Cobalt Blue Holdings Ltd (ASX:COB, OTC:CBBHF) has successfully completed a private placement of fully paid ordinary shares to sophisticated and institutional investors to raise $4 million.

The company will issue 6.9 million new shares at a price of $0.58, which represents a 12% discount to the closing price on November 2, 2022, and a 14% discount to the 10-day VWAP up to and including November 2, 2022.

New shares issued under the placement are expected to start trading on the ASX on November 14, 2022.

“As a result of the placement, the Cobalt Blue board welcomes two new tier-1 long-only domestic resource funds onto our register and believes it’s a great endorsement of our BHCP project,” COB’s chair Rob Biancardi said.

Raising a further $12 million

COB has also launched a non-renounceable rights issue entitling eligible shareholders to subscribe for one new share for every 10 shares held on the record date of November 10, 2022, at an issue price of $0.58 per share, to raise up to approximately $10-12 million (before costs).

Notably, while there is a shortfall facility, if the entitlement issue is fully subscribed for, 33,060,534 new shares would be issued (subject to rounding) and would raise $19.2 million.

Use of funds

Cobalt Blue has several plates spinning and will use the money, along with existing cash resources, to advance its activities through to the second half of 2023 in parallel with work to complete the definitive feasibility study (DFS) on the Broken Hill Cobalt Project (BHCP).

In addition to the DFS, the work will include:

- Initiation of front-end engineering design (FEED) studies, to be executed post-delivery of DFS.

- BHCP Demonstration Plant maintenance and retention of operations staff beyond BHCP DFS test-work (likely to finish in Q1 2023) in order to retain a core of well-trained operators on staff through to commissioning of the BHCP (anticipated 2025).

- Cobalt in Waste Streams opportunities where current test-work is expected to be expanded, potentially requiring larger scale test work at the existing Demonstration Plant.

- Selective local commercial/industrial property purchases required to support future BHCP operations.

- General corporate activities including partner selection and project financing investigations.

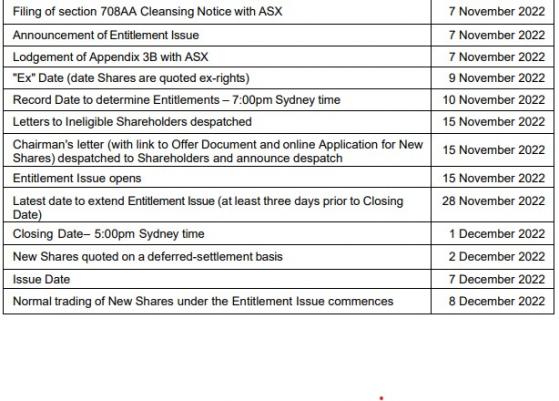

Below are the indicative times relating to the entitlement issue:

Read more on Proactive Investors AU