aruma Resources attracts new subscriptions for exploration-focused placement

Aruma Resources Ltd (ASX:AAJ) has welcomed further monetary support for its A$2.25 million placement, designed to accelerate fieldwork across its core Saltwater, Mt Deans and Salmon Gums assets in WA.

Read more

On your six

Apple (NASDAQ:AAPL) heralds “new era of computing” on unveiling $5,000 AR headset

Almost a decade after the Apple Watch made its debut, Apple has launched another ground-breaking hardware offering, the Apple Vision Pro - an augmented reality headset which is ushering in a new era for spatial computing.

Read more

One to watch

Discovery Alaska pulls the trigger on new Quebec lithium project

Discovery Alaska Ltd (ASX:DAF) director Jerko Zuvela tells Proactive the company has executed a formal option agreement with 1Minerals Corp to acquire the Mia Adjacent Lithium Project in Quebec.

Watch more

Read more on Proactive Investors AU