The past two years haven’t played out too well for gold mining companies writes Brian Chu, founder of The Australian Gold Fund and editor of The Australian Gold report.

Even with gold steadily rising, mining companies haven’t enjoyed the same gains as gold. All investors got was a series of false rallies.

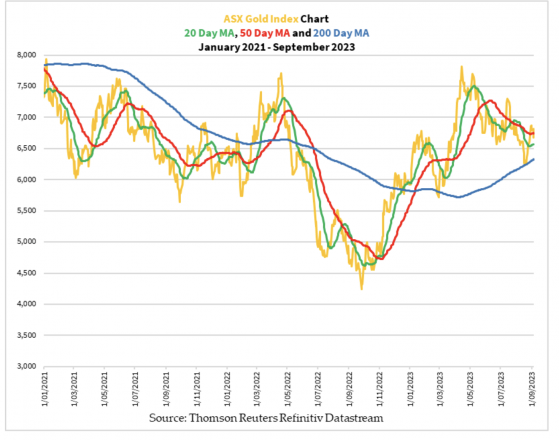

Let me show you the recent performance of the ASX Gold Index [ASX:XGD] in the figure below:

Source: Thomson Reuters Refinitiv Datastream

For the past two years, traders turned a quick profit by buying into the weakness and selling into the false rallies. Long-term investors had mixed success trying to profit from holding the larger producers. That wasn’t so much the case for smaller producers and not at all for the explorers.

Given such conditions, ignoring gold stocks is easy.

But something interesting is playing out right now. As you can see in the figure above, the index bounced off the 200-day moving average on August 21 and looks to be gaining momentum.

Whether this will gain traction remains to be seen.

If this gains traction, it might be the payday that the buy-and-hold investors are waiting for.

While many use prices to gauge how mining companies are performing, it doesn’t reflect what’s happening on the ground and in boardrooms. No, they’re buzzing with activity.

Add to that the monumental collapse of the Evergrande (HK:3333) Group. This could cause an abrupt reversal to the current high-interest rate environment. It could also cause gold to snap upwards or at least fly to safety into mankind’s longest-surviving safe haven asset.

Could that change the game for gold and gold stocks? Possibly!

Tough conditions now, but change can come quickly

You might ask what’s been holding gold down despite a weak global economy and persistent inflation.

Let’s explore this quickly.

The US long-term real yield is now at levels not seen since 2010 as headline inflation has slowed down. This places short-term pressure on the price of gold, as you can see below:

Source: US Treasury, Thomson Reuters Refinitiv Datastream

Since August, the price of oil rose, causing inflation to accelerate once more. This will also affect the profitability of mining companies because their equipment and vehicles consume a lot of diesel.

To gauge the short-term profitability of gold producers, I use the gold-oil ratio, which measures the number of barrels of oil that an ounce of gold buys. It’s worked well for me.

As you can see in the figure below, that’s also been falling recently:

Source: Thomson Reuters Refinitiv Datastream

So far, it doesn’t look like I’m making a good case for gold.

But the insiders see otherwise — and have acted. And I’m inclined to follow them to increase my chances of reaping big rewards in the future.

So, what’s going on inside the boardroom and on the ground?

Cashed up companies on the hunt…and why there are more deals to come

There’s been a flurry of consolidations lately in the gold mining industry.

- Newmont Corporation acquiring Newcrest Mining.

- Ramelius Resources snapping up Breaker Resources and Musgrave Minerals Ltd (ASX:MGV, OTC:MGVMF).

- Genesis Minerals buying the Leonora operations from St Barbara.

- And several mergers among the smaller players.

Many mid-tier (150,000–500,000 ounces of gold produced annually) and junior producers (50,000–150,000 ounces annually) have recently run down their resources and reserves, so they need to replenish them to extend their mine life.

Even the larger players are on the lookout, especially if their operations contain large processing plants that crunch over 5 million tonnes of ore a year.

The problems of depleting resources and insufficient ore to feed hungry mills have become urgent, given that the lockdowns and border restrictions stifled exploration and development.

As a result, mining companies are now trying to make up for lost time by acquiring a company or mine property, especially if they’re deeply discounted.

Plus, the global average grade of gold beneath the ground has fallen over time. However, production costs have sharply risen since 2021 for reasons already mentioned.

My internal research showed that the average all-in-sustaining cost (AISC) of ASX-listed gold producers was around $1,300 an ounce before 2020. It has since increased to around $1,700.

Despite gold rising to almost $3,000, higher capital spending has meant that many smaller producers are burning cash every quarter rather than building a cash pile.

In terms of the scale of a profitable mine operation, the hurdle has increased.

Nowadays, an open-pit mine operation needs a processing plant with an annual capacity of over three million tonnes of ore to be profitable. The alternative is higher-grade ore, preferably from an underground satellite deposit with a grade exceeding three grams of gold per tonne (g/t) of rock.

Larger producers also run the ruler over neighbouring properties and down-and-out explorers to expand their mining portfolio. Meanwhile, smaller explorers and early-stage developers are frantically increasing their exploration spending, hoping not to become easy prey to a producer on the hunt.

Sometimes, there’s a happy coincidence where a producer hungry for more resources comes across a cash-strapped explorer with a deposit that needs substantial funding. This isn’t common, especially when explorers are trading at rock-bottom prices. The market has overlooked them in the gold bull market that began last September.

Your chance to capitalise on the opportunities like an insider

Let me show you in the figure below how there’s a clear divergence in the performance of gold, established gold producers, and speculative early-stage explorers:

Source: Thomson Reuters Refinitiv Datastream

So, how do you play this opportunity?

I suggest a core portfolio containing gold and silver ETF and the larger gold producers. This will give you exposure to the price of gold and silver as well as the upside potential when the mining sector shifts into high gear.

If you’ve got an appetite for additional risk to shoot for larger gains, you may also want to have a handful of cashed-up explorers and early-stage developers.

In such times, it pays to be patient. Conduct thorough research and understand the risks. If your investments come off, the rewards should come later!

Author Brian Chu is founder of The Australian Gold Fund and editor of The Australian Gold report.

Read more on Proactive Investors AU