Electric vehicles (EVs) are expected to represent more than 60% of vehicles sold globally by 2030.

A report by the International Energy Agency (IEA) also suggests the growth in EV demand will have a direct impact on the demand for critical minerals including battery minerals and rare earth elements (REEs).

Demand for battery minerals, such as lithium, is forecast to increase by 40 times between 2020 and 2040, while demand for cobalt and graphite could rise by ~20 times.

As per the IEA report, the demand for REEs could increase by seven times in the same period.

The rise in demand directly correlates with the world's carbon emission reduction goals.

So how do we address rising demand for battery metals, with emissions targets?

Essentially we need to mine more critical minerals to meet future needs.

New supply is critical

Bringing online sufficient new supply of critical minerals to meet increasing demand is a major challenge.

IEA notes that the world will need around 50 new lithium mines, 60 new nickel mines and 17 new cobalt mines to meet carbon emissions goals by 2030.

New mining, processing and manufacturing projects can take more than 10 years to reach production, particularly when doing so in a sustainable way backed by local communities.

However, this seemingly insurmountable challenge, has a positive outlook.

“At a pivotal moment for clean energy transitions worldwide, we are encouraged by the rapid growth in the market for critical minerals, which are crucial for the world to achieve its energy and climate goals,” said IEA executive director Fatih Birol.

“Even so, major challenges remain. Much more needs to be done to ensure supply chains for critical minerals are secure and sustainable. The IEA will continue its early leadership in this space with cutting-edge research and analysis – and by bringing together governments, companies and other stakeholders to drive progress, notably at our Critical Minerals and Clean Energy Summit on 28 September,” Birol added.

No room for complacency

If all planned critical mineral projects worldwide are realised, supply could be sufficient to support the national climate pledges announced by governments, according to IEA analysis.

However, the risk of project delays and technology-specific shortfalls leave little room for complacency about the adequacy of supply. And more projects would in any case be needed by 2030 in a scenario that limits global warming to 1.5 °C.

Diversity of supply also remains a concern, with many new project announcements coming from already dominant countries.

Compared with three years ago, the share of the top three critical mineral producers in 2022 either remained unchanged or increased further, especially for nickel and cobalt.

Additionally, environmental, social and governance (ESG) practices are making mixed progress.

Companies are making headway in community investment, worker safety and gender balance. However, greenhouse gas emissions remain high, with roughly the same amount emitted per tonne of mineral output every year. Water withdrawals almost doubled from 2018 to 2021.

Government support for net zero

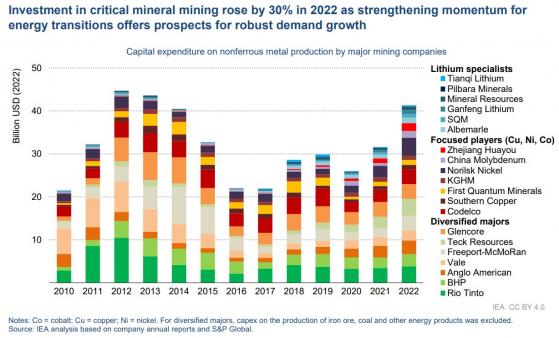

Despite these barriers, global investors are beginning to mobilise, largely driven by national policy commitments to reach net zero by 2050.

Internationally, governments are creating frameworks to boost private sector innovation and capital into expanding clean energy technology supply chains.

This includes the United States’ Inflation Reduction Act, the European Union’s Critical Raw Materials Act and Japan’s Economic Security Act.

These frameworks seek to promote local or regional supply chains through tax credits, government investment and project facilitation.

Over the next 6 to 12 months many companies will be locking in investment decisions that will set their (and the general critical minerals) direction for many years to come.

Exploration spending continued to march upwards, led by Australia and Canada.

In the spotlight: critical minerals stocks

Now we’ll take a look at some of the critical minerals explorers, developers and producers making moves in the market.

Aruma Resources Ltd (ASX:AAJ) recently uncovered significant REE and cobalt-copper enriched rocks during surface sampling at the Saltwater Project in the Pilbara region of Western Australia.

Results from the sampling program confirmed REE enrichment across multiple structures, alongside significantly elevated pathfinder values of phosphorus, strontium and thorium and other base metals.

