It was a mixed day for the ASX today.

The S&P ASX 200 was higher by 0.59%, however the underlying sectors were actually mixed.

Three sectors were higher and eight were lower, with Materials the market leader, rallying by 2.50%. Real Estate was the next best performer up 1.42%. Communication Services was the worst performed losing 1.20% for the day.

Top-performing stocks in this index were St Barbara Ltd (ASX:SBM) up 13.00% and Regis Resources Ltd (ASX:RRL) up 12.50%.

In the news today

Consumer confidence dips

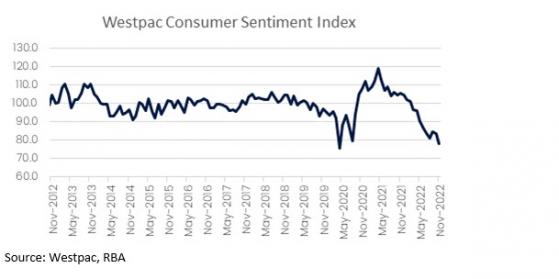

Westpac Banking (ASX:WBC) Corp and National Australia Bank Ltd released their Consumer Confidence and Business Conditions data yesterday, with confidence finally starting to turn down.

CreditorWatch chief economist Anneke Thompson spoke on the matter.

“Yesterday’s release of Westpac’s Consumer Confidence and NAB’s Business Conditions survey gave us the clearest signs yet that interest rate rises and inflation are really about to start impacting the performance of the Australian economy.

“Consumer confidence was down 6.9% month on month and 25.9% year on year. This is at levels similar to the onset of the GFC and pandemic.

“The Treasurer’s fairly bleak assessment of the economy in the October Budget report, as well as continued strong inflation and rising interest rates, are now firmly on the minds of Australian consumers.

"The weakening outlook is also finally resonating with Australian businesses, as Business Confidence reported in NAB’s October survey fell to below the long run average.

“While Capacity Utilisation is still very high (85.8) – and this bears a strong correlation to the unemployment rate – forward orders by businesses have weakened by 7 points and the employment outlook also weakened. This suggests that we can expect the labour market to weaken as fewer jobs are made available.

“Overall, it is expected that the Christmas shopping period is likely to be weaker, as consumers both have less money to spend, and feel less wealthy thanks to falling house values.

"It may be difficult to see this impact immediately as retail sales may hold up in dollar value, due to rising costs of goods. But it is highly likely that the quantity of retail sold will be subdued, and this will impact retailer profitability.

What will curb consumer spending?

With Christmas approaching along with the strongest period of consumer spending of the year and the most profitable one for retailers, Ben Laidler, global markets strategist at eToro, looks at what will test consumer spending this year.

TEST: We are entering the strongest period of consumer spending of the year and the most profitable one for retailers, but this year is a big test. Consumers have been spending down pandemic savings, inflation is high and has turned real wage growth negative, whilst stock market and housing wealth effects’ have plunged. The one big support is generational low unemployment. The likely result is a near halving of estimated spending growth versus last year, but to still healthy levels. The consumer drives 70% of the US economy and is the biggest anchor for global growth. Discretionary stocks have been some of the weakest this year.

ANCHOR: Christmas spending is expected to pull back from last year’s record 13.5% growth to between 6-8% this year (see chart) according to US National Retail Federation. This would still be above the long-term average 4.9% Christmas growth rate, as savings and especially credit are used to bolster spending. Investors have already voted with their feet, with consumer discretionary stocks and themes among the worst performing this year. This gives room for some upside relief to a better spending season.

TRENDS: Consumer spending trends have been changing significantly, shifting away from goods and towards services, while downtrading to cheaper goods and formats. Discount retailers now rank ahead of department stores in Christmas spending popularity. Online spending is seen outperforming again, growing 10-12%. This year 50% of retailers have restocked earlier, given supply chain concerns and the forecasts that shoppers would start earlier to spread budget pressures.

Comment on US mid-terms and what that does for markets

With US mid-terms and the associated circus fast approaching, here’s what head of Global Asset Allocation at Janus Henderson Investors, Ash Alankar, had to say about the matter.

“Similar to the betting markets, the option markets are also pricing in a Republican mid-term win. According to the graph below, the attractiveness of stocks expected to do well under a Republican win look much more attractive than a set of stocks expected to do well under a Democratic win.

“On one end, the reduced likelihood of corporate and personal and capital gain tax increases, that come with a Republican win, will be a tail-wind for all equities and the reduced likelihood of tighter government regulation will certainly benefit industries like financial, healthcare and energy.

“However, on the other end, the prospects of no tax increases and extension of Trump’s tax cuts all potentially are inflationary as the private sector has more disposable after tax income.

“Though fiscal frugality of the GOP can offset such inflationary pressures and with a split government that comes with a Republican win, large spending packages are unlikely to materialize, which will help mute price increases.

“Ricardian equivalence of an extension of low taxes leading to less government spending suggests zero-sum impact on growth, but history does indicate private sector spending is more productive than public sector spending.

“So cumulative, a Republican win will in generally be positive for equities but inflationary risk is unlikely to be mitigated nor accelerated. And hence inflation risk is still the key risk in the system.”

Five at five

Talon Energy delivers "game-changing" maiden gross unrisked 2C Contingent Gas Resource of ~1.2 TCF at Gurvantes in Mongolia

Talon Energy Ltd (ASX:TPD) has delivered what it describes as outstanding results within nine months of the commencement of the stage 1 exploration program, demonstrating the world-class nature of the Gurvantes Project.

Read more

Tamboran Resources completes acquisition of Origin Energy gas assets in Beetaloo Basin

Tamboran Resources Ltd (ASX:TBN) “now holds the largest consolidated position in the deepest section of the Beetaloo Basin,” said MD and CEO Joel Riddle.

Read more

Frontier Energy welcomes Smart Energy Council’s pre-certification of 'green' hydrogen at Bristol Springs

“To have this certification in place from a world leader in zero-carbon certification, the Smart Energy Council, will give our partners, shareholders and prospective green hydrogen customers confidence that our project will be 100% clean and made from 100% renewable energy," Frontier Energy Ltd (ASX:FHE) MD Sam Lee Mohan said.

Read more

NickelSearch delivers ‘exceptional’ metallurgical test results at Carlingup Nickel Project

NickelSearch Ltd (ASX:NIS) remains focused on greenfield exploration for high-grade nickel sulphides, with a major exploration program underway this quarter.

Read more

Infinity Lithium’s San Jose Project to benefit from MoU linked to renewable energy opportunities

The MoU, signed by Infinity Lithium Corporation Ltd (ASX:INF)’s subsidiary Extremadura New Energies, will enhance San José’s potential to take advantage of the renewable energy opportunities in Extremadura.

Read more

On your six

FY23 capital drain continues as only $3.2 billion is raised in October

It sounds like a lot, but it represents a 84% fall year-on-year.

Read more

The one to watch

Artrya says UK regulatory approval for Salix Coronary Anatomy product is landmark development

Artrya Ltd (ASX:AYA) managing director John Barrington chats with Andrew Scott from Proactive about receiving regulatory approval for Salix Coronary Anatomy (SCA) product in the United Kingdom. Barrington discusses the size of this opportunity in the UK as well as growth potential in Europe.

Watch

Read more on Proactive Investors AU