FireFly Metals Ltd has earned a potential A$1.04 per share valuation from its current price of A$0.55 from Argonaut Securities on the back of its Green Bay Copper-Gold Project in Newfoundland, Canada.

The bullish outlook, coupled with a 'Speculative Buy' recommendation, hinges on the successful expansion of FFM's recent acquisition of the Green Bay project, previously operated by defunct Rambler Metals & Mining Plc.

With the company’s focus now firmly shifted away from the Pickle Crow Gold Project, FFM aims to transform Green Bay into a significantly larger copper and gold producer, according to a report by Argonaut.

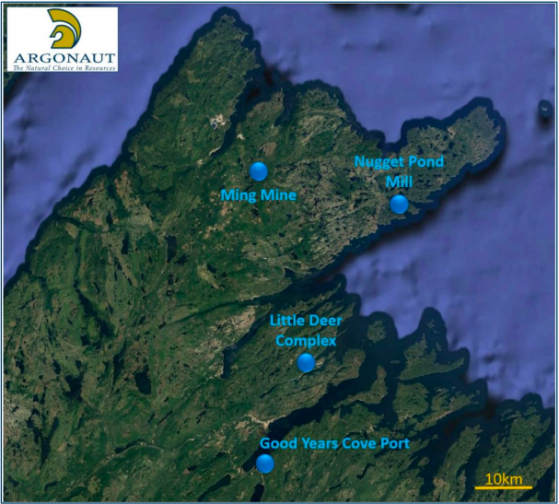

Overview of Green Bay Project.

Ambitious plan

The key to this vision lies in redeveloping the suspended Ming Mine, a past producer boasting developed infrastructure and significant resources.

Argonaut envisions improved underground access, a new 3 million tonnes per annum milling and flotation plant, and optimised mining methods to extract the project's potential.

The research firm’s scenario paints an operation churning out 46,000 tonnes of copper, 23,000 ounces of gold and 144,000 ounces of silver annually over a 14-year period at an All-in Sustaining Cost (AISC) of US$1.77 per pound copper.

Equity and debt funding

Argonaut estimates US$300 million for capital costs, including upgrading underground access and building a new processing plant.

It expects this to be funded using a mix of equity and debt financing.

Using a US$8,000 per tonne copper price, the research firm estimates a Build Date NPV8 of $739 million for the Green Bay project, equivalent to $2.05 per share of FFM’s currently listed capital.

This outlook is, however, dependent upon exploration success and resource expansion.

Promising outlook

“FFM’s Green Bay shows promise for an upscaled mine with a 46,000 tonnes per annum copper production profile,” the report said.

“Resource expansion during the next 18-24 months will be key to underpinning future studies.”

Photos of the Ming Mine portal, ground conditions, development drive and high-grade ore face.

Following are extracts from the report:

Argonaut Green Bay development scenario

Argonaut has modelled a Green Bay development strategy incorporating ore from an expanded Ming Mine and processing via an adjacent, purpose-built, 3Mtpa capacity milling and flotation plant.

While it is possible FFM identified open pit mineable resources, for the moment we focus exclusively upon underground potential. We assume a 24-month build period with construction starting in July 2026.

Under our chosen parameters, our model generates a Green Bay Build Date Post-Tax NPV8 of $739 million ($2.05ps) and Present-Day Post-Tax NPV8 of $552 million ($1.53ps).

Under the same conditions, our Build Date and Present-Day Pre-Tax NPV8 estimates are $1.49 billion and $1.16 billion respectively.

We estimate US$300 million in initial capital requirements, with payback within three years.

Argonaut’s diluted Ming mining inventory of 40 million tonnes grading 1.65% copper, 0.35% gold and 2.5 g/t silver assumes significant exploration success over the next 18 months.

At a nominal 3 million tonnes per annum process rate, we modelled a 14-year mine life.

Our financial model utilises a flat US$8,000 per tonne copper price, US$1,800 per ounce gold and US$20 per ounce silver price.

We model project costs in US dollars and apply a flat 0.70x AUD-USD exchange rate for reporting in Australian Dollars.

We estimate an initial capital requirement of US$40 million for improvement of mine infrastructure. This would include widening of the existing near-surface narrow decline to a standard 5m x 5m and improvement to the shaft as necessary.

The combined shaft and decline entry points should provide sufficient capacity for 3 million tonnes per annum extraction.

Otherwise, a second shaft to deeper reaches may be required in the future.

Our model assumes US$150 million for construction of the new process plant with mill and flotation circuits.

Our plant capital figure is an extrapolation made from other recent base metal studies in North America and Australia.

Previous owners Rambler completed pilot ore sorting test work that achieved >95% copper recovery with 20% mass reduction from lower grade (1.25% copper) sourced from the LFZ.

Implementation of this technology could benefit both capital and operating costs.

We provide US$10 million for a small surface tailings storage facility and US$100 million for other costs (paste plant, ventilation upgrades, electricity upgrades, surface works etc).

Our operating costs are based upon current and proposed operations of similar scale.

We expect mining will be carried out predominantly by transverse long hole open stoping with voids filled with paste tailings.

We also budget for a small surface tailings facility if required.

Utilisation of existing underground workings will reduce incremental sustaining development costs.

Operating costs benefit from a low electricity cost of ~7.4c per kwh. This low power cost could be further leveraged through utilisation of electric vehicles in the mine environment.

Green Bay is subject to no royalties at this time.

Our corporate-level model assumes project funding via a 50:50 debt-to-equity split.

Our steady-stage production model produces 46,000 tonnes of copper per annum at an AISC of about US$1.68 per pound copper net by-product credits.

Read more on Proactive Investors AU