American Rare Earths Ltd (ASX:ARR, OTCQB:ARRNF) identified a new REE deposit in Wyoming, US (Beaver Creek REE project) containing grades between 1.7% and 9.1% of rare earths lanthanum, cerium, neodymium, praseodymium and yttrium.

ARR geologists observed that the rare earth elements are concentrated in veins enriched with allanite, a group of minerals that is a valuable source of rare earths.

Anson Resources Ltd (ASX:ASN) is set to play a crucial role in powering the electric vehicle revolution after producing its first battery-grade lithium carbonate from brines this month at its Paradox Lithium Project in Utah, USA.

The company produced the lithium carbonate by using the flowsheet designed by its direct lithium extraction (DLE) partner Sunresin New Materials Co. Ltd for the project’s lithium-rich brines.

With the product samples at hand, Anson will now be able to advance discussions with potential off-take partners.

The construction of an electrolyte manufacturing facility for Australian Vanadium Ltd (ASX:AVL, OTCQB:ATVVF) in Western Australia is underway following the appointment of an engineering group this month to construct the facility.

AVL aims to produce vanadium electrolyte for commercial use in vanadium flow batteries at the facility by November 2023 and is now working on securing offtake agreements for the produced product.

The electrolyte manufacturing facility has been designed to produce up to 33MWh per year of vanadium flow battery high-purity electrolyte.

Element 25 Ltd (ASX:E25) took another step last month on the path to producing high-purity manganese sulphate monohydrate (HPMSM) at a planned US facility with global automaker Stellantis N.V. completing its first US$15 million investment in the company.

The company will use proceeds from the Stellantis first tranche investment towards its development of a battery-grade HPMSM facility in the USA with a second US$15 million payment forming part of a binding agreement.

Global Lithium Resources Ltd (ASX:GL1) shares surged in July after a mineral resource update for the Manna Lithium Project 100 kilometres east of Kalgoorlie in Western Australia revealed a 24.1% increase in contained lithium oxide to 406,000 tonnes.

The updated mineral resource estimate (MRE) demonstrated a 10% increase in tonnage to the 100%-owned project to 36 million tonnes as well as a 13% increase in lithium oxide grade to 1.13% Li2O.

Green Technology Metals Ltd (ASX:GT1)’s Root Bay lithium deposit continues to shine following the latest batch of high-grade lithium hits.

Assays from another 26 diamond drill holes at the Root Project in Ontario, Canada released this month have delivered the best drill result to date - a 17.6-metre intersection, grading 1.77% lithium oxide from 195.5 metres.

Lightning Minerals Ltd (ASX:L1M) has set its sights on seven promising pegmatite exploration target areas at the Dalmas and Hiver lithium projects in the James Bay lithium hotspot region of Canada, based on 165 discreet signatures generated from multispectral analysis.

Forming an important first proof of prospectivity as the company progresses due diligence on the projects, the target areas are up to 2.7 kilometres long at Dalmas and 2.1 kilometres in length at Hiver.

Lithium Energy Ltd (ASX:LEL) intersected lithium-rich mineralisation in the upper aquifer of the newly drilled Payo 1 concession at Solaroz, grading up to 386 mg/L lithium from 209 to 233 metres depth in a highly encouraging initial assay from the project at the heart of South America's renowned Lithium Triangle.

The company is still drilling for further brine samples at depths of 233 to 257 metres and 281 to 305 metres, where brines are reportedly showing increasing densities, which indicate potential for higher lithium grades.

Lithium Energy considers this a significant milestone, confirming the presence of lithium mineralisation in the 1,973-hectare Payo 1 concession, part of the Northern concession block which has not yet been drilled and was not included in the 3.3 million tonnes lithium carbonate equivalent mineral resource estimate.

Lithium Australia Ltd (ASX:LIT, OTC:LMMFF) shares surged this month after on taking a landmark step forward in the lithium extraction space with a joint development agreement with leading ASX-listed mining company Mineral Resources Ltd (ASX:MIN).

The strategic partnership aims to advance Lithium Australia's patented LieNA® technology, a method that could potentially enhance lithium extraction yields by up to 50% above current market performance.

Under the agreement, MinRes will provide financial backing of up to A$4.5 million for the development and operation of a pilot plant and an engineering study for a demonstration plant and will supply the necessary raw materials for the extraction process.

Read more on Proactive Investors AU